Free Report #21: Gentex (GNTX)

Gentex (GNTX)

Warren Buffett is famous for coining the iconic phrase “economic moat”. The value investing community (myself included) are constantly seeking out companies that have large economic moats, and finding out if they really are a worthwhile investment.

Well today’s company, Gentex (GNTX), might have one of the widest and deepest economic moats I have seen in a long time. They truly dominate the market, akin to how Google dominates the internet.

So, what does Gentex do? What makes this moat so impenetrable?

In this week’s issue, I’ll be diving into what makes Gentex a special company, and see if it is trading at a good value.

Principle #1

A Business That We Can Understand

So what does Gentex do? It’s pretty simple actually: they create anti-glare and dimming mirrors. You how the rearview mirror in your car has a day/night setting? That’s because of Gentex.

But it’s not just rearview mirrors for the automotive market. Gentex also creates fire protection products to the fire protection market and dimmable aircraft windows for aviation markets.

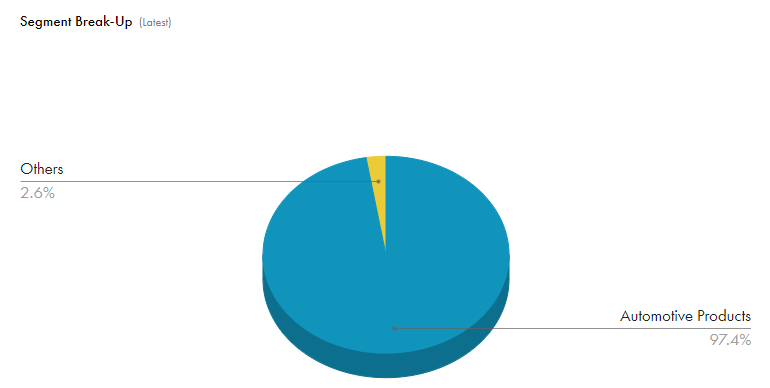

Gentex Corporation breaks down the business into two major segments:

Automotive Products: which includes Automotive Rear-view Mirrors and Electronics and HomeLink Modules.

Others: which includes Dimmable Aircraft Windows, Nanofiber Products and Fire Protection Products.

Almost all of the company’s revenues comes strictly from the Automotive Products segment, with it bringing in around 97% of sales.

You might think, “well, this company does not look very diversified in revenues”, and you would be correct. However, Gentex’s diverse strength come from their global reach.

But here is why you shouldn’t be too concerned about this.

Market Dominance (Economic Moat)

Gentex straight up owns the market in which they operate. The company has over 90% (!) market share for light vehicles. This is Gentex’s economic moat I was talking about.

If you owned a car with a dimmable mirror, there’s an over 90% chance that it was made by Gentex.

That is a very wide moat if I have ever heard of one.

Diverse Revenue Locations

The largest market is of course is the US, but it only provides 33% of the entire revenues. The rest are sources from Japan, Germany, Mexico, and other countries throughout the globe.

This means that Gentex is operating at a global scale, even for a small $7B company. They supply some of the largest automakers in the world like GM, Volkswagen, and Toyota with their state of the art product.

Verdict

The core of Gentex’s business is pretty easy to understand. It is the dominant supplier of a specific product (rearview mirrors) that is needed in nearly every vehicle.

The main business is very strong, with strong relationships with multiple auto manufacturers that allows them to have a diverse source of revenues globally.

Score: 1 Point

Principle #2

A Business That Has Favorable Long-Term Prospects

With Gentex’s stable business model and wide moat, how does it intend to grow?

Growth Drivers

Innovating on Main Product

Gentex aims at generating meaningful growth driven by product launches, improved product mix and unique technology platforms. In the last quarter alone, the the company launched a total of 29 interior and exterior auto-dimming mirrors and electronic features.

Of these new launches, 45% comprised of advanced features, with Full Display Mirror (FDM) leading the way.

Gentex’s FDM is a key growth engine and is likely to grow the company’s top line. Recently, they began shipping FDM on Maserati MC20, Jaguar XF and the Buick Envision Plus.

Gentex is currently shipping its FDM product on 56 vehicle nameplates, and forecasts at least 10 new vehicle nameplate launches for the second half of 2021.

I actually find the FDM product to be pretty cool. You can check it out here for more information.

