Free Report #15: Canadian Pacific Railway (CP)

Canadian Pacific Railway (CP)

Back in May of this year, I went home to visit family for the first time in three years. It was nice to be back in my small town in rural Ohio after seeing bustling European metropolis cities (my life is rough, I know lol).

While visiting, I routinely have to drive across some railway stops to get to my parents house. The track is only about half a mile away from the house and it runs all the way through the town, and even snakes its way behind the school.

As a kid, I distinctly remember hearing the train passing through (either from school or home) at least a couple of times a week. As I got older, these I noticed that occurrences became less frequent. So infrequent in fact, that when the train did go by, class stopped to watch or listen.

On day, I asked my dad: “Are there even any trains running through here anymore?” My dad replied, “Maybe once in a quarter. It’s not nearly what it used to be”.

Why though? I find this to be an odd phenomenon. The US industrial era was built on the back of railroads, and were relied upon in almost every industry. So what caused them to decline?

Well, that story is beyond this newsletters perview. But here’s the thing: rail is still alive in well in the North America.

In fact, we need to go a bit farther north to see exactly what is going on.

Let’s dive into this week’s company: Canadian Pacific Railway (CP).

Principle #1

A Business That We Can Understand

History

As I mentioned before, the railway industry is an old one, and most of the companies have been operating for at least a century. Canadian Pacific is no different.

The Canadian Pacific Railway story began back in 1881. The company had one specific goal: link Canada’s populated centres with the vast potential of its relatively unpopulated West. Amazingly, this feat was accomplished in only four years, when originally it was scheduled to take ten!

CP then grew at a rapid pace, and even expanded into some unrelated industries. They were one of the first in the country to erect telegraphs lines, discovered (by accident) a huge amount of natural gas, and even created their own fleet of steamships on the Great Lakes and Pacific Ocean!

The company went through many business cycles (especially during both World Wars) but went on to refocus its efforts in the 1950’s as Canada’s primary cross-country freight and logistics railway service.

Present Day Operations

Fast forwarding to present day, CP is now a $50B railroad company operating on 13,000 miles of track across most of Canada and into parts of the Midwestern and Northeastern United States.

CP has a staggering amount of tracks laid across North America. As you can see, their rail network stretches from key North American ports on the East and West coasts. This provides their customers with the shortest and most efficient routes possible to key ports on either side of the continent.

Even though they are primarily a Canadian railway company, CP serves much of the Northeast and Midwest US, with tracks snaking all the way down into Kansas City, Missouri.

CP’s shipping business is diversified in two important ways: merchandise and geography.

In 2020, CP hauled shipments of grain (24% of freight revenue), intermodal containers (21%), energy products (like crude and frac sand), chemicals, and plastics (20%) coal (8%), fertilizer and potash (10%), automotive products (4%), and a diverse mix of other merchandise.

It is further geographically diversified by shipping to a global market by linking Europe and Asia, across the southern border down to the US and even Mexico, and domestically within Canada itself.

Business diversity is extremely important to CP. The company mainly ships natural resources and these natural resources constantly fluctuate in value. At any given time, a specific item or geographic area could be underperforming. Just like a stock portfolio, by having a diverse mix of assets, CP is able to weather this volatility when it arrives.

CP serves two main crucial operations for both the US and Canada by shipping coal and grain across the countries. If you like beer, bread, and electricity, you probably have CP to thank for them.

Verdict

CP is operating a vast railway network across North America that delivers crucial merchandise and natural resources for hundreds of millions of people. Their efficient track and diverse mix of merchandise allows them to get products to consumers quickly and efficiently.

Score: 1 Point

Principle #2

A Business That Has Favorable Long-Term Prospects

Growth Plans

When I think of a high growth company, I don’t think of railroads. I don’t really think anyone does these days, as the railroad industry is perceived as an ancient form of technology we have mostly moved past.

If you want an amazing growth story here, you won’t find it. The most CP has to offer is already there: the physical assets. Obviously, CP has a lot of physical assets that include items like land, locomotives, train cars, rail yards, and most importantly, the railways themselves.

But when the company already has the track built, all the need to is maintain what they have and make it more efficient in order to expand margins.

CP has identified a few areas where they plan to grow:

Adding more locomotives

Expanding terminals and yards

Increase train speed and length

The good thing is that CP has mostly been accomplishing these goals. The only thing they have been struggling with is average train speed. Otherwise, performance of their operations have been trending in an upward trajectory.

The most growth I see for CP seems to be in their land availability at their railyards. This extra land allows the company the flexibility to expand their operations by adding different facilities to grow business.

All this work is hopefully supposed to translate over to the finances, and reward shareholders. Over the past five years or so, things seemed to have been going well for CP, as increased efficiency has translated to improved top and bottom line performance.

