Free Report #13: WD-40 (WDFC)

WD-40 (WDFC)

WD-40 is a company I think most people (Americans anyway) are very familiar with. For myself, the WD-40 brand and product is basically synonymous with my father. I remember him using it on nearly everything that required lubrication.

Everything from a squeaky door hinge all the way down to a rusty bolt, my dad was constantly using WD-40 on lots of things in our old house. When I think about it, WD-40 is one of the few products that was always in our house at all times. You never knew when you would need it, but you surely never wanted to be without it.

To be honest, I didn’t know WD-40 was a public traded company until I started researching for this write-up. Can a company that makes spray on lubrication really be valuable enough to become a publicly listed company?

The answer is a resounding yes. This company is one of the most honest I have ever come across. How so?

Let’s dive into WD-40.

Principle #1

A Business That We Can Understand

Company History

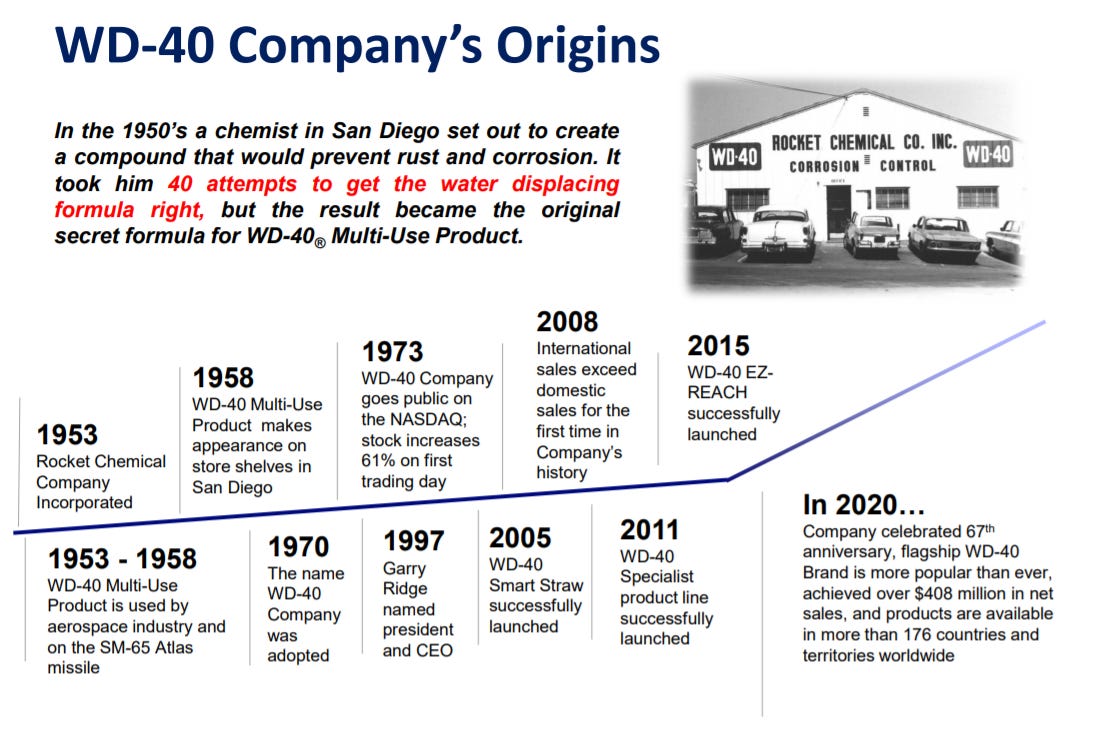

All the way back in 1953, a few chemists at Rocket Chemical Company started working on a solvent formula with one goal in mind: to create a rust preventing degreaser for the aerospace industry.

After 39 failed attempts, the chemists finally developed a formula that worked. Not being a creative bunch, they named it WD-40 (Water Displacement, 40th Formula).

WD-40 soon became a massive hit in the aerospace industry. What they didn’t know, is that they also had created demand for a product outside the aerospace industry.

While working with the product at Convair, (an aerospace contractor) some of the employees took notice of the fantastic use of the product on regular homemade products. It worked so well, that those employees would smuggle cans in their lunchboxes and use it on various items in their home.

