Issue #16: Canadian National Railway (CNI)

Canadian National Railway (CNI)

In last week’s issue, I focused on Canadian Pacific Railway (CP), and how they are one of the two major Canadian railroad companies. If you haven’t read it yet, I would highly recommend doing so, since this week I will be covering their main competition: Canadian National Railway (CNI).

The CP issue provide you with some background for this week’s read, as well as good information on railroads in general.

There is a good reason I am writing on two railroad companies back to back. The two companies are in an intense bidding war to acquire Kansas City Southern (KSU) in order to become the most dominant railroad company in North America.

Here’s the kicker: it just heated up even more!

The day after I published my CP issue, CP announced a counter-bid to CNI’s offer to take over KSU. CP came in with a bid of $2B higher than previously offered.

This rivalry is just too juicy (and timely!) for me to ignore. I write this in hopes to determine which company is the better RR before the acquisition goes through.

This issue may be a bit shorter than most since I already covered some basic RR topics in the CP issue. I will strictly be going for the main course and avoiding the appetizers.

Let’s dive in!

Principle #1

A Business That We Can Understand

History

Some quick history on CNI before we press on. CNI has been around for a long time, but not as long as CP.

CNI was actually founded by the Canadian government back in 1918 when the government decided to consolidate many of the smaller nationalized RRs into one transcontinental RR. Of course, this merger began the intense rivalry with CP, since there was now another large railway service in play.

The government allowed this competition to fester for about 15 years until they passed the Canadian National–Canadian Pacific Act in 1933. This act forced the RRs to cooperate more by eliminating duplicative services.

Present Day

Fast forward to 1995, and the government finally relinquished their hold on CNI and allowed them to become a fully privatized company. CNI then had freedom to conduct acquisitions to expand their network, which they did so considerably.

CNI’s rail network now sprawls across two-thirds of the North American continent, with crucial lines that go all the way to the Gulf of New Mexico. This rail line that bisects the US is a crucial one for one reason: CP doesn’t have it.

Operations

CNI ships almost the same type of cargo as CP, with an impressively diverse amount of cargo. I would say it is slightly more diverse than CP’s but only by a small amount.

CNI definitely uses its three-coast network to its advantage. By having access to the Mid-Western and Southern US, it allows CNI to have a more robust portfolio of items to ship to these destinations.

Verdict

CNI is operating a very large (larger than CP) railway company, with access to key coastal areas in both Canada and the US. The cargo is nearly the same as CP, but access to the Deep South of the US allows them to broaden their options.

Score: 1 Point

Principle #2

A Business That Has Favorable Long-Term Prospects

KSU Acquisition

Just like they have in the past, the main way for CNI to grow is through acquisitions. This brings us to the hotly contested US RR company, KSU. As I stated previously, this battle is still ongoing with CP.

An important note: whichever company actually acquires KSU, it still has to go through the regulators to be approved. Now, I doubt the regulators would let the bidding war go this far without any intervention, but I really have no insight into how these processes work.

Regardless, both CP and CNI are marketing the KSU merger as a “must win battle”. There is no denying that the KSU acquisition would add enormous value for either company, with the biggest gain being access to the Mexican market.

Whichever railway actually gets KSU is no doubt the more valuable company. This will be something I watch closely, especially since there will likely be some stock price volatility which may create some buying opportunities.

Growth Plans

Again, just like CP, CNI has multiple options to increase value by expanding their railyards for more efficient operations. Simply based on the information provided by both companies, it seems that CNI has a bit of an edge here because of their more diverse locations and hubs.

I think the growth with the most potential is the intermodal investments the company is making on the Western Canadian coast, specifically in the ports of Vancouver and Prince Rupert. The investments for Prince Rupert port upgrades are even jointly funded by the Canadian government.

This helps the company prepare for more demand to and from Asia, which is likely to increase in the coming years.

Additionally, the company seems to be investing heavily into AI and other technologies in order to automate inspections as quickly and safely as possible.

Risks

The biggest risks railway companies are capital expenditures and debt. Let’s take a look at CNI to see how they are managing their big ticket items.

Capital Expenditures

I was genuinely surprised to see how steady both CFO and CAPEX is for CNI. Both are rising, but remaining relatively proportional to one another. About roughly half of CNI’s CFO goes back into CAPEX, which is actually not too bad for the industry. This is a bit more steady than CP’s CAPEX, which is nice to see.

Debt and Liquidity

Unfortunately, CNI’s liquidity issues seems to be similar to CP’s, which is not heartwarming. I know this is standard for the industry, but I am not quite sure why. This is a bit concerning, especially when the company would want cash during a bidding war.

