Free Report #23: Philip Morris International (PM)

If you have been subscribed to Stock Spotlight for a while, you noticed that my stock picks for this newsletter are industry agnostic, and that is for a reason.

When it comes to stock analysis, a narrow focus on a specific industry can work for some people. It can help one specialize in an area and get to know that industry intimately, and that’s great.

That being said, I use this newsletter as a tool to not only to offer you some great content, but to broaden my own horizons and sharpen my analytical skills. Therefore, I don’t like to exclude any industry just because I am not familiar with it, or have an aversion to it.

I embrace the learning curve with an open mind.

That leads me to this week’s company, Philip Morris International (PM). I have a colleague at work that is a subscriber to this newsletter. He always is intrigued with my weekly analysis and enjoys picking my brain.

Earlier this week, he suggested that I cover a sin stock. If you are not familiar with sin stocks, they are the industries that are generally “sinful” in nature.

For more information, check out this great article by Alpha Architect explaining the narrative.

Now, of course, sin is subjective. Generally speaking, sin stocks are typically ones that operate in the following industries:

gambling

tobacco

alcohol

guns

defense industries

oil and gas

For me, the first thing that pops into mind when I think of sin stocks are tobacco companies. Since PM being is one of the largest tobacco companies in the world, I thought “Why not start here?”

So, do sin stocks still offer investors good value? I have no idea, but I am curious to find out.

Foreword

Before we get into it, let me start off with this: While I don’t necessarily endorse smoking, people are free to make choices that positively and negatively affect them.

It’s 2021, and everyone knows that smoking kills.

Of course, I have my own moral and ethical opinions on tobacco companies, but I won’t be presenting them here. I will simply be viewing PM through an objective lens as a shareholder of a business.

It’s up to each individual investor to decide where they are comfortable deploying their capital.

Principle #1

A Business That We Can Understand

PM is on of the largest tobacco manufacturers on the planet, with a market cap of ~$150B. The “international” is in the name is for a reason. They create and ship tobacco and other nicotine-containing products outside the United States in more than 180 countries.

The company is very globally diverse. It’s revenue breakdown by region are very unconcentrated, with the largest division being the EU.

Brands

You are no doubt familiar with PM’s brand of premium cigarettes. The company owns famous brands like Marlboro, Parliament and Virginia Slims. It also owns mid-priced brands like L&M, Lark, Merit, Muratti and Philip Morris brands.

Other leading international brands include Bond Street, Chesterfield, Next and Red & White. PM manages to own a large portion of the top performing brands on the global market.

The company is also engaged in the development and commercialization of Reduced Risk Products (RRPs), which generally are “less harmful” than cigarette smoking. This includes PM’s newest flagship product: IQOS.

IQOS is a heated tobacco product (HTP) that heats the tobacco instead of burning it. Instead of releasing harmful smoke, the product releases vapor. PM markets IQOS as a healthier option over typical cigarettes.

The company also is working on developing newer smokeless tobacco products and brands, such as:

Vapor products

Nicotine pouches

Carbon heating products

Nicotine salt

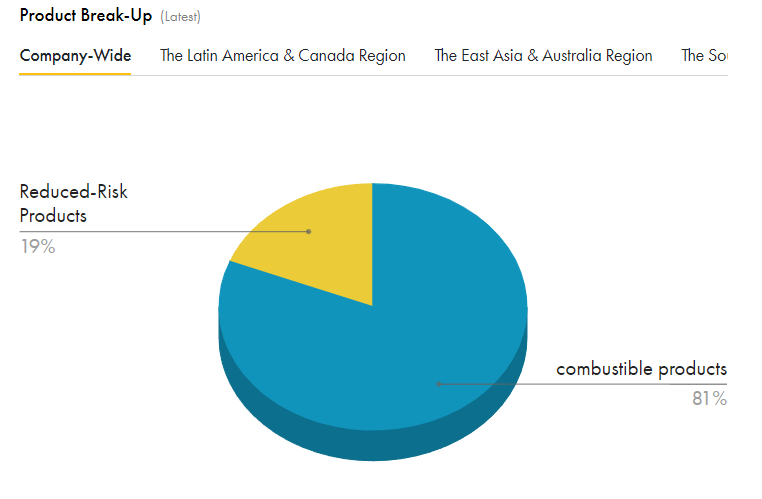

RRPs are the popular and fastest growing line of merchandise, but still remains a small part of the overall product makeup.

Relationship with Altria

PM has a bit of a complex organizational structure, specifically with Altria Group (MO). In March 2008, Philip Morris International was spun off from the Altria Group. However, Philip Morris USA, Inc. continues to be a subsidiary of the Altria Group.