Growing “Others” Segment

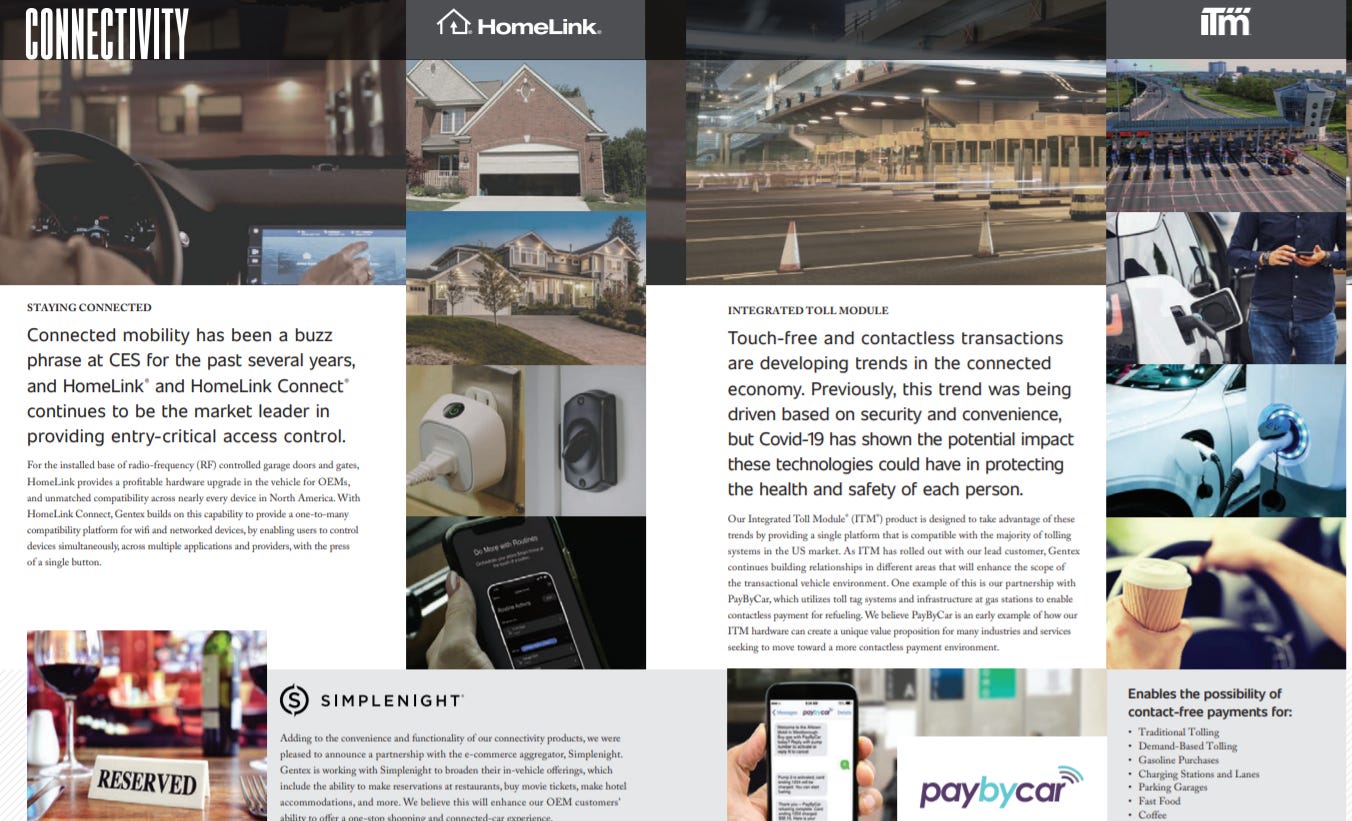

Beyond the main mirror products, Gentex’s Integrated Tool Module, HomeLink, and Dimmable Aircraft Windows seem to be significant growth drivers. Gentex is seems to be turning to tech in order to grow.

Let’s start with the Connectivity segment. The HomeLink Connect app enables users to control their existing home automation devices in one app. Penetration for HomeLink is likely to grow, as the demand for connectivity to homes increases.

Also included in this division is the paybycar app. Paybycar allows users to pay for tolls, gas, and charging stations with contactless payment.

The next biggest growth driver is the Dimmable Devices segment, specifically the Dimmable Aircraft Windows.

Gentex has supplied variable dimmable windows for the passenger compartment on the Boeing 787 Dreamliner Series of Aircraft. Last year, (right before COVID) Gentex announced it would be providing it’s product to Airbus’s aircraft as well.

