Free Report #19: AutoNation Inc. (AN)

AutoNation (AN)

Americans love cars. Some of us even own multiple cars. In fact, the American car to adult ratio is over 1, with around 290M cars and 258M adults!

That’s a lot of automobiles, and it may seem excessive. It probably is. America is a nation obsessed with excess, so this jives. That being said, owning a car is absolutely crucial in most parts of the country, especially if you live in rural America.

If you live in a large city, (New York, L.A., Chicago, etc.) you can get around the city just fine with public transport. But in rural Ohio, where I am from, this simply is not an option. The only public transport that exists is the school bus.

So, in most places, owning a car is a necessity to commute efficiently. Therefore, the car economy (both new and used) is enormous. It seems like town in America, no matter how small, has its own used car dealership, like Ricks Auto Sales.

You can either go to Rick’s and buy a shoddy car, or you can go to a professional dealership. There are many different ones that come to mind, that all offer somewhat differing experiences:

CarMax (KMX)

America’s Car-Mart (CRMT)

Penske Automotive Group (PAG)

This industry is large fractured, and to analyze the entire industry is beyond the scope of this newsletter. So, for the sake of this publication, I decided to take a closer look at the largest in the country, and see if any moats are there.

Let’s take a look at AutoNation Inc. (AN).

Principle #1

A Business That We Can Understand

What They Do

AutoNation is the largest automotive dealer in the United States, with 2020 revenue of $20.4 billion and about 230 dealerships and over 300 locations including collision centers.

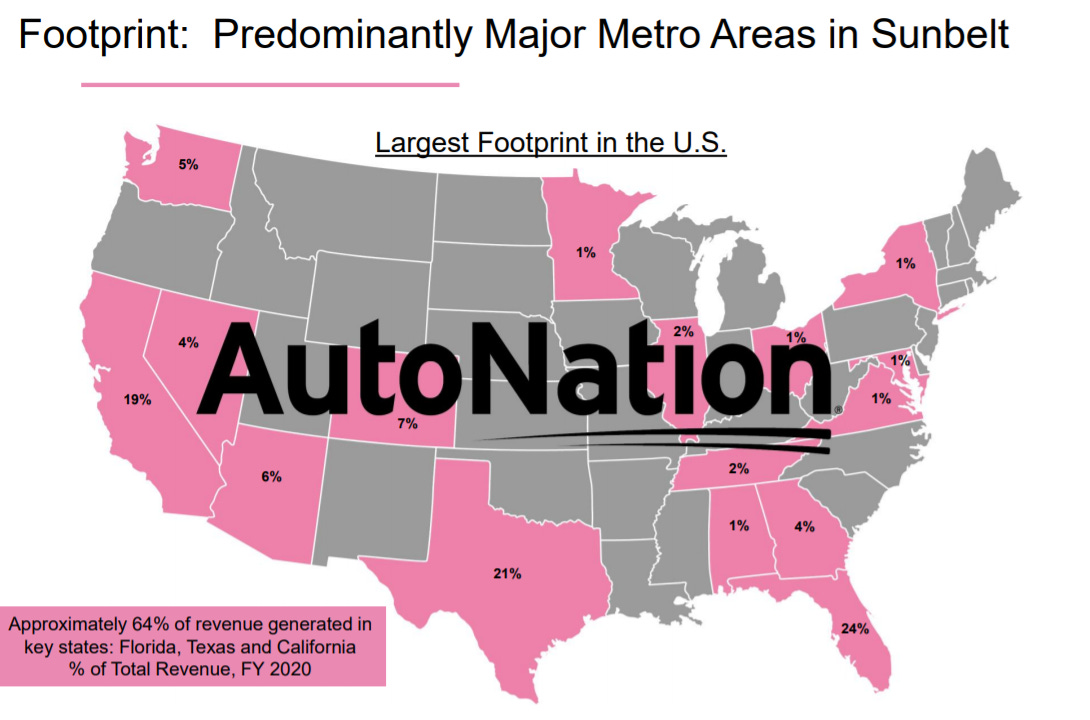

AutoNation operates a very large scale operation, with over 300 locations across the country. This wide footprint gives them the largest scale in their industry. The locations are quite spread out, but mostly focused in the southern portion of the US.

Most revenues come from most populous states in the union, such as Florida, Texas, California, and Colorado. This market penetration is crucial for AutoNation, as market share is extremely difficult in these very populated areas.

Operating Segments

As the largest auto retailer in the country, you can buy nearly any brand of vehicle from AutoNation.

