Free Report #11: Deere & Company (DE)

I grew up in a small, rural town in Ohio where farmland abounds. My family were not farmers, but I grew up with plenty of families who were farmers, and some of them still are.

In high school, I would pass by at least a few fields during my mile commute to school. In those fields, were tractors. That tractor was usually a John Deere. When I got to school, I had some classmates that were wearing a John Deere T-shirt or hat.

Additionally, my in-laws have a decent amount of yard space (probably two acres or so). My father-in-law has only ever had two riding mowers in the 30 years he has lived at the property. Which brand were those mowers? You guessed it: John Deere. He refuses to even look at any other brand.

So what is it about the John Deere company that makes it so revered?

For one, I think it is simply good branding and image control. John Deere is an old company that has been around for a very long time. People that have used the companies products have probably been doing so for generations. The brand is also synonymous with farming and/or country life.

Heck, some people even have tattoos of the brand!

Secondly, the company is known to make the highest quality tractors, and other machines, that last for a very long time. For farmers, this is extremely important, since tractors and combines are a significant capital expenditure item.

That being said, is the John Deere company a good investment? Let’s take a look.

Principle #1

A Business That We Can Understand

Down on the Farm

Deere is the world's leading manufacturer of agricultural equipment, producing some of the most recognizable machines in the heavy machinery industry.

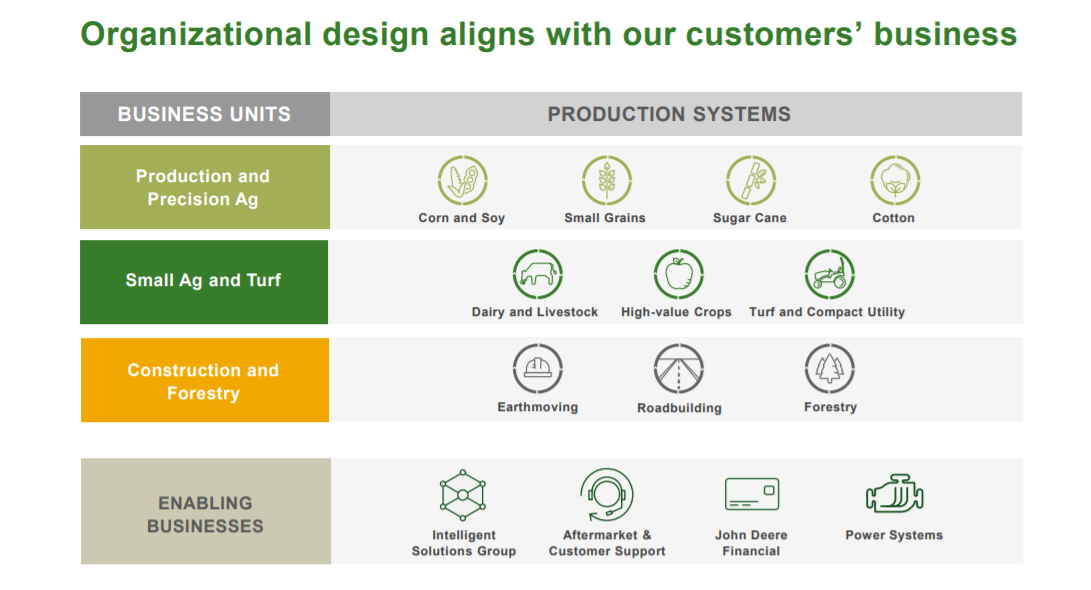

The company is divided into three reportable segments: agriculture and turf, construction and forestry, and a financial arm, John Deere Capital Corporation.

The agriculture and turf segment makes up the majority of revenues at over 60%. These include the more well known machines that farmers use, such as:

tractors

combines

cotton pickers and strippers

harvesting equipment

mowers

The construction and forestry segment represents about 30% of revenues, with specific equipment in hard working industries such as road-building, logging, and material handling. These include heavy machines like:

backhoes

crawler dozers

excavators

milling machines

asphalt pavers

compactors

log harvesters

Through it’s financial segment, the John Deere Capital Corporation, the company provides retail financing for machinery to its customers, in addition to wholesale financing for dealers; which increases the likelihood of Deere product sales. This segment provides the remaining 10% of revenues.

Segment Breakdowns

Here is a further breakdown of John Deere’s revenues and product line:

John Deere makes a majority of its money from its agriculture and turf segment. However, the company is still well diversified into different sectors and industries that hopefully balance one another out.

Its products are available through a robust dealer network, which includes over 1,900 dealer locations in North America and approximately 3,700 locations globally. Yes, John Deere is also globally diversified, with almost 40% of operating profits coming from outside the US and Canada.

Verdict

The John Deere Company is operating one of the largest scale heavy machinery manufacturing businesses in the world. Overall, John Deere is an easy to understand business that’s diversified in both revenue and geography, which is nice to see.