It didn’t take long for the company to realize they had made a quality product that had use far outside just the aerospace industry. WD-40 found itself on shelves in local stores in San Diego in 1958, where it has expanded globally since then, all while retaining the same name and formula.

Slick Business

Fast forward to today, and the WD-40 company still manufactures and sells its famous lubricant. However, the company has expanded into other products and industries, such as household cleaning supplies, which now a decent portion of the company.

The maintenance products segment include the WD-40 signature brand aerosol spray lubricant as well as degreasers, rust removers, and bicycle maintenance products. This is the main money maker for the company, as it represents about 90% of sales.

Cleaning products include toilet cleaners, carpet stain removers and deodorizers, and heavy-duty hand soaps used to clean grease. This segment represents about 10% of sales. You may recognize some of these brands like:

2000 Flushes

Carpet Fresh

1001

Spot Shot

Lava/Solvol

The company organizes itself into three segments based on geography: Americas, Europe/Middle East/Africa, and Asia-Pacific. Around half of the company's revenue comes from the Americas segment, which includes the United States, Canada, and Latin America.

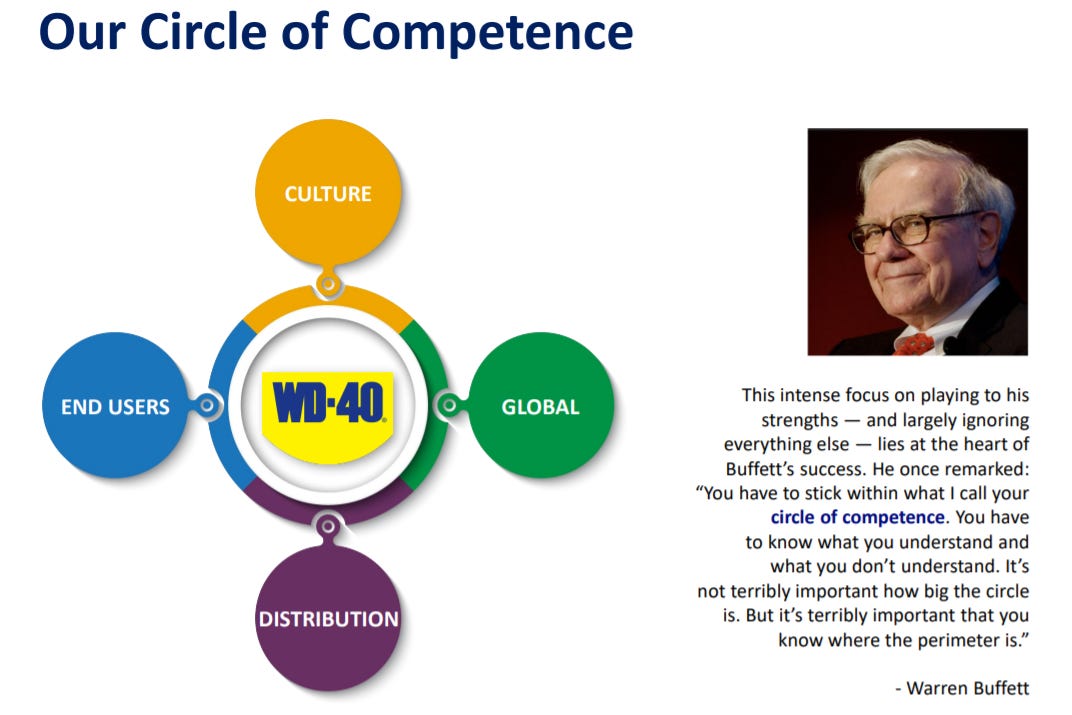

Circle of Competence

I found something I have never seen from a company while researching WD-40. It was the below slide from their investor presentation:

This is amazing to see. Finding a company in 2021 that actively abides by Buffett’s “Circle of Competence” mantra is very rare. What’s more amazing is it seems that the company truly abides by this philosophy, since they have not really strayed too far from the original product back in 1953. They stuck to what they know.

