Free Report #17: Sherwin Williams (SHW)

Sherwin Williams (SHW)

Frankly, paint is not a substance I am particularly familiar with. Being a pretty messy liquid, I have always never really like painting anything really.

That being said, that doesn’t mean that I have never painted. In fact, I have painted decks, garages, houses, cornhole boards, etc. It’s odd to think about, but nearly everything we touch has some kind of paint, ink, or dye on it.

So does this mean that a company that sells these items are a good investment? To be honest, I have no idea. I know next to nothing about this industry.

But that is the beauty of writing this newsletter. I get to explore different companies each week to find fresh and interesting ideas.

Without further ado, let’s dive into one of the largest paint manufacturers: Sherwin Williams (SHW).

Principle #1

A Business That We Can Understand

History

Sherwin Williams has been around much longer than I originally thought. The company was founded all the way back in 1866 in Cleveland, Ohio by the Henry Sherwin and Edward Williams.

They started out simply by selling one thing: ready-mixed paints.

The company went under some restructuring and modifications in the early years, but by the 1870’s, business was booming for the company. You see, back in that time, ready made and mixed paints were not commonplace like they are today. If you wanted paint, you had to buy ingredients separately and mix the paints yourself.

Sherwin Williams solved this problem by mixing paints on site, cutting out that work for the customer. This was immensely popular, and Sherwin Williams grew quickly. Over the years, they continued to thrive and buy up other companies, becoming the largest manufacturer of paints in the United States.

Present Day

Fast forward to present day, and Sherwin Williams is still the dominant paint manufacturer and distributor of paints in North America, Asia, and Europe. However, they have expanded their business greatly, and now own many brands that create other coatings, such as varnishes, lacquers, and stains.

They have acquired many brands that you may be familiar with, such as Krylon, Cabot, and Thompson’s Water Seal. In 2017, Sherwin Williams acquired rival paints maker Valspar in an all-cash transaction, creating a premier global paints and coatings company.

Operations

Sherwin Williams has three reportable operating segments: The Americas Group, The Consumer Brands Group and The Performance Coatings Group.

Let’s break each of these down.

The Americas Group: This is the largest and most important to the company’s stability. The division creates and sells a wide array of industrial coatings and paint products across North and Latin America through dedicated dealers and company-operated stores. This segment accounted for around 57% of Sherwin Williams’ 2020 sales.

The Consumer Brands Group: The division includes the company’s Consumer Group and Valspar's Consumer Paints segment. The segment operates highly efficient supply chain for paints and coatings related products across the globe. These are the products you find in your local hardware store. The segment accounted for around 17% of Sherwin Williams’ 2020 sales.

The Performance Coatings Group: The remaining unit includes the company’s Global Finishes Group and Valspar's Coatings Group coupled with Valspar's Automotive Refinishes products business. It sells a plethora of industrial coatings and finishes for for wood, marine-based objects, and automobiles. The segment accounted for around 26% of Sherwin Williams’ 2020 sales.

Sherwin Williams has reached the point of market saturation in the Americas. With over 4,000 wholly owned paint stores in operation, this allows the company to reach giant scale where a competitor is unlikely to ever challenge their superiority.

Two more really quick things I like about this company:

They operate an end-to-end supply chain with high quality control. From manufacturing the paint, to selling it in the stores, everything is done by the company.

They operate a dual network of wholly owned stores, but also sell their consumer products to your local hardware stores. Their products are wherever the customer decides to go, which effectively makes their reach much larger than it actually seems.

Verdict

Sherwin Williams is operating a great business that appeals to both industrial needs and DIYers alike. By making a simple, but necessary product, the company has effectvily cornered the coatings market.

Score: 1 Point

Principle #2

A Business That Has Favorable Long-Term Prospects

Growth Drivers

Here is the major downside with long established businesses like Sherwin Williams: organic growth is hard. In fact, with the research I have done on the Sherwin Williams, very little was said about the future growth of the company. That being said, let’s dive into what I think are the growth drivers of the business.

Increase in Stores Overseas

It seems that the business has most of its room to grow in overseas markets beyond the Americas, as it has already reached a saturation point.