By partnering with the largest aircraft manufacturers in the nation, Gentex will no doubt benefit from this.

Risks

Research and Development and CAPEX

CAPEX and R&D are crucial to maintain profitability. Over the past couple year, Gentex’s R&D has increased mildly. If these costs get to be too much, it could affect bottom line earnings.

Short-Term Headwinds

Like a lot of companies, Gentex is currently facing some issues due mainly to COVID. The sales of dimmable aircraft windows have obviously declined since the pandemic, and are likely to remain depressed until things get back to normal (whenever that will be).

Also, the company is facing lower demand due to the microchip shortage in the car manufacturing industry. Until this problem is solved, Gentex will continue to sell less products in general.

Verdict

Gentex seems to have plenty of growth opportunities ahead of it. I like the fact that they are leaning heavily into tech in order to grow, with Homelink the most exciting prospect.

While Gentex is dealing with some problems, these mainly because overall unfavorable economic conditions unrelated to the company itself. These are also very short term problems, and should work themselves out in the next year or so.

Score: 1 Point

Principle #3

A Business That is Operated by Honest and Competent People

President & CEO

Mr. Steve Downing is the current President and CEO of Gentex. He has been with the company for almost 20 years, and has been CEO for over three years. He joined the company back in 2002 as a financial analyst and worked his way up the corporate ladder to CEO in 2017.

Of note, he was the CFO before becoming the CEO.

Mr. Downing seems to have a middling review on Glassdoor, but he also has not been the CEO for super long.

Alignment

Gentex is over 85% institutionally owned and nearly 15% owned by the general public. Insiders only account for .2% of the company, which is a bit disheartening. I find this to be a bit surprising since Gentex is a (relatively) smaller company, so I expected a bit more insider ownership.

ROIC and Profitability

Gentex’s management has been able to churn out some very nice ROIC, ROE, and gross margins over the past decade, especially for an industrial type of firm.

It is a teeny bit worrisome that nearly all metrics have been on a decline over the past couple years, but 2020 is no doubt due to COVID. However, it is hard to complain about a company that almost consistently has over 20% ROIC and ROE.

If gross margins were to slip below 35%, then I think this would be good cause to investigate further on what is causing the issues.

Rewarding Shareholders and Capital Allocation

Gentez’s management has been able to maintain a healthy balance sheet, and its commitment for shareholder value maximization is praiseworthy.

The company has a high current ratio of 4.71x and unlevered balance sheet compares favorably with the industry and increases the firm’s financial flexibility to tap into growth opportunities.

Gentex remains committed to preserve shareholder value via buybacks and dividends. During full-year 2020, it returned $405.7 million to shareholders via dividends ($117.2) and stock buybacks ($288.5 million).

I forgot to mention this in the growth section, but Gentex does have a history of acquisitions. In fact, the company has been pretty active recently, acquiring 8 different firms in the past two years.

Verdict

Gentex’s management team seem to be doing the right things for the company. The CEO seems fine and capital allocation strategy is creating decent shareholder value.

I would like to see more insider ownership and would be concerned if gross margins continued to fall. But for now, this gets by with a point.

Score: 1 Point

Principle #4

A Business That is Available at an Attractive Price

Free Cash Flow

GNTX has had an extremely consistent and healthy growth of FCF over the past decade. The company has been able to compound FCF over 35% per year!

This type of growth is incredible, especially for this sector.

GNTX’s P/FCF is likewise pretty consistent over that timeframe, hovering between 15x and 20x.

I think that GNTX has pretty good growth prospects, as well as a decent amount of cash to spend for acquisitions. However, I think the company will struggle for the next year or two, simply due to the unstable economy.