Whether it’s an luxury European car, (Land Rover, BMW, Porsche) an economical Japanese model, (Honda, Toyota, Nissan) or the good old American classics, (Ford, GM) AutoNation has a car for every customer.

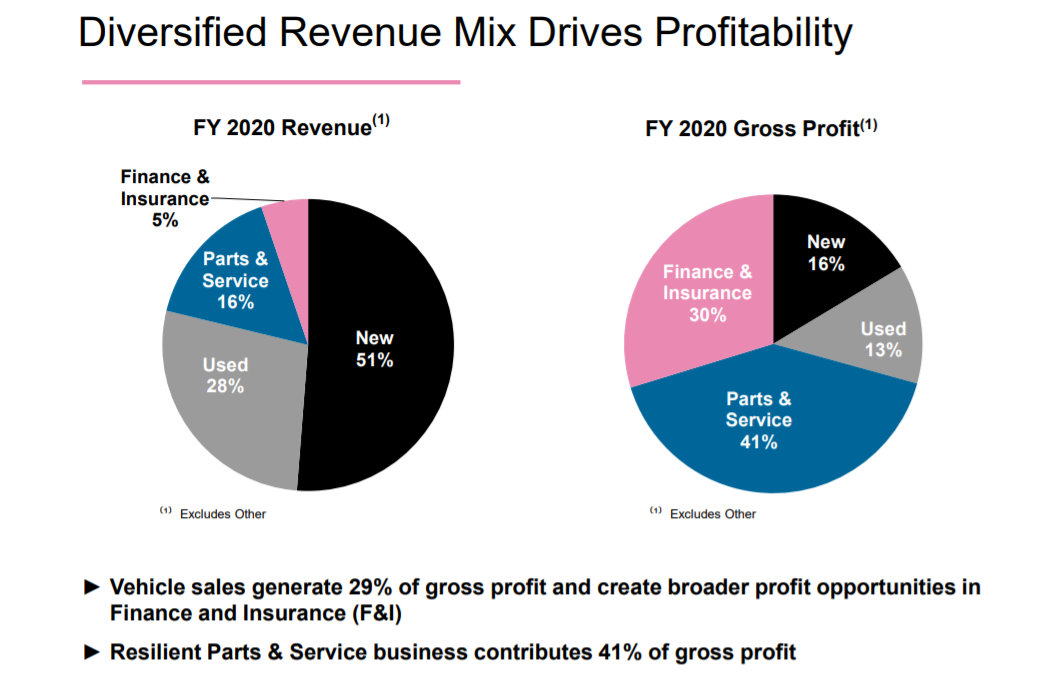

New-vehicle sales account for about 51% of revenue; the company also sells used vehicles, parts, and repair services as well as auto financing, which make up the rest of the revenue.

However, the most profitable segments of the business are also the smallest segments. The Parts & Service and Finance & Insurance divisions make up 71% of gross profits. This is a good thing, since car sales is very closely linked to the performance of the overall economy.

Image Control

After perusing through the reports, I noticed the company puts a large emphasis on image control and branding. I’m sure this is a big deal across the industry, but I feel like car retail is a business that requires more consumer trust than normal.

I have never purchased a car from AutoNation, so I can’t speak to their customer experience. However, I have definitely heard of them, and known many people that have been customers of AutoNation. I can’t say I have heard anything bad about them, but as always, your mileage may vary (good pun?) from customer to customer and store to store.

That being said, the AutoNation brand and image seems strong and trustworthy, which is very important to their operations.

Verdict

AutoNation’s core businesses are good, but I don’t think they are great. It still ticks the box for me here as understandable, but I don’t think it is necessarily a great business to be in.

AutoNation has a strong brand and national presence, but it’s in a business that is highly competitive, cyclical, and requires a lot of brand and image control. These are things I don’t want to have to worry about while running a business. But, I am still willing to give it half a point here.

Score: 1/2 Point

Principle #2

A Business That Has Favorable Long-Term Prospects

Growth Drivers

Let’s see if being the biggest is the best. We know that AutoNation has a very large store footprint, so that begs the question: is there still room to grow?

Store Growth

The answer seems to be yes, both organically and through M&A activity. In fact, AutoNation has some pretty ambitious growth plans for it’s stores.

AutoNation is currently running a pilot program of opening new stores in key areas. If successful, they plan to use this program to roll out over 130 new stores by 2026. These are highly ambitious growth plans, and it will take a lot of good execution to make good on the plans.

But it’s nice to see a plan for growth.

AutoNation plans for each new store to be fully profitable after 18 months of opening, generating nearly $2.4M per year. At a cost of $10M per store, this is about a 7% ROIC after 10 years.

