Free Report #14: Snap-on Inc. (SNA)

Snap-on (SNA)

Personally, I have a disdain for manual labor. I don’t enjoy working with my hands very much. Sometimes it can be satisfying, but more often than not, I find myself far more comfortable with my hands typing away on a keyboard, as I am right now.

However, there are many people opposite of me. In fact, millions if not billions, make their careers working in manual labor. I am very grateful for people that work with their hands and are good at what they do.

I’m talking about people like:

Plumbers

Carpenters

Electricians

Construction Workers

Automobile Technicians

For instance, when my toilet stops flushing, or my car starts leaking a random fluid, I have no clue how to properly fix these things. Nor do I have a desire to. 90% of the time, I will always hire someone to fix something rather than do it myself.

So, what do all these people have in common? They can’t just make/fix things out of mid-air with nothing. Tools help get the jobs done most efficiently.

That’s where Snap-on (SNA) comes in. Snap-on makes all kinds of tools for various industries for all the careers I just mentioned.

Is Snap-on a good company to add to your portfolio? Let’s find out.

Principle #1

A Business That We Can Understand

History

Snap-on has been in business for a long time. In fact, in 2020 they celebrated their 100 year anniversary, which is remarkable. Back in 1920, Snap began their business by selling a unique product at the time, which was a “snap on” interchangeable socket.

But soon after, the business owners then realized that there was an element that was lacking in order to get their products into customers hands: distribution.

So, Snap figured out how to deliver the tools directly to the customers. They simply loaded up their van full of their tools, and went directly to the customer.

This turned out to be wildly successful, and the company has been operating like this ever since, except now they operate a unique franchise model.

In 2021, Snap-on has expanded immensely. They know create many of the tools you may be familiar with or even work with in your home. You’ve likely seen these in your dad’s toolbox.

These include tools like:

wrenches

sockets

ratchet wrenches

pliers

screwdrivers

punches

chisels

power tools

The Right Tool For the Job

As explained in the history section, Snap-on began by selling tools out of a van. The company now does this through over 12,000 franchisee-operated mobile vans. These van operators serve auto technicians who purchase tools at their own expense.

A unique element of its business model is that franchisees bear significant risk, as they must invest in the mobile van, inventory, and software. At the same time, franchisees extend personal credit directly to technicians on an individual tool basis.

This is a really interesting model, as there are not many companies that I know of that are franchised in this manner. Nevertheless, the unconventional model seems to have worked for them.

Snap-on currently operates four segments: repair systems and information, commercial and industrial, and tools, and financial services.

Snap-on Tools Group (37% of 2020 Total Revenues): The segment consists of the business operations serving the worldwide franchise van channel.

Commercial & Industrial Group (28%): This segment comprises business operations providing tools and equipment products and equipment repair services to a broad range of industrial and commercial customers worldwide through direct, distributor and other non-franchise distribution channels.

Repair Systems & Information Group (28%): The segment consists of business operations providing diagnostics equipment, vehicle service information, business management systems, electronic parts catalogs and other solutions for vehicle service to customers in the worldwide vehicle service and repair marketplace.

Financial Services (7%): Provides financing to franchisees to run their operations, which includes offering loans and leases for mobile vans.

Snap-on serves many different sectors and industries. These include sectors range from aerospace and defense contractors working on tanks, all the way down to the maintenance technician changing the oil in your car.

Snap is somewhat geographically diverse, but most of their sales come from the US. I will discuss more about this later on.

Verdict

Snap-on is currently operating a special franchise-type of business model where they deliver tools directly to customers, but also benefits from having a non-franchised portion of the business by selling via non-franchise distribution channels.

I see a pretty strong business that benefits from diverse revenue streams. Good enough for me!

Score: 1 Point

Principle #2

A Business That Has Favorable Long-Term Prospects

Growth Drivers

Runways for Growth

The company is actually quite upfront about their growth methods, which is refreshing to see. Snap promotes growth by focusing on their four core runways for growth:

Let’s break down these goals individually.

Enhance the Franchise Network: This will be accomplished by ensuring Snap maintains strong franchisee health metrics, enhances franchisee productivity, introduces new products, and innovates the selling process with programs aimed at amplifying the power of the van channel.

Expand with Repair Shop Owners and Managers: By leveraging their deep and long-standing relationships with their customers, Snap will innovate and and add new products that will help the workers directly. They will also help shop owners and managers improve technical competency so they can grow and integrate broad capabilities.

Extend to Critical Industries: Snap like to focus their company by serving industries that offer repeatable and reliable businesses. This means they need to remain on the forefront of upcoming industries to ensure they are the first to offer solutions.