Even though growth is not easy at their scale, the good thing is that Sherwin Williams can rely on two sets of customers: DIY/Remodelers and Industrial Paint Contractors.

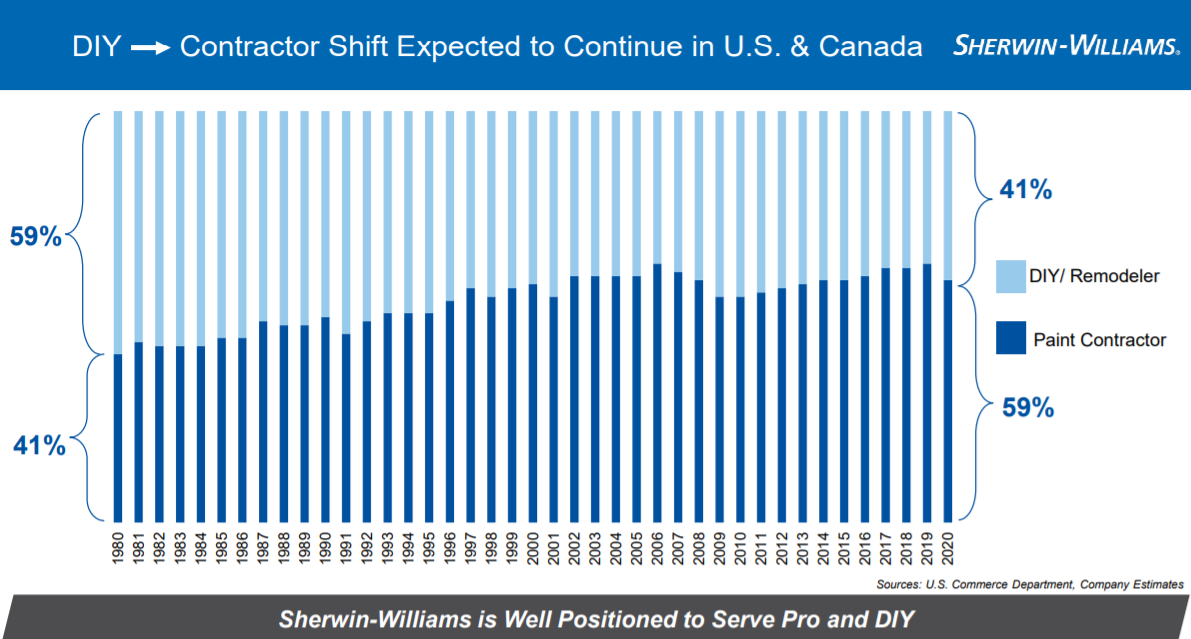

These two markets are very different from one another, but represent almost equally large chunks of the overall business. Back in the 80’s 59% of the customer base was DIYers, but that has slowly declined to 41% in 2020, with Industrial Paint Contractors taking more share every year.

This growth is mainly in line with the overall economy. In booming times, the Industrial Paint Contractors make up the bulk of sales. In times of economic decline (like in 2020), the DIYers make up a larger share of the market.

This flexibility allows for Sherwin Williams to have a very stable business in both good and bad economies, which is great because Sherwin Williams’ organic growth prospects are limited.

Mergers and Acquisitions

As old and dominant as Sherwin Williams is, the only real way to grow is through mergers and acquisitions. Sherwin Williams has gone through many, with the previously mentioned Valspar as the latest large M&A for the company.

This key acquisition greatly consolidated the industry, and allowed Sherwin Williams to climb even higher towards market dominance. In addition to expanding Sherwin Williams’ global platform in Asia-Pacific and Europe, the Middle East and Africa regions, the buyout adds new capabilities in the packaging and coil segments.

Even though the buyout was four years ago, most of these synergies haven’t been fully realized. But management expects for these benefits to be seen starting this year and next year.