Verdict

WD-40 is probably one of the easiest companies to understand that I have ever researched. They make a one incredibly simple product that has multiple uses in many different industries.

They have diversified a bit with cleaning products, but this remains a small portion of the overall company. They have mostly stuck to what has worked in the past: WD-40.

Score: 1 Point

Principle #2

A Business That Has Favorable Long-Term Prospects

Future Growth

Did you think that a company that just makes spray on lubricant would have an amazing future growth strategy? No? Well, you’d be right…sort of. They do have a growth plan, but it is quite simple…not that there is anything wrong with that.

WD-40 lays out their future growth aspirations in five strategic initiatives.

These initiatives are pretty simple to understand, and you can review them yourself if you want. Instead, I am going to focus on what the company defines as its four “Must-Win Battles” for future growth.

WD-40 has most of the North American market completely saturated, so there are limited opportunities for growth there. The company knows in order to grow, it has to expand to other markets, especially in the Asia-Pacific.

By adding slight modifications to the original WD-40 product, such as a nozzle that sprays two ways, or an “EZ-Reach” flexible straw to spray hard to reach areas, WD-40 is making the product more user friendly.

The goal here that by adding these slightly more convenient utility, they can command a slightly higher margin.

In FY 2020, WD-40 launched its “Specialist” line-up. These products are uniquely branded to tackle specific consumer problems, like removing rust, or to lube the chain on your bike.

These small formulaic adjustments allows customers to more easily recognize a product that will solve their unique problem, which will enhance the quality of the brand name.

WD-40 has made a strong effort to enhance its online presence in the past few years. Given the rise of the pandemic in 2020, that was a wise move. They recently expanded their website to over 90 countries to help drive e-commerce and brand awareness. Apparently, this helped generate an e-commerce growth of 58% YoY.

Truth be told, I don’t see myself or many other consumers ordering WD-40 online from the company website. Nevertheless, it’s good to see the company embracing changing consumer habits rather than fighting them.

Wide Economic Moat

Lastly, WD-40 has an obvious economic moat in its branding and economies of scale. The brand awareness (at least in the US) of the company is very high, and you know exactly what the product does.

I highly doubt anyone would try to compete with WD-40s long-standing dictatorship of its product. The new product would have to be significantly better than the WD-40 formula, and then make wide enough appeal.

After nearly 70 years of market dominance, that would be very hard to accomplish.

Risks

The only real risks I see for this company is mismanagement of debt and stagnation of revenue growth. However, neither of these has happened recently. The company is growing revenues (albeit slowly) and reducing leverage.

In 2017, the company seemed to recognize that they needed to trim some debt, as the debt/equity ratio was over 100%. They quickly paid some debt off, and now the debt/equity has remained below 80%, which is just fine in my book.

Verdict

As an investor, I am not looking at WD-40 as an explosive growth story. If you were expecting 20% growth, then you are in the wrong place.

The growth is achievable and easy to understand. The more enticing thing here for me is the lack of risk.

Score: 1 Point

Principle #3

A Business That is Operated by Honest and Competent People

Chairman & CEO

Mr. Garry Ridge currently serves as WD-40’s Chairman and CEO. Mr. Ridge is originally from Australia, which is where he first joined the company in 1987. He was hired into a leadership role, where he was Managing Director for all the companies operations in the Asia-Pacific region.

He eventually was appointed as CEO in 1997, just ten years after he first arrived at the company. He has remained in the CEO position since then.

Mr. Ridge’s 23 year tenure is an amazing corporate accomplishment, as many CEOs never stay that long at one company. This is very good to see as an investor.

Alignment

WD-40 is almost 89% institutionally owned, with 10% being owned by the general public and the remaining 1% owned by insiders.

This is not necessarily surprising to see since WD-40 has been around for so long. This stock is in a lot of ETFs and mutual funds.

ROIC and Profitability

ROIC and ROE have been stellar over the past decade, with margins also being remarkably stable. For a company like this to have steady ROICs over 20% and ROEs over 30% in nothing short of incredible.

Capital Allocation

Something I love to see is when management is upfront about what they plan to do with the capital the business generates.