If you are curious to the history on this restructuring, then check out this summary from Investopedia.

But here’s the bottom line: PM ships a many products that are sanctioned by the FDA, to Altria Group, for sale in the United States.

Verdict

I find the overall business model of PM to be quite easy to understand. Create tobacco products and sell them to a global market.

I love the global diversification of this company. I don’t know of many other businesses who happen to be in this many markets. This allows PM to receive all kinds of revenues in multiple currencies.

True diversification in all regards.

They also have an extremely well known line-up of brands that you will find in any drug store or gas station around the world.

That has to count for something in my book.

Score: 1 Point

Principle #2

A Business That Has Favorable Long-Term Prospects

This is no doubt the most important part of the analysis for PM. Being a tobacco company, PM has a plethora of risks that are specific to its industry.

PM has some ambitious future goals. The company wants their smoke-free business to become the majority by 2025. While this is a noble goal, it is a monstrous task.

At the same time, this objective is very likely to fuel a surprising amount of growth potential for a tobacco company.

Let’s dig a bit deeper to determine which outweighs the other.

Growth Drivers

RRPs

Let’s evaluate PMs priorities on how they plan to transform the business.

RRPs is the largest growth catalyst for PM. In fact, without RRPs, I would not expect this company to remain profitable in the future.

Adapt or die.

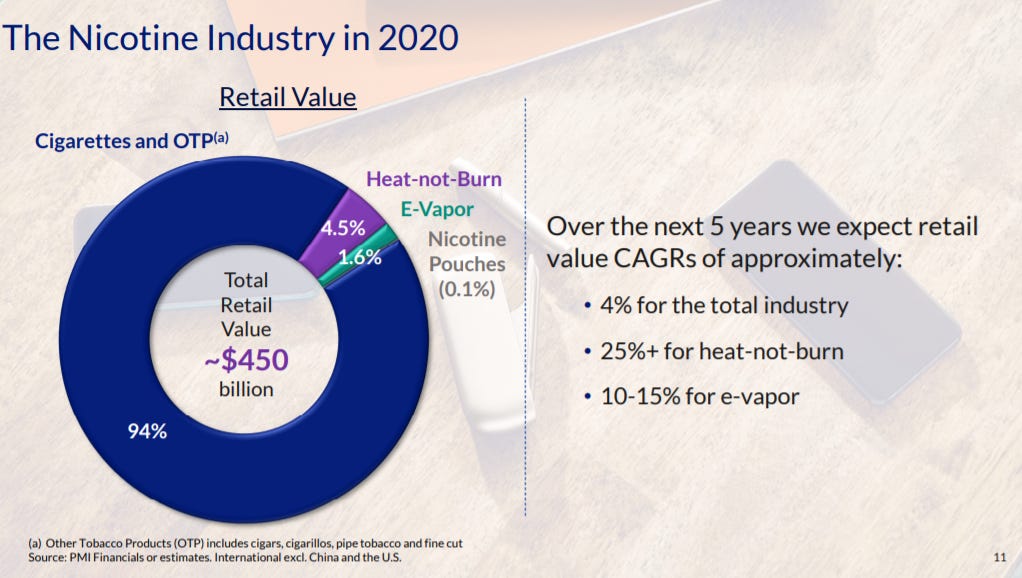

Luckily, the company has the leading HTP product, IQOS, in its portfolio. According to PM, the outlook and opportunity looks very rosy for the product, with a largely unpenetrated market and high growth rates (25%+).

The goal here is simple: convert current cigarette smokers IQOS, while maybe attracting some newer smokers along the way.

IQOS already showing to be quite popular in certain markets, with Japan being a huge growth market for the product. In fact, it’s going exactly to plan for PM: combustibles are decreasing and HTP adoption is increasing.

Personal testimony: I lived in Japan (Tokyo area) from 2015 - 2018. Smoking is still quite popular there. However, throughout my time in the country, I noticed a huge transition to the IQOS product. The advertising and marketing for the product was very strong indeed. Simply based on my observations, many Japanese smokers definitely picked up on this trend.

The FDA, USDA, and other global authorities have quickly approved the product, probably with hopes it will gain popularity and help eliminate normal cigarettes.

The good thing is that if this plan comes to fruition, then the company would be even more profitable than they would be by just selling normal cigarettes, as gross margins on IQOS are high due to PM’s pricing power.

Speaking of pricing power…

Pricing Power

PM has enjoyed significant pricing power for decades. This power allows the company to combat declining revenues and income when unfavorable government legislation and tax rulings come down on them.

