Free Report #20: Kroger (KR)

Kroger (KR)

Growing up, I lived only about five minutes away from the largest Kroger in the county. That’s not saying much, since it was not that big of a store and town, but it was still the largest around.

When I was in high school, the company started building a new “Super Kroger” store right next to the old one. The new Super Kroger was enormous, probably three times as large as the old Kroger store.

When the new store opened, it was quite the event in my little town. I actually remember a few people taking off school in order to check it out (that’s not a joke). I think it even made the local news!

So, what was all this to-do about a grocery store? To be honest, I still don’t know. It’s just a grocery store, right?

Yes, it is just a grocery store. But think about how many times you visit a grocery store in a year, and how vital they actually are in your life. This fact became quite apparent during the pandemic, as people who were employed at grocery stores were quickly dubbed “essential workers”.

But is there something that makes Kroger special, or something that makes it stand out from others? Why would anyone take of school or work to visit a new opening?

I am very familiar with Kroger as a consumer, but not an investor. So, come bridge the gap with me, and let’s see if Kroger’s stock is a good investment.

Principle #1

A Business That We Can Understand

History

The Kroger story actually began in 1883 in my hometown of Cincinnati, Ohio. Mr. Barney Kroger invested his entire life savings into opening his store in a downtown location.

Mr. Kroger put his main focus on quality products, while delivering excellent prices to his customers. For example, around the turn of the century, most grocers purchased bread from local bakers and would then turn around and sell them for a measly profit.

By investing a bit more into quality and efficiency, Mr. Kroger figured out that if he opened his own in-store bakery, he could lower the prices for customers and keep quality high, leading to added convenience and profits for both parties.

After his success with bread, Mr. Kroger also noticed the same problem was also prevalent with meat products. So, he replicated the same idea with bread, and created his own in-store delis.

It was the essence of the “one-stop-shopping”.

I think you get the picture. Mr. Kroger then went on to grow the business enormously, with the in house Kroger brands representing a large part of the business that the founder started.

Present Day Operations

In 2021, Kroger has grown to a colossal sized American grocer, with 2,742 supermarkets operating under several banners throughout the country. Around 82% of stores have pharmacies, while over half also sell fuel.

The grocer owns many other stores chains that you may recognize, such as:

City Market

Food 4 Less

Fred Meyer

Harris Teeter

King Soopers

Pick 'n Save

Ralphs

and more

The company also operated more than 150 fine jewelry stores, 35 manufacturing plants, 220 clinics, and 2,200 pharmacies. As mentioned, Kroger features it’s leading private-label brands and manufactures around 30% of its own-brand units (and 40% of its grocery own-label assortment).

Kroger’s supermarket and multi-department stores operate under four segments, combo stores, multi department stores, marketplace stores, and price impact warehouses

Lastly, Kroger is a top-two grocer in most of its major markets, only trailing behind Walmart. Virtually all of Kroger's sales come from the United States.

Verdict

Understanding the core of the grocery business is pretty simple: feeding people profitably. Of course, that a gross oversimplification, but regardless, that is the end goal of the business.

Operating at massive scale is crucial in order for a business like Kroger to be successful, and as the second largest grocer in the nation, they most definitely qualify.

Score: 1 Point

Principle #2

A Business That Has Favorable Long-Term Prospects

Low-Margin Business

The grocery business is a notoriously low-margin business, thus most investors don’t tend to gravitate to them. They are perceived as slow growing and boring.