Growth Bottom Line

For CP (or any railway for that matter) to grow, all it needs to do is increase efficiency, and expand business operations slightly over time. I have not seen any indications to actually build more rail, so the growth mainly comes from how much the company can expand margins.

Risks

Capital Expenditures

Of course, running a railway company is a capital intensive business, as there are various physicals assets to maintain. Unfortunately, the CAPEX budget chews up a lot of CP’s cash flows, with about 50% just spent on maintenance CAPEX.

However, over the past few years, CP has made progress in reducing CAPEX as a percentage of cash flows.

Debt and Liquidity

Debt issues can be devastating for a company, especially for shareholders, since we are the ones who get paid last in the case of a liquidation. Over the past few years, CP has been having some liquidity issues.

This means that CP may be forced to liquidate some of their long-term assets in order to raise cash to pay off their debts. This is never a good sign for a company, and a bit worrisome that this problem has persisted over the last five years.

However, this problem is not really specific to CP, as many other railways operate like this.

Competition and Industry Consolidation

Back when the railroad industry was taking its baby steps, there were dozens of corporations competing for railway dominance. Since then, the industry has consolidated greatly, as Canada only has two main railroad companies: Canadian Pacific (CP) and Canadian National (CNI).

These two companies have always been competing, but CNI has been ever so slightly larger, and has rails stretching all the way down to the Gulf of Mexico in the US.

Recently, CP and CNI were in a heated battle to acquire another American railroad company: Kansas City Southern (KSU). As you may have guessed, KSU has many tracks in the southern part of the US, but more importantly, rails that lead deep into Mexico.

KSU was originally supposed to agree to a merger with CP, but at the last minute, broke off the deal and went ahead with CNI.

With CNI’s newly acquired access to KSU’s railways, CNI now has access to nearly every single coastline in North America.

Verdict

I really think the core business model of railroads themselves are amazing. A railroad in itself is basically a giant network effect; the bigger, the better.

While the CAPEX and liquidity issues are present, they are somewhat standard for the railroad industry as a whole.

I would what bother me more is the competition from CNI. With the combination of CNI and KSU, I think this may pose a threat to CP, although I need to do more research in order to be sure.

For that reason, I think if CP focuses on efficiency, I think they can separate themselves from CNI. But time will tell.

Score: 1/2 Point

Principle #3

A Business That is Operated by Honest and Competent People

Mr. Keith Creel is the current President and CEO of CP. He has been leading the company since 2017, but originally joined as COO back in 2013.

Mr. Creel is a railroad man through and through. He began his career in 1992 at Burlington Northern Railway (now owned by Berkshire Hathaway), and then moved on to many other railway company positions until he landed his first executive position with CNI.

Mr. Creel seems like a great man in charge as CEO of a rail company. He has been with the industry his entire career and seems to know the industry in and out.

Alignment

As a large, established, and well-known company, it’s not surprising to see that CP is mainly institutionally owned. However, I was surprised to see that the general public owned nearly 25% of the company.

Unfortunately, neither the management team or the board have any significant stakes in the company.

ROIC and Profitability

For a railway company, CP has some pretty amazing qualitative metrics. ROIC, ROE, and Gross Margins are all relatively high and climbing higher each year. This is exactly what we are looking for.

In my opinion, being able to grow margins for a railway company is very important, and CP has seen some great success in doing so over the past decade.

Rewarding Shareholders

The main way CP rewards its shareholders is pretty simple. Expand margins, grow free cash flow, use free cash flow to buy back shares and pay a healthy dividend.

This has been done quite effectively in the past, so I don’t foresee it stopping in the future. It’s worked so well in fact, that the stock has returned nearly 20% per year the past decade by using this method.

Verdict

Management at CP seems quite competent and capable. I am not seeing any red flags here. This capital allocation model is used with almost every railroad, and CP has managed to compound their stock for quite some time.

Things look good here.

Score: 1 Point

Principle #4

A Business That is Available at an Attractive Price

Free Cash Flow

CP has been able to solidly compound FCF at a quite healthy rate of 25%. It’s no surprise that this relatively safe cash flow has come at a premium. CP’s P/FCF has traded above a 70x multiple in the not so recent past.

That multiple has contracted since the company has had a solid spike in cash over the past year. This was because CP was awarded a $700 million payout from the botched KSU acquisition.

