Investing in Hated Sectors: Finding Value in Unloved Stocks

Investing in hated sectors carries real risks, but it can also be a way to pick up stocks at a deep discount.

Why Invest in a Hated Sector?

At any time, there are corners of the market that investors simply cannot stand. These are the sectors or stocks that create immediate, reflexive, rejection. Few or no analysts cover these stocks. Everybody assumes you are an idiot if you mention investing in them.

If that’s so, why would you ever want to consider investing in a hated sector or hated stock? Often the core reason is that a hated sector or hated stock is cheap. Really, really cheap. That makes sense, if almost no one on the market wants to buy it, the price will plummet. And after all, one key method of value investing is buying cheap stocks below their intrinsic value.

Nevertheless, hated sectors are generally hated for a reason. Recent performances are often abysmal. Long-term prospects are ranging from poor to terrible. Return on capital might be deeply negative. The industry as a whole is making losses year after year. This type of situation can be profitable deep value but it can also be a deadly value trap.

How to Find a Hated Sector

Finding a hated sector is the easiest part. A quick reading of the financial press can give you ideas. Large publications have strong incentives to cover the most spectacular news, with a tendency to focus on the negative. The economic collapse of a country or the woes of an entire industry make for a great story that sells. As a result, they end up covering a problem when it is at its worst. So when everyone screams a sector is “dead”, it is time to pay attention and give a critical look.

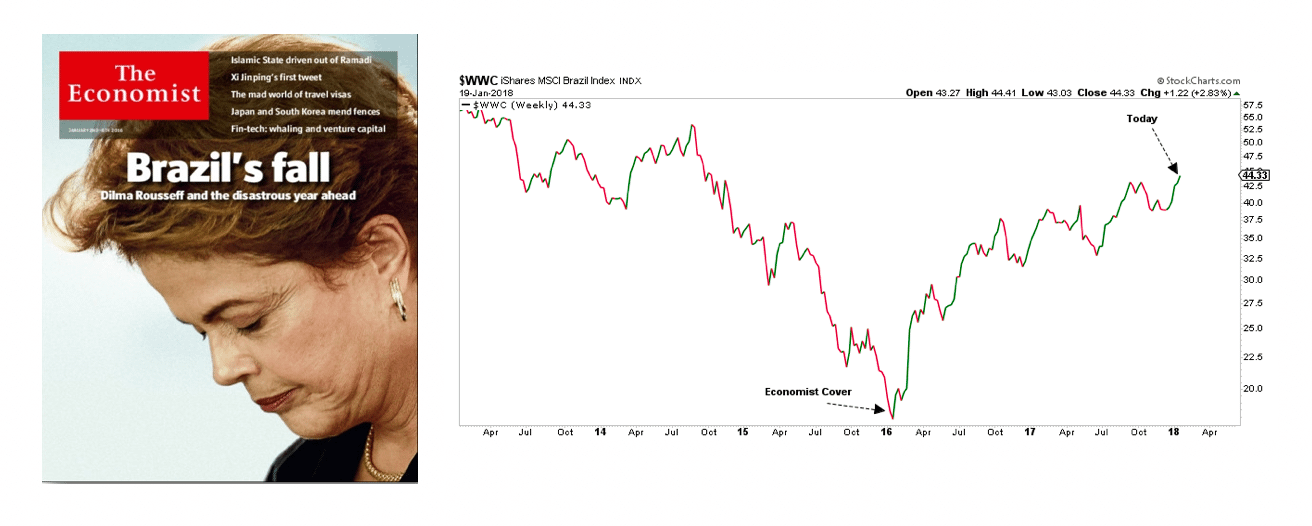

There is strong evidence that indeed when journalists start to cover a crash, most of it is already done, and is often followed by a strong rebound. This idea is popular enough that The Economist felt forced to publish a defense of its magazine covers. For example, it took notice of Brazil’s economic troubles at the exact bottom of the Brazilian markets, before a strong rebound.