Risks

Debt

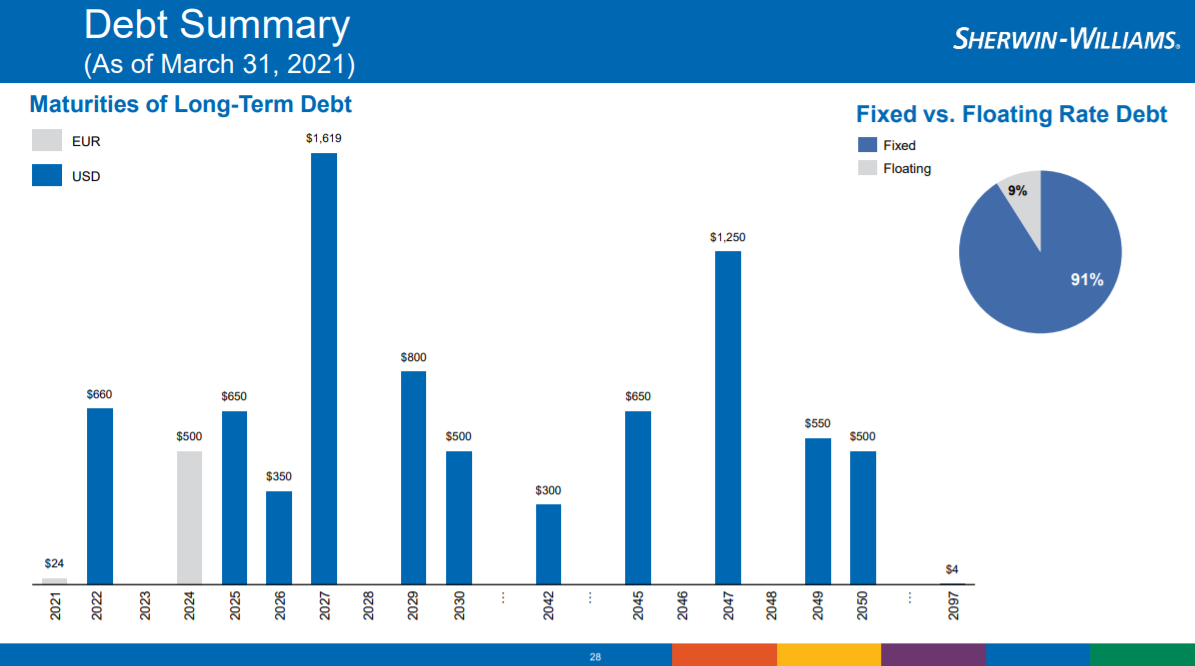

Sherwin Williams took out a lot of debt in 2017 for the Valspar acquisition. They levered up quite substantially in order to get the deal done. This kind of move can be dangerous if not done well.

However, management seems to be prioritizing bringing down the debt over time, as they have a good amount of liquidity to take care of payments, many of which aren’t due for many years down the line.

With a stable business like this, the main risk I see is management over extending itself for future acquisitions. The Valspar acquisition seemed to be a big one for the company, and I don’t think they will be doing another like it in the near future.

If they did decide to do so with debt, then I would be concerned, as the debt would start to get too large and eat into shareholder returns.

Verdict

Unfortunately, Sherwin Williams does not have many organic growth ahead, with the only identifiable one being opening new stores in overseas markets. The company will have to be careful how it approaches future M&As, as its debt levels are pretty high, at just under 3x debt to equity.

I think the company can handle the debt, but I am not super convinced of the organic growth, which is preferable. In this case, I think the company’s moat is very strong, which will ultimately be successful.

Score: 1/2 Point

Principle #3

A Business That is Operated by Honest and Competent People

Chairman, President, & CEO

Mr. John G. Morikis is the current Chairman, President, & CEO of Sherwin Williams. Mr. Morikis has been a Sherwin Williams employee since 1984; quite the tenure! He started all the way from the bottom and worked his way through the company to become CEO. Prior to his appointment as CEO in 2016, Mr. Morikis was the company COO for 10 years.

Mr. Morikis also serves and directs on many boards, such as Director of American Red Cross, Greater Cleveland Chapter, Director of University Hospitals Health System, and as a Member of the Joint Center for Housing Studies Policy Advisory Board at Harvard University.

Mr. Morikis seems like a perfect candidate to lead the company. Being employed by Sherwin Williams for his whole life, Mr. Morikis should have a great understanding of this company.