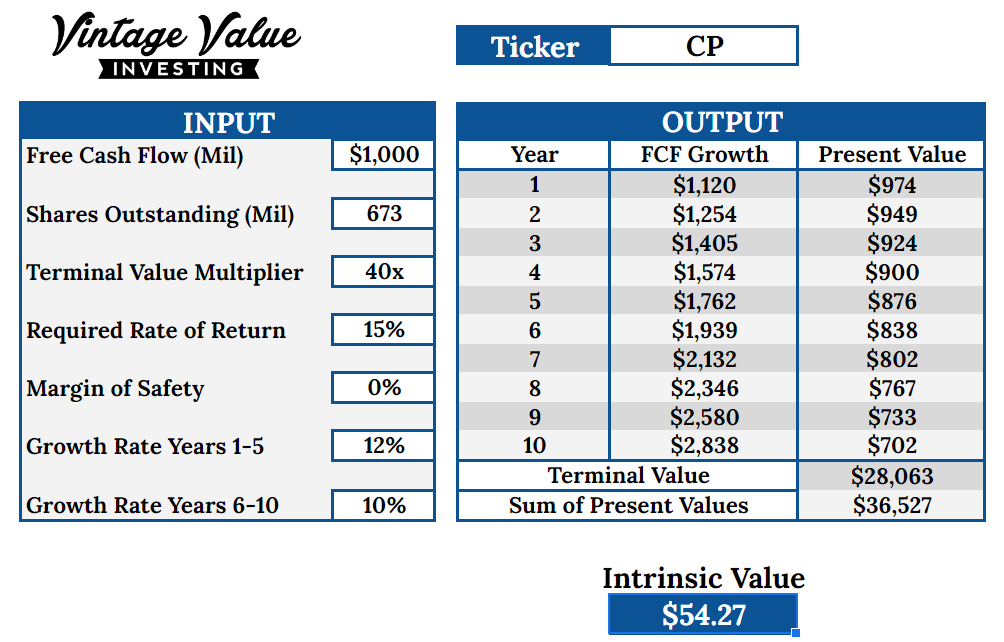

I think conservative growth rates are important for this forecast. I cannot say for certain how much the company will grow due to the increased competition with CNI. I think that if CP can double down on efficiency, it will help them break away from CNI.

This will cause more money to be focused on growth CAPEX, ultimately lowering the FCF growth. I think a healthy growth rate of 12% and 10% respectively is good enough to account for this.

The P/FCF multiple is currently low due to the extra cash on hand. Historically, the company has traded anywhere in the 40x - 50x range. I will assume a “conservative” estimate of 40 for my DCF.

Discounted Cash Flow

Here’s my DCF work on CP with zero margin of safety:

And here’s a 15% margin of safety:

Verdict

Current CP share price: $73.49

My buy price: $46.13

This was an unsurprising DCF for me. Railroads are known to usually be traded at high valuations given the safety of the business model and shareholder friendly buybacks and dividends. They are also in a plethora of ETFs and mutual funds, which constantly plows money into the stock.

Keeping all estimates constant, CP is currently priced at approximately a 11% return, which is not terrible at all.

Score: 0 Points

Final Thoughts and Score

Canadian Pacific Railway (CP) Score: 2.5/4

As I stated before, railroads are inherently good business. It really comes down to a few things when choosing one to buy:

Ability to expand profitability and margins and return cash to shareholders

Expand rail network by acquiring other smaller companies

Valuation

After writing this article, I realized that CNI may be the better choice. They already have fulfilled one of these criteria above and may fill the others; I just need to research it some more.

Let me know if you would like me to write about CNI next!

Recommended Articles

The Complete List Of Q2 2021 Hedge Fund Letters To Investors: Vintage Value Investing

This week, I spend most of my time compiling and reading Q2 hedge fund letters. I love reading these letters. It provides me a lot of insight into different methods of thinking, as well as exposes me to different stock ideas.

Check out the list of over 125 fund letters. Enjoy!

Music

Sleep Token released a new song this week from their upcoming album This Will Be Your Tomb.

“The Love You Want” once again shows off how incredible this band is at writing music. The layering of sounds and building intensity is a style that Sleep Token has mastered. Again, the lyrics and vocals are on another level.

I really cannot wait for this album. I am almost convinced that this band cannot release a bad song.

Holdings Disclosure

Neither I nor anyone else associated with this website and newsletter has a position in CP and no plans to initiate any positions within the 72 hours of this publication.

I wrote this article myself, and it expresses my own personal views and opinions. I am not receiving compensation, nor do I have a business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer

None of the writers or contributors of Stock Spotlight are registered investment advisors, brokers/dealers, securities brokers, or financial planners. This report is being provided for informational and educational purposes only and on the condition that it will not form a primary basis for any investment decision.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA (publishers of Stock Spotlight) on whether to buy, sell or hold shares of any particular stock.

None of the information in our articles is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The information is general in nature, and is not specific to you.

Vertigo Studio SA is not responsible and cannot be held liable for any investment decision made by you. Before using any article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA on whether to buy, sell or hold shares of any particular stock.

We did not receive compensation from any companies whose stock is mentioned in this report.

No part of the analyst's compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed in this report.