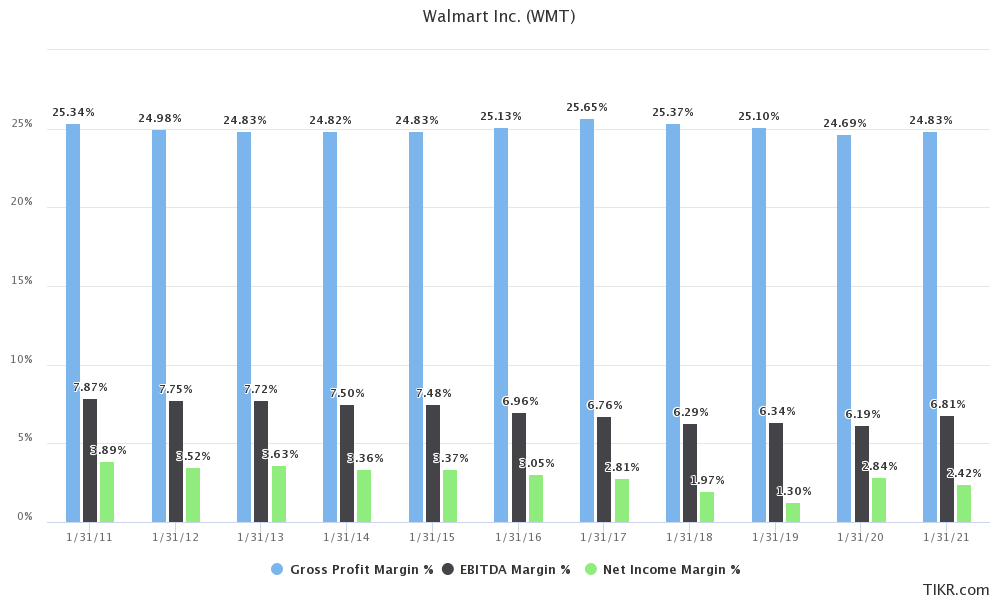

This is not an untrue statement. Take a look at Kroger and Walmart’s margins over the past decade:

So yeah, I can understand why investors wouldn’t be thrilled with sub 30% gross profit margin, and around a 2-3% net income margin. There is not a lot of room for error here.

This is especially true when you have software companies operating above 70% gross profit margins.

This begs the question: can Kroger still grow it’s business while operating such thin margins?

Growth Drivers

The only real way for a grocer that has achieved scale like Kroger to intrinsically grow, is by improving the customer experience, cutting costs, and creating mergers and acquisitions.

This can be done with different strategies:

Improve convenience

Cut costs and pass the savings to the customers

Create (or stay on top of) consumer trends

Streamline operations to improve efficiency

Embrace technological solutions

Buy out smaller companies at good prices

Kroger has plans to do nearly all of these things, so I will highlight the main drivers that I find most important.

Digital Business

Kroger’s digital business remains one of its key growth drivers, especially due to the pandemic. Kroger is focused on offering solutions to customers that want their items delivered to their home, or picked up in stores.

Kroger has heavily invested in its fulfillment centers in order to facilitate this new wave of commerce, with over 2,200 pickup locations and 2,400 delivery locations. Additionally, Kroger has recently partnered with the online British grocer Ocado, to create brand new delivery facilities in Florida and Ohio.

Kroger recently announced a pilot in partnership with Drone Express, to eventually leverage drone delivery to customers.

Cost Cutting

But delivery is not the only growth driver. Kroger is embracing smarter advertising and AI solutions in order to give customers the best possible experience, and cut costs.

With the “Restock Kroger” program, management is targeting margin-rich alternative profit streams such as personal finance, media, and customer data insights. Under the program, the company is also passing the benefit of cost containment to customers by lowering prices.

The Restock Kroger program saved the company over $1B in 2020. Interestingly enough, the company recently announced a $1B stock buyback, no doubt coming directly from these savings. This is incredible, since it is resulting in direct value creation for shareholders.

Mergers & Acquisitions

Of course, as a grocery behemoth, M&A activity is critical strategy for Kroger to maintain market share and scale. Kroger has completed plenty of M&A’s over the past 15 years, and seems to average 2-3 per year.

Risks

Stiff Competition

Since the grocery business is one that serves everybody in the nation, it is a naturally very large and fragmented industry. That means that there is competition everywhere.

In fact, the grocery industry might be the most ruthless and cut-throat of them all, which is strange to think about, right?

Anyway, Kroger faces intense competition from traditional big players such as Walmart, Albertsons, and Safeway. It also has to deal with the online e-commerce giant, Amazon. Not only for groceries, but at other brick and mortar locations, with Whole Foods.

Kroger is big, and they have to stay big in order to be profitable.

Margin Control

As stated previously, this industry operates with very thin margins. This leaves very little room for error when it comes to profitability. To counter this, management has to have actionable plans for volatile food prices (like we are seeing now) in order to make it out with some cash left over.

If the executive team fails to pull this off, it is disastrous for the entire company and the shareholders.

Verdict

Being one of the largest chain of grocers in the US has its perks, and I think Kroger is using those perks as best as they can. By partnering with other smaller and more nimble companies, like Ocado, Kroger can effectively increase their reach and effectiveness.