Score: 1 Point

Principle #2

A Business That Has Favorable Long-Term Prospects

Tailwinds

Rising Commodity Prices

So far in 2021, we have seen a significant amount of inflation. Whether or not inflation will be here for the long term remains to be seen. Regardless, during this inflationary period, we have seen a sharp rise in commodity prices since the pandemic began.

Certain commodities like grain, corn, oil, and lumber have all seen tremendous price increases. Growing demand in commodities invectivizes more farming. The increased prices allows farmers to make more money, which in turn will allow them to buy more farming equipment from John Deere.

This has translated to increased sales for the company, as Deere has witnessed a large increase in orders over the past year. This has boosted numbers on both the top and bottom lines.

Growing Infrastructure Demand

Lumber prices are currently at an all time high. This is largely due to the huge increase in demand for houses since people want more space while spending more time in their homes. This means that industries that Deere serves in the construction and forestry segment will also be more active, requiring more machinery.

Additionally, the rising demand and legislation for increased infrastructure across the entire US is another large tailwind for the company. While the details of President Biden’s infrastructure bill are still being debated, the bill will likely be passed, resulting in major cash in-flows to construction companies.

Solid Brand Name

Warren Buffett once said something about Harley Davidson that I think also rings true for John Deere:

“I don’t know if Harley Davidson stock is worth $20 or $30. I like a business where customers tattoo their name on their chest - I’m not sure you can go around questioning those guys!”

Proof of this attitude abounds in rural areas. People really love this brand. As long as the company is able to successfully manage the brand name, this is one of the company’s largest strengths.

Headwinds

Material and Logistics Costs

Rising raw materials prices for creating Deere’s machines, like steel, have increased the company’s cost to manufacture their machines. Additionally, freight and logistics costs have increased. This will no doubt impact Deere’s margins somewhat, but will hopefully be offset with the rise in demand of their products.

Debt

John Deere’s debt levels are definitely not low. The company has been steadily been increasing debt over the past few years and has a quite high D/E ratio of over 3.

While this debt is concerning, the company is able to make their payments with and interest coverage ratio of over 17. Also, the type of business that Deere is operating is capital intensive, and requires a lot of machines and personnel. They are middling in their industry regarding debt levels.

Verdict

John Deere’s business is stable, and better yet, growing. Due to rising prices in commodities, increased demand for homes, and impending infrastructure reform, everyone wants a John Deere.

Debt levels are high, and the business is capital intensive. These are not something I prefer in a business.

However, I think the positives outweigh the negatives here. A lot of these positives may be temporary, but at the end of the day, we will always need to farm, which means we will always need farming equipment.

John Deere will always be primed to sell that equipment, boom or bust.

Score: 1 Point

Principle #3

A Business That is Operated by Honest and Competent People

Chairman & CEO

John C. May is the current Chairman and CEO for John Deere. Mr. May has a long tenure with the company, as he first joined as a management consultant all the way back in 1997. He eventually worked his way up to a senior management position in 2012, where he held the positions of President of the Worldwide Agriculture & Turf Division, Vice President of the Global Turf & Utility platform, Managing Director of Deere’s China.

Mr. May recently was appointed as CEO in November 2019, not long before COVID hit. I like the tenure of Mr. May as CEO, as I prefer to have someone leading the company that knows it very well. With only a year and a half as CEO, it’s too soon to judge, especially since last year was the mess that it was.

Alignment

Unfortunately, insider ownership of Deere is lacking with less than 1% owned by insiders. I was interested to see that a private equity firm, Cascade Investment owns about 9% of the company, at about a $10B valuation. I would not have guessed a company the size of John Deere would have that much VC/PE involvement.

ROIC and Profitability

John Deere is a manufacturer, and manufacturing is generally a low margin, capital intensive business. In that regard, John Deere is pretty typical. Gross and net margins are respectable, but not high by any means.

ROIC and ROA are closely intertwined since this is an asset heavy business. Unfortunately, neither have broken the 10% mark, which is my normal threshold.

Verdict

The general feeling I get from the management of John Deere can be summed up in one word: “Meh”.

The CEO has not been tenured long enough to judge and there is little insider ownership. Margins and ROIC are stable, and are typical for the industry. I will be really interested to see how they perform in 2021 with increased business.

I am willing to give half a point here since I see potential in the company in the future.

Score: 1/2 Point

Principle #4

A Business That is Available at an Attractive Price

Free Cash Flow

DE has had some pretty unpredictable FCF over the past decade. This is likely due to some pretty hefty debt payments that it is required to make. However, FCF seems to be spiking dramatically as everyone tries to get their hands on a tractor.

However, something I really appreciated as a shareholder, is the slide below. I wish every company was as straightforward as this. As you can see, the company is committed to maintaining a good credit rating, likely so they can continue to borrow like they have been. They then find growth opportunities, pay dividends, and buy back shares.