Alignment

Sherwin Williams is unsurprisingly mostly institutionally owned. However, it is nice to see that the Employee Share Scheme owns over 8% of the company.

Of note, the CEO, Mr. Morikis, owns over $100M of the company, which is likely a large portion of his personal net worth.

ROIC and Profitability

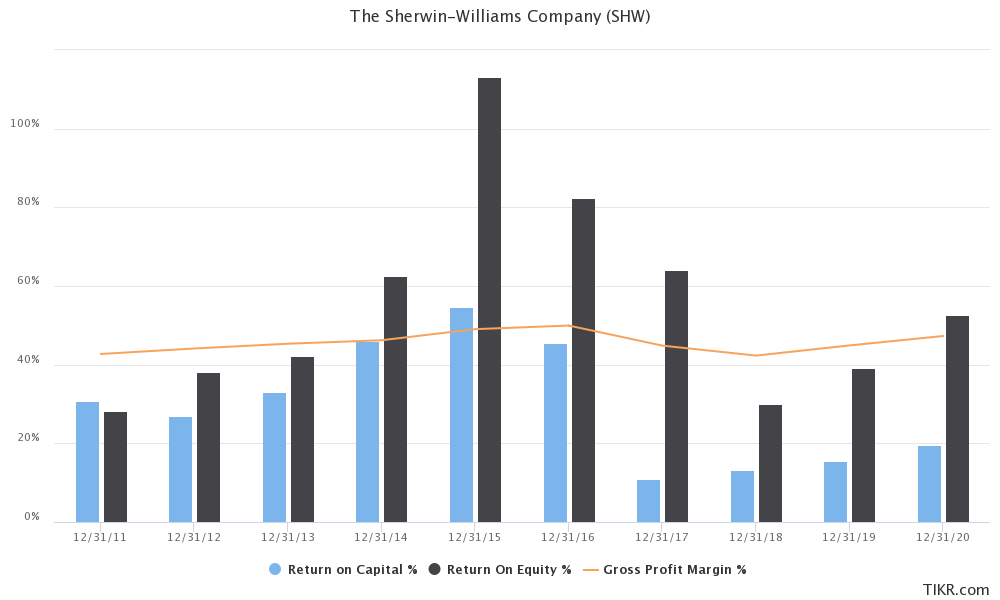

Sherwin Williams operates with excellent profitability metrics. Prior to the Valspar acquisition, the company was operating at near all time high profitability. Ever since the acquisition, the company’s metrics took a sharp dip due to the large amount of debt accrued. But even so, in 2017 ROIC was over 10% and ROE was over 30%, which is excellent.

Rewarding Shareholders and Capital Allocation

Since there are limited organic growth prospects for the company, Sherwin Williams rewards shareholders through M&As, dividends, and share buybacks. Sherwin Williams’ management is very upfront about not holding cash back from its shareholders.

Verdict

While I would like to see the company invest more in organic growth, that may not be the most viable option for them anymore at this stage of the business lifecycle. Dividends and buybacks are what will likely what will provide shareholder value.

I like the CEO, and I like their profitability even better.

Score: 1 Point

Principle #4

A Business That is Available at an Attractive Price

Free Cash Flow

SHW has been a steady FCF machine over the past decade, with impressively steady growth in the past five years. FCF has compounded at a rate of nearly 20% per year, almost doubling within the past few years.

This growth is likely the synergies from the Valspar acquisition finally kicking in.

Of course, this growth always comes at a cost. But it actually does not seem to be as expensive as I thought it might be. It seems SHW trades anywhere between 20x - 30x cash flows, which is somewhat reasonable for 20% growth per year.