Additionally, AutoNation just recently bought 11 stores and one collision center from Peacock Automotive Group, which helped boost its store count.

Digitalization

The car retail industry has been seeing increased competition in the online car buying space, with new up and comers like Carvana and Vroom. Luckily, AutoNation has been boosting it’s online presence and accessibility. This function is even more necessary in the pandemic economy we find ourselves in.

By smartly managing their large inventory of cars, AutoNation has created the digital platform AutoNation Express.

AutoNation Express is the storefront enables customers to buy and sell vehicles online, providing them a truly comprehensive and personal experience only found within AutoNation.

Risks

Internet Based Competition

As mentioned previously, the car retail industry it probably one of the most competitive and cutthroat industries I can think of. New internet-only brokers like Carvana and Vroom represent a significant threat, especially with Millennial and Gen Z customers, who are more comfortable with online shopping than older generations.

AutoNation is investing heavily into combatting this new wave, and is determined to be apart of the online car buying space. These newer internet based companies are still quite new, so it will be interesting to see how things shake out.

Standard Industry Competition

Now forget about the internet based companies, because we still have the normal competition such as CarMax, America’s Car Mart, and many others individual privately owned stores.

This industry is so fragmented, it is extremely difficult for a retailer to break out and gain significant market share.

Cyclicality

When times are tough, people don’t by cars, and car retailers and manufacturers take big hits to profits. Of course, there can and will always be tough times for the economy, but a business that has to rely on the overall economy to thrive is definitely a risker bet.

Car Sharing

According to PWC, 51% of car buyers under the age of 30 can easily imagine using car sharing or similar services rather than owning a car.

Whether we like it or not, we are transforming into a more sharing and communal society. It’s very likely that in the next decade, we will see a whole new industry that will be like a subscription service for cars.

It sounds wild, but most of the younger generations today (myself included) are very much OK with this prospect. Owning more things is not necessarily better, especially if you don’t have a daily need for it.

Now will car ownership be decimated in the next decade? Absolutely not. But I definitely don’t think it will grow in the future, at least not in America.

Verdict

I think AutoNation deserves to be commended on their growth aspirations. I am sure they have a lot of people working hard in order to make it happen. I hope they reach their goals too.

But in a best case scenario, they only seem to churn out 7% ROIC from store openings, which is sub-par. I could get that kind of compounding in the S&P 500 and without thinking at all.

However, the growing headwinds and the likelihood that there will be less car ownership in the long term is what deters me the most. In order to hold this company long term, I have to be convinced that car ownership will grow, and right now I’m not convinced.

Score: 0 Points

Principle #3

A Business That is Operated by Honest and Competent People

CEO & Director

Mr. Mike Jackson is the current CEO and Director of AutoNation. Mr. Jackson has been with AutoNation for along time. He served as CEO of AutoNation previously for 20 years, from 1999 to 2019.

After a brief stint away, he returned back in 2020. I am not sure why this is, and the company does not explain it, but I digress. It’s nice to see a long tenured CEO like Mr. Jackson at the helm.

Before leading AutoNation, Mr. Jackson worked as the CEO of Mercedes-Benz USA. Mr. Jackson has been in the auto industry his whole career, and seems to be quite familiar with luxury brands like BMW and Mercedes.

Alignment

For being a car retail company, AutoNation has more intriguing ownership than I anticipated. Cascade Investment, the fund that runs the Bill and Melinda Gates Foundation, owns almost 17% of the company. Melinda Gates herself is the second largest individual owner, with 8% ownership.

The largest individual owner is Edward Lampert, with 12%, or an almost $1B stake in the company. Mr. Lampert worked as the Director of AutoNation until 2007.

Meanwhile, the CEO only owns about $12M worth of the company. He did own a lot more, but recently sold a lot of shares, probably because the stock has been sitting at all time highs.

ROIC and Profitability

AutoNation has been able to maintain decent ROIC and ROE’s for their industry. However, the company seemed to reach an ROE peak back in 2015 and has been declining ever since.

ROIC seems to be increasing, possibly due to the increase in stores they recently acquired.

Overall, ROE and ROIC are not bad at all, but the decline in ROE lately worries me a tad.

Rewarding Shareholders and Capital Allocation

AutoNation’s preferred method of shareholder growth seems to be share repurchases. Over the past decade, AutoNation has repurchased 59 million shares, and they don’t seem to be stopping.

2021’s already is slated for over a $1B share repurchase, which seems strange to me, considering the stock price is at all time highs. Luckily, CAPEX is quite low, which is great to see.

Verdict

AutoNation’s management seems fine to me. Nothing stellar, but nothing terrible either. Mr. Jackson is a long tenured CEO, and the profitability is decently high.