Additionally, I like the Kroger Restock program. It seemingly is working well, and allows the company to funnel those savings directly back to shareholders.

The industry has always been competitive, and always will be. As long as the managers don’t screw things up, I am pretty confident Kroger will be in a good place in the future.

Score: 1 Points

Principle #3

A Business That is Operated by Honest and Competent People

Chairman & CEO

Mr. William Rodney McMullen is the current Chairman & CEO of Kroger. Mr. McMullen has maintained a super-tenured status with Kroger, after first joining the company as a part-time store clerk all the way back in 1978!

He then proceeded to work his way up the corporate ladder, and reached his first executive position in 1989. He continued to wade his way through the company’s HQ, until finally being appointed as Chairman & CEO in 2014.

His over 40 year experience with the company is truly commendable, and I don’t know if there is anyone else alive that would know Kroger better than him.

Alignment

Being the nation’s second largest grocer, Kroger is unsurprisingly 76% institutionally held. Interestingly enough, Warren Buffett (through Berkshire Hathaway) owns over 8% of the company.

This was a recent buy for Warren, which intrigued me into researching this Kroger. Of note, the CEO owns just under .5% of the company, or around $145M.

ROIC and Profitability

The company has seemingly always been able to generate pretty high ROEs, with decent ROICs. However, ROIC has been trending downwards a bit over the past few years, which is a bit troubling to see.

Nevertheless, I am pretty happy with these numbers.

Rewarding Shareholders and Capital Allocation

Kroger rewards its shareholders the old fashioned way: by continuing to pay out dividends and buying back shares. The company plans grow earnings, but a mature and stable company like Kroger will be offering value to shareholders primarily through dividends and buybacks.

Kroger also is kind enough to break down their CAPEX a bit for us. As you can see, inthe past couple years the company has prioritized growth CAPEX over maintenance CAPEX. Management seems to focus more on the digital acceleration as well as margin expansion, which is exactly what I want to see out of this company.

Verdict

Kroger’s management team seems to be on very much on the right track. I like the very experienced CEO, solid ROE and ROIC, and commitment to shareholder returns.

However, what I really like seeing is the increased growth CAPEX. Kroger fund CAPEX completely with their free cash flow, and it’s great to see them prioritize digital acceleration and margin expansions.

Score: 1 Point

Principle #4

A Business That is Available at an Attractive Price

Free Cash Flow

KR has been able to grow FCF at a decent rate of about 10% per year. 2020 saw a huge spike in cash generation, due mostly to the pandemic with large increase in people stocking up on grocery items.

Since we have started to reopen, FCF has fallen back down to normal levels.

Given this large spike in FCF, KR’s P/FCF went to a decade low of 8x, making the stock look cheap. The share price gradually caught up to the FCF, and now sits at normal levels of around 15x-20x.

As far as forecasting future FCF growth, I find that pretty difficult, however, I am pretty confident that the company will continue to grow and innovate to stay on top.