Build in Emerging Markets: This is where I see most of the growth potential. Snap has a small portion of their business conducted internationally. By creating more manufacturing capacity overseas, launching new product lines, and establishing distribution, they can achieve scale to new markets.

Fortress Balance Sheet

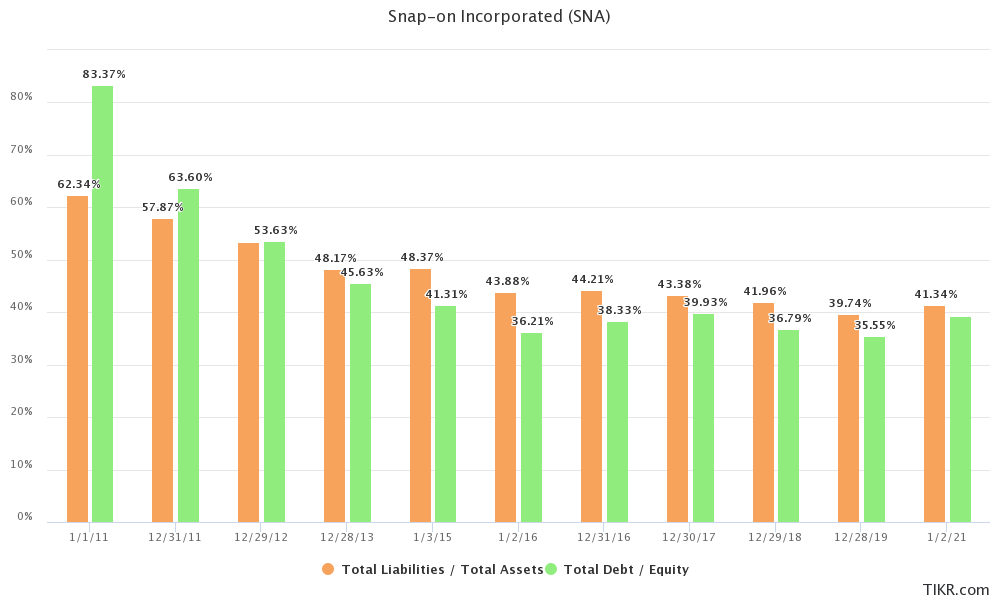

Snap has managed to maintain a pristine balance sheet over the past decade, with assets never over-taking liabilities. More impressively, they have taken down their debt levels by half, where they now hover around a very comfortable 40% debt/equity.

This financial discipline will assure that Snap will be just fine during an economic downturn, like we are experiencing now. Not only that, but they could even afford to take on extra debt for growth if they chose to.

Risks

Failing to Break Into Overseas Markets

The growth driver that is most rewarding is also the most risky. It’s always hard for any company to grow internationally. Foreigners may prefer their own tools from a manufacturer in their homeland, and it take a lot of time and effort in order to change consumer sentiment.

In order to achieve proper scale overseas, Snap’s management will need to identify key market that are ripe for entry and disruption. Proper relationships will need to be established, and this will take a lot of time.

Reliability on Raw Materials

Since Snap-on actually manufactures their own tools, they remain exposed to major volatility in raw-material prices, particularly with steel and oil. The company relies heavily on steel and a bit of petroleum to create the products, and a lot of petroleum to deliver them with the vans.

Unexpected rise in the price of raw materials might force Snap-on to increase product prices, which in turn, is likely to exert pressure on margins.

However, management has managed to do a decent job of maintaining good margins in the past.

Verdict

Just like my article last week on WD-40, I am not looking at Snap-on as a high growth investment. I view it more as a safe alternative play that can still deliver decent returns with little risk.

I like small amounts of risk.

Score: 1 Point

Principle #3

A Business That is Operated by Honest and Competent People

Chairman, President, & CEO

Nicholas T. Pinchuk has been leading Snap-on as CEO since 2007, and has been with the company since 2002. During his almost 14 year tenure, he has lead the company very well. He has introduced the RCI initiative (we will get into that here in a bit) and has led the company through both the GFC and now COVID, and have came out stronger each time.

Prior to joining Snap-on, Mr. Pinchuk has had a myriad of executive management positions with big names like the United Technology Corporation and Ford. He’s even a Vietnam war veteran.

Alignment

It’s not really surprising to see that Snap-on is about 90% institutionally owned, as they are an old company that is in many ETFs and funds. Of note, the CEO, Mr. Pinchuk, currently owns about 1% of the company, with over $124M invested.