I also like that the company prefers to return cash in the form of buybacks and not a dividend.

Score: 1 Point

Principle #4

A Business That is Available at an Attractive Price

Free Cash Flow

AN has actually been able to grow FCF at a decent rate of 19%, while seeing a major spike last year, after it sold some long held equities. I suspect the company plans to use this extra cash for growing the AutoNation stores.

AN’s P/FCF seems to hang around 20x, but has recently compressed due to the spike in cash flow due to the realized gains, and is currently sitting around 8x.

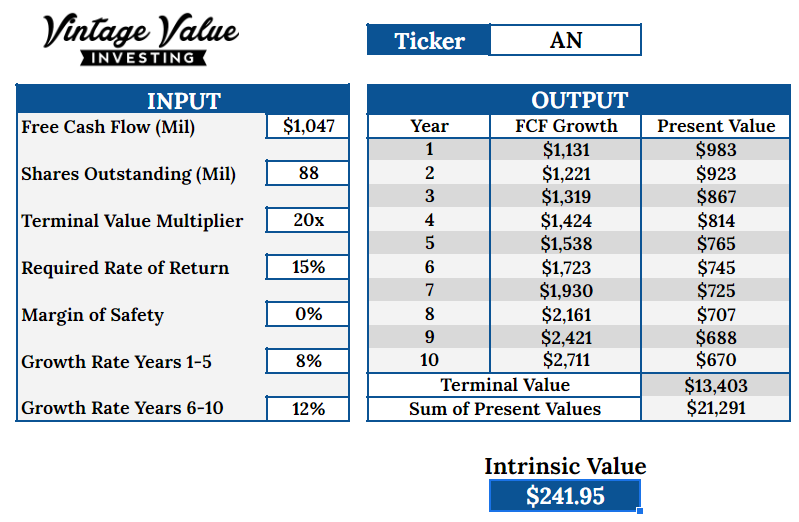

I will assume a very conservative growth rate of 8% per year, and then 12% as a best case scenario, hoping that the new stores drive future cash flow growth. I will also assume a normal P/FCF of 20.

Discounted Cash Flow

Here’s my DCF work on AN with zero margin of safety:

And here’s a 20% margin of safety:

Verdict

Current AN share price: $106.26

My buy price: $193.56

This caught me off guard completely. I was fully expecting this company to be fully priced, especially with the share price doubling since 2020.

This definitely warrants further research to make sure I didn't miss anything in the reports. If the stock is really this undervalued, even with a run-up, then there could be some real opportunity here.

According to my math here, AN is currently offering a 15% return with a 10x P/FCF, and with a 35% margin of safety. If these numbers hold up, then this could be a great value play.

Score: 1 Point

Final Thoughts and Score

AutoNation Inc. Score: 2/4

I really did not expect the company to be so undervalued at first glance. I am very curious, and will research this further.

That being said, I don’t have a lot of confidence in the business model. Revenues have been stagnating/declining over the past few years before the pandemic, but the AutoNation was still able to grow their cash flows.

Margins are still good, and the company is benefiting from economies of scale. The real catalyst here is if the company can grow stores like they plan to and the competition remains manageable to the company.

Even with the seemingly undervaluation, I still don’t have a great outlook for the industry, and that deters me more than anything.

Music

Dayshell is a group that I think has a lot of talent, but is not nearly discussed enough. The vocalist has a unique cadence, and the melodies are very catchy.

“Pressure” is a great example of the kind of music Dayshell has to offer. The chorus is catchy and the guitar and drum work is sublime. Although I don’t really think the music video is good, don’t let that deter you from giving this song a listen.

Thanks for reading!

-Dillon Jacobs

Holdings Disclosure

Neither I nor anyone else associated with this website and newsletter has a position in AN and no plans to initiate any positions within the 72 hours of this publication.

I wrote this article myself, and it expresses my own personal views and opinions. I am not receiving compensation, nor do I have a business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer

None of the writers or contributors of Stock Spotlight are registered investment advisors, brokers/dealers, securities brokers, or financial planners. This report is being provided for informational and educational purposes only and on the condition that it will not form a primary basis for any investment decision.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA (publishers of Stock Spotlight) on whether to buy, sell or hold shares of any particular stock.

None of the information in our articles is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The information is general in nature, and is not specific to you.

Vertigo Studio SA is not responsible and cannot be held liable for any investment decision made by you. Before using any article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA on whether to buy, sell or hold shares of any particular stock.

We did not receive compensation from any companies whose stock is mentioned in this report.

No part of the analyst's compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed in this report.