If anyone knows why the companies operate this way, please let me know!

Verdict

The lynchpin for CNI’s growth (or CP’s growth) is, of course, the KSU acquisition. Whichever company gets KSU, they will immediately become more valuable than the other.

Disregarding the KSU situation, I think that CNI seems to have a bit more growth plans than what I saw from CP. Their transmodal growth seems to be quite promising. CNI is embracing technology as much as they can in order to increase efficiency as well.

CNI seems to have put in the work to achieve a point here, but again, everything seems to hinge on the KSU merger.

Score: 1 Point

Principle #3

A Business That is Operated by Honest and Competent People

President & CEO

Jean Jacques Ruest is the current CEO of CNI. He has been leading the company since 2018 when he was appointed to the position.

Mr. Ruest has been with CNI since 1996, which is right around the time the company was taken private. Before he was CEO, Mr. Ruest was the Chief Marketing Officer.

It seems like he’s doing good things, since in 2019 he was awarded the Railroader of the Year award.

Alignment

CNI is largely held by institutions and the general public. Cascade Investments VC firm owns about 11%, with the remainder being held by individuals. Of note, Melinda Gates it the largest individual shareholder, owning about 3% of the company.

The CEO owns roughly .12%, or $89M CAD in the company. This is likely a large amount of his personal net worth, so this is great to see.

ROIC and Profitability

Similar to CP, CNI’s gross margins, ROE, and ROIC are looking very good for an older railroad company. The only thing I find slightly concerning is the small dip in ROE and ROIC over the past few years. This is most likely due to investments in growth CAPEX.