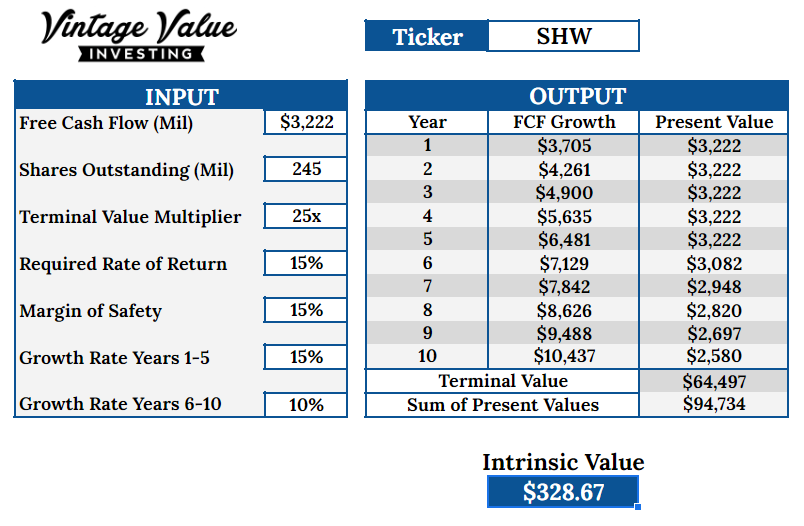

For my DCF calculation, I will assume that FCF will compound at a rate of 15% for the first five years, when it reaps the benefits of the Valspar deal, and then slow things down to 10% in the remaining five years.

I will assume a median P/FCF of about 25x.

Discounted Cash Flow

Here’s my DCF work on SHW with zero margin of safety:

And here’s a 15% margin of safety:

Verdict

Current SHW share price: $307.06

My buy price: $296.04

This DCF surprised me a bit, as I was expecting SHW to be pretty overvalued. Turns out, its only slightly overvalued, according to my estimates. One variable not accounted for here are the share buybacks. The share count is unlikely to remain at 272 million, as management has been trimming shares by at least 1% per year.

If we trim the share count down to 245 (which is entirely possible in 10 years) then SHW is currently undervalued.

I am willing to give SHW half a point here since the numbers are so close. Not a steal, but you are not overpaying either.

Score: 1/2 Point

Final Thoughts and Score

Sherwin Williams (SHW) Score: 3/4

After researching this company, I think Sherwin Williams is operating a fantastic business. I honestly expected them to be more overvalued than they currently are. Sherwin Williams is the type of stock that you can hold as part of a broad portfolio and enjoy the compounding with dividends and buybacks.

Even with the Valspar acquisition in 2017, the stock has been on a tear, returning over 28% in the last decade!

Recommended Articles

Business History with Gary Hoover: Neckar’s Notes

Frederik’s writing over at Neckar’s Notes always captivates me. He has great storytelling abilities that I love reading.

In this article, he interviews Gary Hoover, who runs the American Business History Center. The site is an enormous resource that I thought deserved a shout out.

Be sure to subscribe to Neckar’s Notes substack as well!

Music

Silent Planet is an excellent band, one of my all time favorites. They have the most bold lyricist/vocalist, Garrett Russell, in the entire scene. The guy can somehow make metalcore screaming poetic.

It seems like forever since they have released new material, so I was primed to inject their new music into my ears.

“Panopticon” is a heavy new addition for the band…and I love it. The guitars are extremely downtuned, Garrett’s vocals are on a brutal level, and the song is just downright groovy.

Give these guys a try. They deserve so much more listens than they get.

Thanks for reading!

-Dillon Jacobs

Holdings Disclosure

Neither I nor anyone else associated with this website and newsletter has a position in SHW and no plans to initiate any positions within the 72 hours of this publication.

I wrote this article myself, and it expresses my own personal views and opinions. I am not receiving compensation, nor do I have a business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer

None of the writers or contributors of Stock Spotlight are registered investment advisors, brokers/dealers, securities brokers, or financial planners. This report is being provided for informational and educational purposes only and on the condition that it will not form a primary basis for any investment decision.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA (publishers of Stock Spotlight) on whether to buy, sell or hold shares of any particular stock.

None of the information in our articles is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The information is general in nature, and is not specific to you.

Vertigo Studio SA is not responsible and cannot be held liable for any investment decision made by you. Before using any article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA on whether to buy, sell or hold shares of any particular stock.

We did not receive compensation from any companies whose stock is mentioned in this report.

No part of the analyst's compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed in this report.