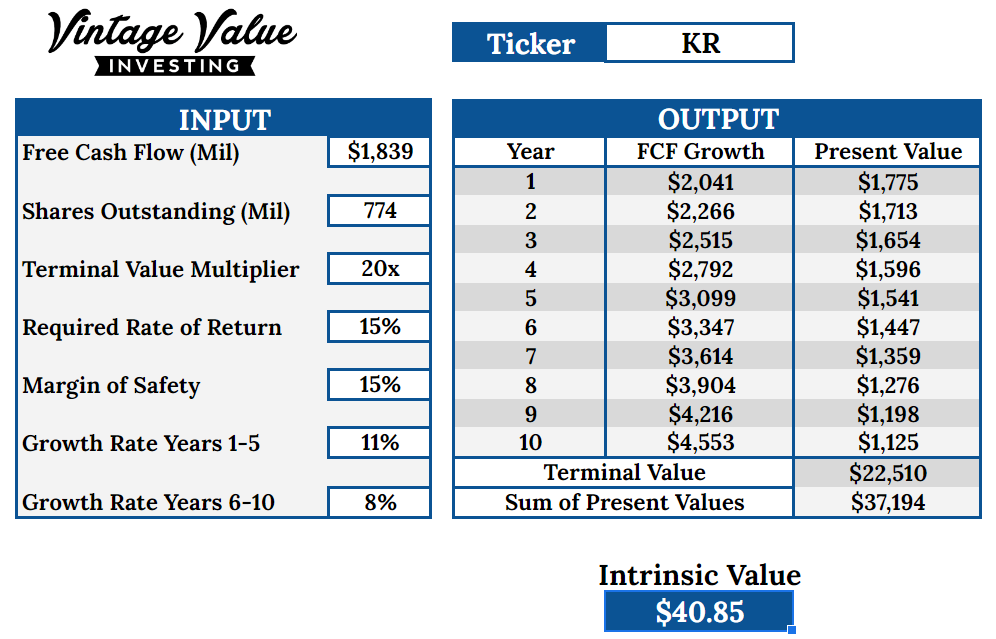

For the next few years, I think it is likely that they will continue to grow FCF about 11%, or the higher range of what management expects shareholder growth to be. I’ll then slow it down to the lower range of 8% to account for the lower range, which will hopefully account for both positive and negative scenarios.

I think a P/FCF of 20x is pretty appropriate, as that is the historical average.

Discounted Cash Flow

Here’s my DCF work on KR with zero margin of safety:

And here’s a 15% margin of safety:

Verdict

Current AN share price: $42.67

My buy price: $40.85

This is a lot closer than I thought it would be, which is sort of surprising since KR has had a decent run-up since the pandemic. You could have bought this company at about $21 per share in July 2019 and see it appreciate about 100%!

More impressively, this is also throughout the pandemic when everything else was selling off.

To be honest, I think that the stock is pretty fairly valued and could even be undervalued. My calculation does not take share reduction into account, which KR has done aggressively over the decade.

I think a half point here is appropriate since I can’t say for certain that it is undervalued, but fairly priced.

Score: 1/2 Point

Final Thoughts and Score

Kroger (KR) Score: 3.5/4

Kroger was a pleasure to review. It was quite a bit easier than most, since I am quite familiar with the business.

I think Kroger is a solid company, and you could do a lot worse. I am impressed to see that you can buy it at an affordable price right now. What’s more, it seems be a really nice hedge against market volatility, as the stock price didn’t even flinch during the March 2020 crash.

In some businesses, bigger is better. For Kroger, I think that statement is true. Their scale has allowed them to reach most Americans in the nation fairly easily. Threats from Amazon and others exist, but I think Kroger’s moat is intact.

Recommended Reading

I recently discovered Asian Century Stocks Substack, by Michael Fritzell. Michael is Swedish, but lives in Singapore. As the title states, he mainly writes about Asian companies, which is nice, because I don’t have much exposure to that part of the world right now.

This article is a nice little breakdown of Sony. Give it a read!

Music

Orbit Culture is a band that a followed a few years ago, but failed to keep up with. Little did I know, they released their full length LP, Nija, last year. I completely missed it.

Luckily I have been catching back up this week. I get a lot of Metallica vibes from this band, and I found their previous EP, Redfog, to be an incredible listen. This song “Nensha” is definitely a heavier sound from their previous work, which I really did not think was possible.

Oh, and they are Swedish too. I just so happen to be really promoting Sweden this week I guess.

Thanks for reading!

-Dillon Jacobs

Can You Recommend This Newsletter?

Recommendations are the lifeblood of Stock Spolight’s growth. A few people sharing it on Twitter can really be a huge deal in terms of driving audience growth.

Here, I’ll even provide you some language you can just copy and paste:

I’ve really enjoyed @St0ck_Spotlight newsletter. If you like stock analysis, you should really check it out!

Thanks!

Holdings Disclosure

Neither I nor anyone else associated with this website and newsletter has a position in KR and no plans to initiate any positions within the 72 hours of this publication.

I wrote this article myself, and it expresses my own personal views and opinions. I am not receiving compensation, nor do I have a business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer

None of the writers or contributors of Stock Spotlight are registered investment advisors, brokers/dealers, securities brokers, or financial planners. This report is being provided for informational and educational purposes only and on the condition that it will not form a primary basis for any investment decision.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA (publishers of Stock Spotlight) on whether to buy, sell or hold shares of any particular stock.

None of the information in our articles is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The information is general in nature, and is not specific to you.

Vertigo Studio SA is not responsible and cannot be held liable for any investment decision made by you. Before using any article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA on whether to buy, sell or hold shares of any particular stock.

We did not receive compensation from any companies whose stock is mentioned in this report.

No part of the analyst's compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed in this report.