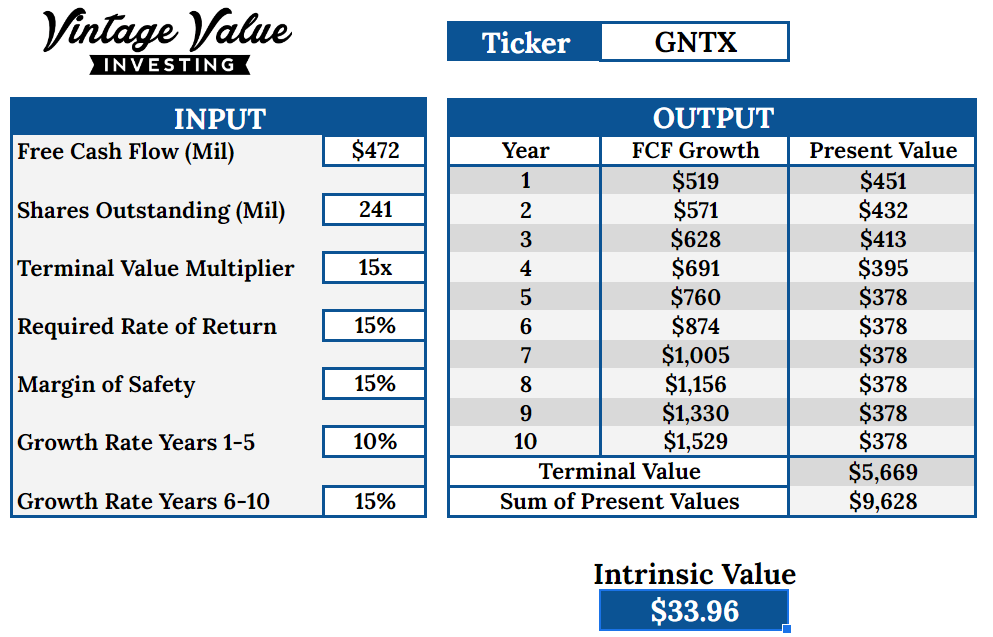

To account for this, I will use a conservative growth rate of 10% in the beginning, and ramp it up to 15% in the years after. I will use a conservative P/FCF multiple of 15x as well.

Discounted Cash Flow

Here’s my DCF work on GNTX with zero margin of safety:

And here’s a 15% margin of safety:

Verdict

Current GNTX share price: $32.24

My buy price: $33.96

GNTX manages to just squeak by into my buy price range. I actually am a bit surprised, since I figured GNTX’s consistent cash flows would be significantly bid up.

While you aren’t getting a significantly undervalued stock, the objective here is to buy at an attractive price. I think that GNTX more than qualifies for this, especially with these conservative growth rates.

Score: 1 Point

Final Thoughts and Score

Gentex (GNTX) Score: 4/4

I really like what I see here out of Gentex. The company has a very wide moat, and enjoys almost all market share. It’s main product is great, and has proven to be a cash flow machine.

The additional products in the “others” segment seem to have solid growth potential if managed correctly. If Gentex could grow this segment to be around 10% of revenues, then I think this would make for some immense value creation for shareholders, in addition to buybacks and dividends.

I am definitely going to need to go deeper on this company and see if this growth is indeed possible!

Recommended Reading

I really enjoy Rational Reflection’s write ups on his Substack and main site. He is very active on Twitter as well. In fact, I think most of his best content is there.

This post is more of a high level macroeconomic view of the markets, (which I usually don’t care for) but this is a good one.

Music

Spiritbox’s long anticipated new album Eternal Blue, finally was released this week. This album is simply one of the best listening experiences I have had in a very long time. Definite album of the year contender!

Lead vocalist, Courtney LaPlante, is without a doubt the most talented vocalists in the scene. I am just glad we finally have an amazing female vocalist in the genre! Her performance here is nothing short of masterful.

I could go on for hours about this album. Each track brings something different and unique to the table. I picked “Sun Killer” simply because it stood out to me the most, but I highly recommend you give the entire thing a listen.

Can’t wait to consume this over the next week in preparation for Sleep Token’s album next week!

It Takes Two Seconds to Share This Post

Chances are that if you have read this far, then you probably know someone else who could benefit from my insights. Before you close out, maybe you could take a moment and share it with a friend? Doing so really helps the growth of this weekly newsletter.

Thanks!

Holdings Disclosure

Neither I nor anyone else associated with this website and newsletter has a position in GNTX and no plans to initiate any positions within the 72 hours of this publication.

I wrote this article myself, and it expresses my own personal views and opinions. I am not receiving compensation, nor do I have a business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer

None of the writers or contributors of Stock Spotlight are registered investment advisors, brokers/dealers, securities brokers, or financial planners. This report is being provided for informational and educational purposes only and on the condition that it will not form a primary basis for any investment decision.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA (publishers of Stock Spotlight) on whether to buy, sell or hold shares of any particular stock.

None of the information in our articles is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The information is general in nature, and is not specific to you.

Vertigo Studio SA is not responsible and cannot be held liable for any investment decision made by you. Before using any article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA on whether to buy, sell or hold shares of any particular stock.

We did not receive compensation from any companies whose stock is mentioned in this report.

No part of the analyst's compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed in this report.