ROIC and Profitability

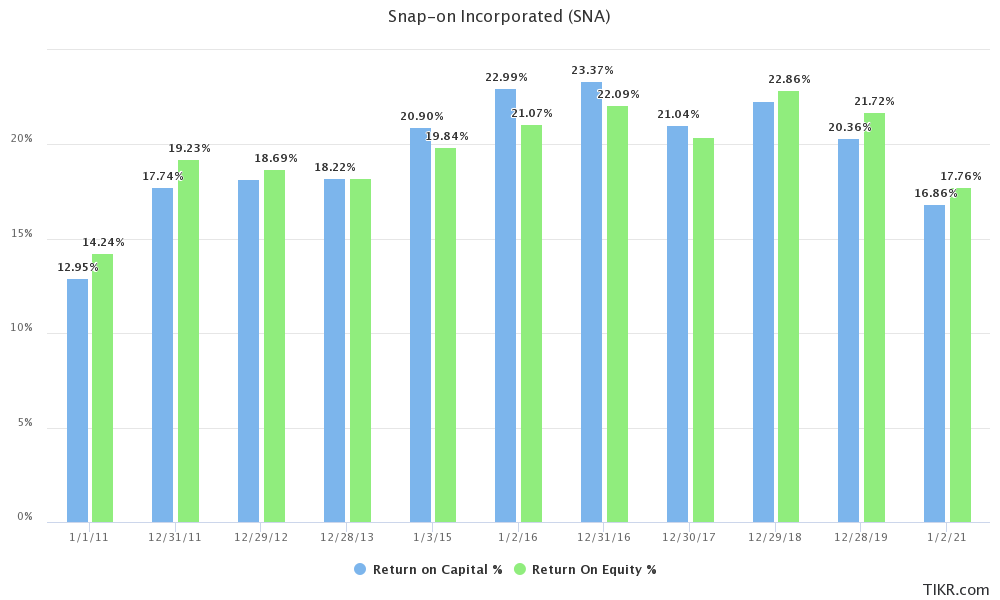

ROIC and profitability are far above the 10% threshold that I normally look for. In fact, the company has managed to nearly maintain above 15% ROIC and ROEs for the past decade, which is no small feat.

Rapid Continuous Improvement (RCI) Initiatives

Snap-on management has been notoriously shareholder friendly over the years. This is in part from management’s dedication to their Rapid Continuous Improvement (RCI) Initiatives.

The RCI process is designed to enhance organizational effectiveness and minimize costs besides helping Snap-on to boost sales and margins, and generate savings, all with the goal of increasing business, and thusly shareholder, value.

Like growth, they focus on four core areas:

Safety: Snap has drastically reduced the number of workplace accidents by 90%.

Quality: Snap stands by their brands and only want to offer customers the best products they can possibly make.

Customer Connection: By heavily integrating themselves with their customers, they are the first ones to be present when a need arrives.

Innovation: Striving to create new and unique products to tackle emerging problems. An example being new vehicle technologies.

Lastly, the company has rewarded shareholders with consistent stock buybacks and an increasing dividend.

Verdict

I have nearly no qualms with management here. They seems to be ticking all the boxes I look for in good management.

Easy point.

Score: 1 Point

Principle #4

A Business That is Available at an Attractive Price

Free Cash Flow

For a really old manufacturing company, I was really surprised to see the amount of FCF that SNA has generated over the past decade. Impressively, they have managed to compound FCF at almost 35% per year!

These are high tech company type of growth rates here, and I think it is because of good management and stable margins.

SNA has also traded at a pretty hefty premium historically, but FCF has risen a lot over the past few years, and the P/FCF has dropped to a more reasonable level at around 15.