We can see that management prioritizes achieving sustainable long-term growth, maintaining stable liquidity and debt and rewarding shareholders by paying a dividend, and spending the rest on organic growth, acquisitions, or share repurchases.

Pretty standard, but I appreciate the communication upfront.

The Tribe

WD-40 consistently refers to themselves as a “tribe” in their reports and presentations. They don’t seem to view themselves as a traditional company, but more through the lens of a tight knit community.

This is an interesting perspective that you don’t see at most companies. Yes, it can be a gimmicky thing, but when reading about WD-40, you do get the a strong sense of caring for all stakeholders.

Verdict

I get very warm and fuzzy vibes from management here, which is really comforting. The CEO has been with the company through major economic turbulence, such as: the dotcom bubble, the GFC, and now COVID.

But when you have strong executives at the helm who know what they are doing, you can be sure they will steer you through the storm.

Score: 1 Point

Principle #4

A Business That is Available at an Attractive Price

Free Cash Flow

WDFC has been able to churn out some decent FCF over the past decade, compounding at about a 6% CAGR. I think this is decent growth considering the business model.

However, WDFC’s FCF has traded at a premium for the decade, recently hitting 80x. This is a really high multiple, but it is trending down since more FCF is being generated. P/FCF currently is at 39x.

I think it is reasonable for the company to keep growing FCF at a constant 6% over the next decade. They have done it in decades prior, so I don’t think it is impossible here. P/FCF will likely consolidate down to “normal” levels of 30x.

Discounted Cash Flow

Here’s my DCF work on WDFC with zero margin of safety:

And here’s a 15% margin of safety:

Verdict

Current WDFC share price: $239.23

My buy price: $72.29

WDFC is very overvalued right now. I think this is because many people have recognized the relative safety and stability of WDFC’s business model, and are willing to pay a premium for it.

However, I think it is unrealistic to expect 15% returns per year from a business like WDFC anyway. But I do think that it’s far too expensive for the only 2% returns it is likely to provide at this valuation.

That being said, the company continued to compound greater than the market, returning roughly 18% per year. So who really knows?

Score: 0 Points

Final Thoughts and Score

WD-40 (WDFC) Score: 3/4

I love the business of WD-40 and I would love to be a shareholder; just not at these astronomical prices. WD-40 is a storied product/brand, and I think it will continue to be so in the next 10 to 20 years.

The think I like most about this company is the limited amount of risk you are likely to encounter with the stock. It did remarkably well during the COVID crash, and the price is thusly inflated.

Recommended Articles

The Chobani Story: Neckar’s Notes

I recently came across Frederik’s Substack, Neckar’s Notes. Frederik is a wonderful writer who can weave a great story. One of his most recent articles discusses the amazing rags to riches journey of Chobani’s CEO.

It’s an fun read, I highly suggest you take a look for yourself.

Music

I love Architects, although I have conflicting feelings about their most recent album For Those That Wish To Exist. But this is not an album review newsletter, so I will reserve my feelings on the subject.

That being said, Architects previous discography is near flawless. One of my favorite songs “These Colours Don’t Run” tells a harsh, cold, and dismal story of the haves and have-nots, and how humans unfortunately destroy a lot of what we touch.

A sobering message, I know. But it’s important to be reminded of these things once in a while, and equally as important not to dwell on them.

Holdings Disclosure

Neither I nor anyone else associated with this website and newsletter has a position in WDFC and no plans to initiate any positions within the 72 hours of this publication.

I wrote this article myself, and it expresses my own personal views and opinions. I am not receiving compensation, nor do I have a business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer

None of the writers or contributors of Stock Spotlight are registered investment advisors, brokers/dealers, securities brokers, or financial planners. This report is being provided for informational and educational purposes only and on the condition that it will not form a primary basis for any investment decision.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA (publishers of Stock Spotlight) on whether to buy, sell or hold shares of any particular stock.

None of the information in our articles is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The information is general in nature, and is not specific to you.

Vertigo Studio SA is not responsible and cannot be held liable for any investment decision made by you. Before using any article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA on whether to buy, sell or hold shares of any particular stock.

We did not receive compensation from any companies whose stock is mentioned in this report.

No part of the analyst's compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed in this report.