Rewarding Shareholders

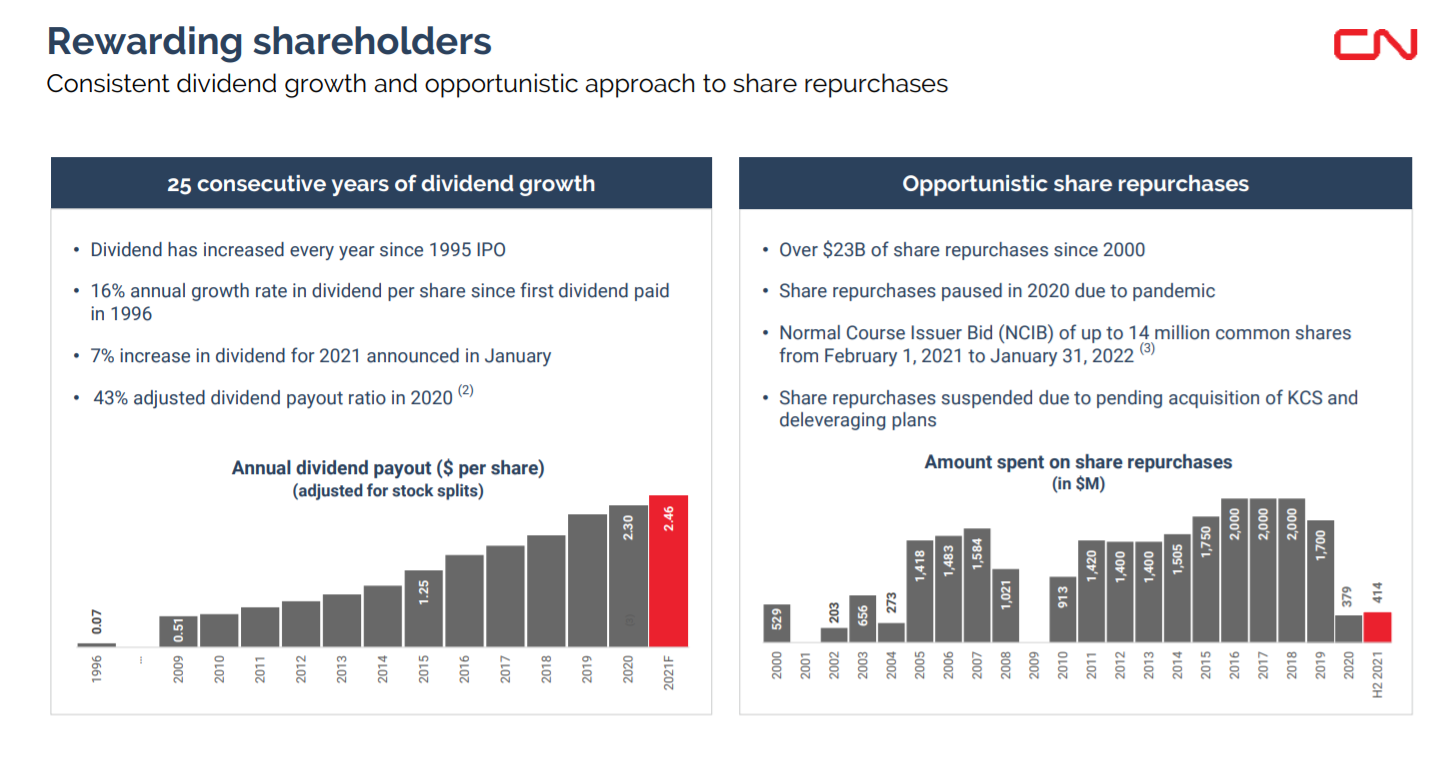

CNI has been rewarding shareholders as a typical railway company does: dividends and stock buybacks. The company has issued a healthy and growing dividend ever since they went private back in ‘95.

CNI paused their share repurchases in 2020 due to the unforeseen impacts of COVID and have kept them low recently due to the pending KSU acquisition. Once the KSU drama is finally resolved, I would expect these buybacks to kick back in.

Verdict

The CEO does not have much of a track record that I could find, but the company’s executive team as a whole seem to be making the right decisions. I like that there are some decently large individual stakes in the company as well.

Score: 1 Point

Principle #4

A Business That is Available at an Attractive Price

Free Cash Flow

CNI has seen some pretty steady FCF growth over the past decade, nearly doubling FCF in that time frame. Of course, this steady business has come at a pretty high multiple. CNI’s P/FCF seems to hover around 50x and even reached a whopping 140x before the pandemic!

I find it pretty hard to determine CNI’s FCF growth rate over the next coming years. Of course, things rely on the success or failure of the KSU acquisition.

Since the acquisition is far from complete, I will calculate that they will continue to maintain steady operations. This means they will continue to compound FCF at around 10% per year, and slow down to 8%.

CNI seems to hover around the 35x - 50x P/FCF multiple, so I will go with 35x to be conservative.

Discounted Cash Flow

Here’s my DCF work on CNI with zero margin of safety:

And here’s a 15% margin of safety:

Verdict

Current CNI share price: $108.08

My buy price: $77.39

Ironically, CNI is just about similarly overpriced as CP. According to my estimates, CNI is currently offering about a 12% return with no margin of safety, which gives it a slight advantage over CP’s 11% return.

Even though it is offering a decent return, I think the price of the KSU is almost completely baked in the current price. I think I would be uncomfortable purchasing the stock at this price pre-acquisition.

Score: 0 Points

Final Thoughts and Score

Canadian National Railway (CNI) Score: 3/4

So, in the head to head battle for the railway of Canada, I think CNI has a slight edge here. Both are overvalued, but I think that CNI has two important things over CP:

Lots of reinvestment opportunities for future growth (at least more than what I saw with CP)

Management and ownership seems slightly more favorable to shareholders

But these are somewhat minor differences. CNI seems to be the a bit more slow and steady growing, while CP has been able to churn out impressive 25% annualized FCF growth.

I will be watching with bated breath to see who wins this acquisition battle over KSU. Whichever company wins (pending regulation approval) will undoubtedly be the king of the North American railroads.

Recommended Articles

Fiverr – Investment Thesis: Investing Curator

A very interesting take on Fiverr. Fiverr is a very interesting company that seems to have a lot of value potential…as long as the management can execute properly.

Music

I generally have like most of The Plot in You’s music. The lead vocalist, Landon Tewers, has a heavy direction into the band’s overall direction and style. I really enjoy his vocal performances, as he brings a lot of emotion into his voice as he sings.

The band’s most recent release “Face Me”, is a solid new track from the band. Landon delivers on the vocal front as usual, while almost even rapping for a few beats.

I like the track overall, and am hungry for the next album!

Holdings Disclosure

Neither I nor anyone else associated with this website and newsletter has a position in CNI and no plans to initiate any positions within the 72 hours of this publication.

I wrote this article myself, and it expresses my own personal views and opinions. I am not receiving compensation, nor do I have a business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer

None of the writers or contributors of Stock Spotlight are registered investment advisors, brokers/dealers, securities brokers, or financial planners. This report is being provided for informational and educational purposes only and on the condition that it will not form a primary basis for any investment decision.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA (publishers of Stock Spotlight) on whether to buy, sell or hold shares of any particular stock.

None of the information in our articles is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The information is general in nature, and is not specific to you.

Vertigo Studio SA is not responsible and cannot be held liable for any investment decision made by you. Before using any article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA on whether to buy, sell or hold shares of any particular stock.

We did not receive compensation from any companies whose stock is mentioned in this report.

No part of the analyst's compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed in this report.