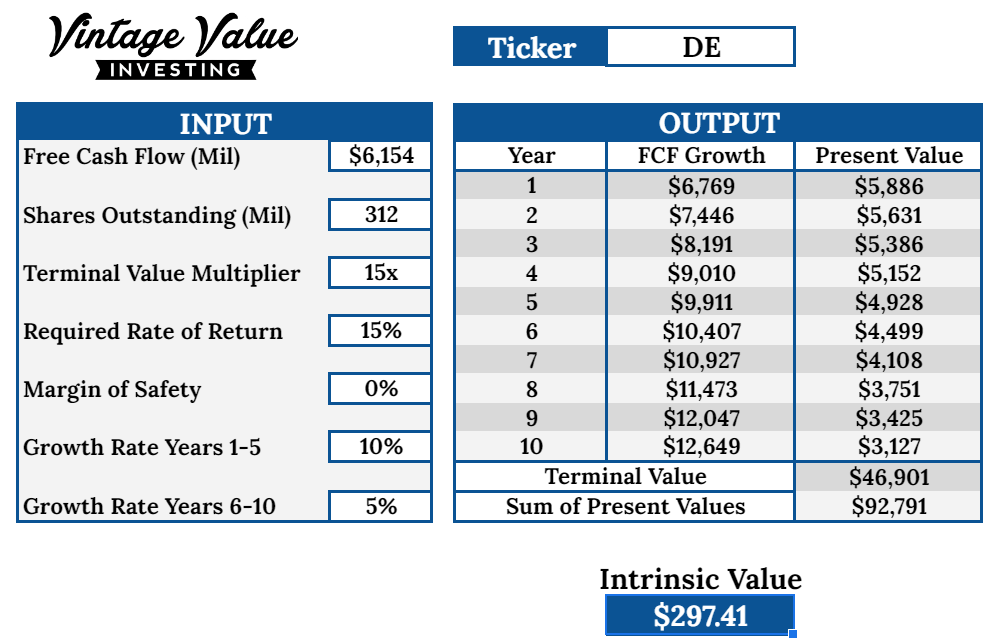

DE’s P/FCF has been volatile because their FCF has been volatile, which makes it hard to determine a number. However, it seems that a company in their industry generally trades around a P/FCF of 15, so that’s what I will go with.

I think the next few years will really be telling for growth. I think DE will benefit greatly with the increase in commodity prices and demand for infrastructure.

It’s hard to project, but I think a conservative estimate is that FCF will likely grow by 10% over the next five years following the commodity boom, and then taper off to 5% from then on. However, this model does not account for DE’s share count diminishing, which is more than likely to happen, especially with more cash.

Discounted Cash Flow

Here’s my DCF work on DE with zero margin of safety:

And here’s a 15% margin of safety:

Verdict

Current DE share price: $343.58

My buy price: $252.80

Based on my initial projections and DCF, DE seems pretty overvalued. However, DE seems to be offering a 12% return, albeit with no margin of safety.

That being said, it’s still too pricey for a 15% return. I’m not seeing green here.

Score: 0 Points

Final Thoughts and Score

Deere & Company (DE) Score: 2.5/4

When all is said and done, I truly think that John Deere is a great company. Their long history is ingrained into American culture, and when someone imagines a tractor in their head, its normally a green and yellow model.

Unfortunately, it seems like Deere is fully priced. It has seen quite the run up in price since earnings have been growing the past year.

Given management’s straightforward approach with their cash, I think that Deere has some good tailwinds to benefit from over the next few years. In combination with a surefire dividend and stock buyback policy, I think it is totally reasonable that Deere could return around 7% - 10% per year. I just prefer a little bit more.

Recommended Articles

5 Lessons From Owning 5 Shares For 10 Years: Maynard Paton

I recently discovered Maynard’s blog, but it is a wonderful treasure trove of information. I particularly enjoyed his most recent piece discussing 5 points from holding onto stocks for the long term. Investing is far more physiological than many believe, and this article is proof of that.

Music

Lucid Plant is an interesting band. They mimic a lot of the sounds from my all time favorite band, Tool. That being said, their sound is dynamic and trippy.

Lucid Planet makes music that really transports you to another place. The progressive, tribal, and metal fusion that’s going on sounds like it’s in a different world entirely. I picked their song “On The Way” from their new album simply because its my favorite. But honestly, all of their songs are great.

Holdings Disclosure

Neither I nor anyone else associated with this website and newsletter has a position in DE and no plans to initiate any positions within the 72 hours of this publication.

I wrote this article myself, and it expresses my own personal views and opinions. I am not receiving compensation, nor do I have a business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer

None of the writers or contributors of Stock Spotlight are registered investment advisors, brokers/dealers, securities brokers, or financial planners. This report is being provided for informational and educational purposes only and on the condition that it will not form a primary basis for any investment decision.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA (publishers of Stock Spotlight) on whether to buy, sell or hold shares of any particular stock.

None of the information in our articles is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The information is general in nature, and is not specific to you.

Vertigo Studio SA is not responsible and cannot be held liable for any investment decision made by you. Before using any article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA on whether to buy, sell or hold shares of any particular stock.

We did not receive compensation from any companies whose stock is mentioned in this report.

No part of the analyst's compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed in this report.