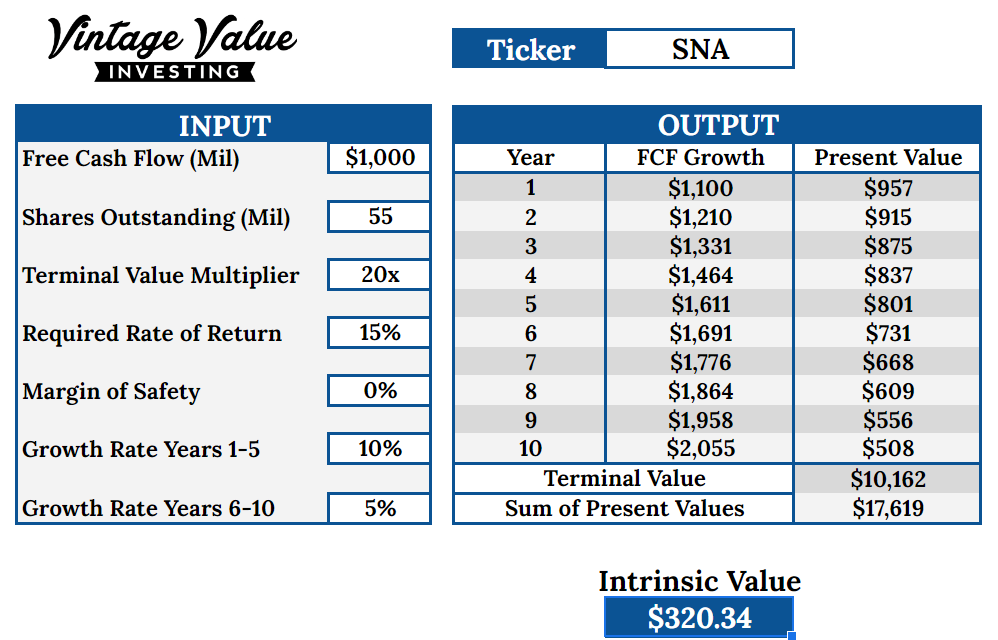

Pending some uncertain doom for the company, I don’t foresee any major issues here. But for a conservative take, I will go ahead and project the company to grow FCF by 10% for the first five years, and then slowly dip to 5% the following five years.

Since the company is trading at reasonable P/FCF, I will keep it at 15, and enjoy any upside as a bonus if it reverts to the mean of around 20-25.

Discounted Cash Flow

Here’s my DCF work on SNA with zero margin of safety:

And here’s a 15% margin of safety:

Verdict

Current SNA share price: $217.98

My buy price: $233.03

I am sort of shocked by this valuation. I had to double check my numbers to make sure things were correctly inputted. I thought for sure that a boring, cash flowing machine would be more highly priced than this.

This is even more stark since the stock price has over doubled since the COVID crash last year. If you were lucky to pick that bottom at $101, you would have really been able to snatch up a deal.

Bonuses

This valuation was made around today’s P/FCF, which is around 15. If the multiple expands and returns to the mean of just 20, that would be a huge upside to the stock price.

Also, I think that my calculations are quite conservative. SNA will likely continue to buy back stock and issue dividends, which are completely un accounted for in my valuation.

Easy pass here!

Score: 1 Points

Final Thoughts and Score

Snap-on Inc. (SNA) Score: 4/4

I am honestly pretty surprised. I fully expected Snap-on to be fully valued at best and overvalued at worst. An undervalued calculation is quite unexpected, especially with the share price running so much lately. I will no doubt have to double-check my numbers, but things look very nice from a valuation standpoint.

For now, I think Snap-on is offering a lot of good things for investors, but most important of all, low risk. Given their long-standing stability, closeness to the customer, impeccable balance sheet, and guaranteed dividend and buybacks, there is not much to lose here other than paying too much.

I am not expecting Snap-on to double again this year, but I think that it can be a very nice portfolio stabilizer. Also, you don’t have to necessarily rely on high growth rates to get you your returns.

This is a classic case of “heads I win, tails I don’t lose much”.

Recommended Articles

Summer 2021 Notes and Thoughts: Vintage Value Investing

I recently wrote a bit of a different article this week. This is an informal look into some things I have been reading, watching, listening, and experiencing this summer that I thought I would share with my audience.

It ranges the gamut of media, so be prepared for some potentially non-related investing items.

Let me know what you think!

Music

I have never been a huge Whitechapel fan, that is until the released their most recent album The Valley back in 2019. This album took things to the next level for the band, as they really experimented with some non-traditional deathcore elements.

The song “Hickory Creek” is one of those experimental songs that the band put out on the album. The lead vocalist, Phil Bozeman, is known for his brutal screams and growls, but for the first time ever, he uses clean vocals on the entire track.

This may not sound like a big deal for a normal band, and it may sound like a normal song to someone that is not familiar with Whitechapel’s sound. But when you put this song against their previous work, it is a big deal.

I really liked the track, especially because the song (and entire album) is about Phil’s childhood, with the tragic story of his mother’s passing. Give it a listen and see what you think.

Holdings Disclosure

Neither I nor anyone else associated with this website and newsletter has a position in SNA and no plans to initiate any positions within the 72 hours of this publication.

I wrote this article myself, and it expresses my own personal views and opinions. I am not receiving compensation, nor do I have a business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer

None of the writers or contributors of Stock Spotlight are registered investment advisors, brokers/dealers, securities brokers, or financial planners. This report is being provided for informational and educational purposes only and on the condition that it will not form a primary basis for any investment decision.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA (publishers of Stock Spotlight) on whether to buy, sell or hold shares of any particular stock.

None of the information in our articles is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The information is general in nature, and is not specific to you.

Vertigo Studio SA is not responsible and cannot be held liable for any investment decision made by you. Before using any article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA on whether to buy, sell or hold shares of any particular stock.

We did not receive compensation from any companies whose stock is mentioned in this report.

No part of the analyst's compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed in this report.