Characteristics of a Hated Sector

Beyond press coverage, here are some of the characteristics of a hated sector:

A multi-year decline in share prices

Multi-year period of financial losses

Disrupted by new technologies

Strong political hostility to the sector

Negative perception by society at large

Geopolitical risk

Very low multiples/ratios, likely to have contracted steadily for years

High probability of bankruptcy

Any of these factors or several of them combined can drive a stock into the “hated” category.

Picking Stocks From a Hated Sector

A good way to mitigate the risks of investing in a hated sector is to find the strongest companies in it. Stronger companies are less likely to go bankrupt or dilute the existing shareholders. No matter how poor the performance of the sector, the best companies in it are more likely to survive and still be there when better days come. The strongest companies can be picked following a few factors.

One factor will be the company’s size. Larger companies will have more assets, more influence, and more access to capital to survive a tough period. They will also control a larger share of the overall market. They might as well have unique patents or assets. All of these should give the company some pricing power and the ability to rebound.

Another aspect to look for is low debt. The lower the debt, the more maneuvering ability the company will have. High debt might lead to restructuring, incapability to invest in the future, being forced to sell assets at a discount, etc.

The last key point is management quality. Experienced managers who have already survived previous downturns are invaluable. They are more likely to see hard times coming and prepare accordingly. Managers owning a significant part of the business will also prioritize the business’s survival over short-term profits.

Another method to consider is investing in a hated sector only when its performances are finally recovering. By waiting for the worst of the storm to pass, investors might miss the absolute bottom but may also be rewarded quicker for their bold move.

The Dangers of Hated Sectors

The largest risk of a hated sector is for it to stay permanently this way. Not every hated sector is poised for a rebound. Horse buggies were replaced by cars. Zeppelins by planes. Film photography by digital pictures. Low valuations can stay low or get much lower and eventually zero.

Another thing to take into account is if the sector is hated for structural reasons. For example, the airline industry is notorious for not turning a profit as a whole. Such sectors might forever be hated for good reasons like consumer preferences, economic structure, or pricing power.

Some sectors are also hated for reasons that have nothing to do with their fundamentals. Many investors won’t touch cigarettes, arms, or fossil fuels no matter what their fundamentals are. These industries may pay high dividends to attack investors, but the source of the hate may be long-lasting, even permanent.

Overall, it is best to focus on temporarily hated sectors, especially if they are an irreplaceable component of the world economy and unlikely to be fully replaced by new technologies in the next decade. This was the case for Internet stocks in the early 2000s or Oil & Gas in 2020.

The Pros & Cons of Hated Sectors

Pros:

Plenty of cheap stocks to pick from.

The downside is in theory limited by the margin of safety and low multiples.

Reversion to the mean works in your favor.

Money flowing back into the sector can generate multi-bagger gains.

Industry leaders often re-emerge with a stronger competitive position.

Cons:

Technological disruption could lead to a permanent downturn and a value trap.

The turnaround might take years, tying up your money and generating high opportunity costs.

It can still get a lot worse before getting better.

High-stress strategy, hard to keep conviction if prices keep going down.

Conclusion

Investing in a hated sector is in theory the ideal contrarian investing strategy. Providing plenty of cheap companies selling at a discount, this is the perfect hunting ground for deep-value investors. It is also a method with high risks to fall into a value trap or immobilize capital for years with no or negative returns.

Because of these risks, investing in hated stocks or sectors requires extra caution, due diligence, and a focus on high-quality companies. This type of high risk, high volatility, and high reward strategy will be more of a fit for experienced investors with a solid stomach, long-term horizon, and a very disciplined approach to investing.

Could You Share This Post?

Not only will you help your friends become better investors but recommendations are the lifeblood of Stock Spotlight’s growth. A few people sharing it on Twitter can really be a huge deal in terms of driving audience growth.

Thanks!

This article originally appeared on FinMasters.com - Investing Strategies: Investing in Hated Sectors