Even when company raising prices on cigarettes, it has been proven to have a negligible effect on consumer behavior. The addictive quality of nicotine is so strong, consumers just don’t care. They need their fix from their favorite brand.

The ability to adjust the price of combustibles is PM’s superpower. In fact, you can see the evidence in the company’s recent performance in 2021.

I’ll end this section with a quote from Warren Buffett:

“The single-most important decision in evaluating a business is pricing power”

Acquisitions and Transformation

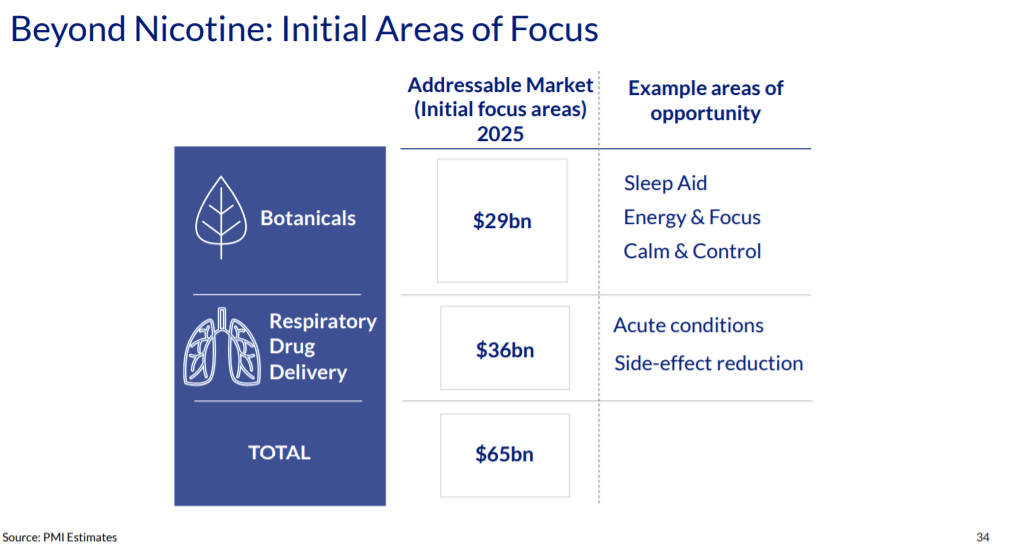

Lastly, let’s touch on the final portion regarding PM’s business transformation. In February of this year, the company revealed a new plan dubbed "Beyond Nicotine".

The goal? Create at least $1B yearly net revenues from non-nicotine products by 2025.

And how does PM plan to go about this? Acquisitions.

Beyond Nicotine utilizes PM’s its expertise in what they already know: such as inhalation technology and natural ingredients (tobacco). This is most evident in the 2021 purchase of Vectura Group, which is a provider of innovative inhaled drug delivery solutions.

The has also recently acquired Fertin Pharma A/S and OtiTopic. Both of these companies focus on specific respiratory and pharmaceutical drugs, including general wellness products.

Risks

Government Regulation

It’s no secret that the tobacco industry faces many challenges as governments around the world are imposing restrictions on tobacco companies which, in turn, are lowering cigarette consumption.

The U.S. Food and Drug Administration (FDA) has made it mandatory for tobacco companies to dissuade customers from smoking by placing caution labels on their packaging. In fact, some major tobacco companies (like Altria), have been mandated by the courts to create self-critical advertisements of their products.

Additionally, the FDA introduced an initiative in 2017 to dramatically reduce nicotine in cigarettes in order to make them less addictive. Research for this imitative is still ongoing.

Obviously, if this initiative is successful, the lowering of nicotine levels will undoubtedly prove disastrous for cigarette manufacturing companies. To add salt to the wound, the FDA is super concerned with minors accessing vapor products.

To be fair to PM, this was more regarding the Juul debacle, which is not their product. The IQOS less minor friendly since I don’t think flavors can be added like Juul.

Also, this is just one government. PM has to worry about over 180 of these regulations!

Declining Cigarette Market

Cigarette smoking has been on the decline for decades. In fact, since 1980, cigarette sales have plummeted worldwide.

I am pretty sure this data does not shock anyone. It’s 2021, and we’re all are aware that smoking is an unhealthy activity that causes a plethora of diseases.

No matter how cool PM’s new products may seem, here is the inescapable truth: inhaling anything but air into your lungs (even vapor) is not healthy.

This is a huge risk for the company. Market share is disappearing, and is a big reason why revenues have been in decline over the long term.

Currency Troubles

The natural hurdle of an international company is currency conversion. Volatility in exchange rates from different global currencies remains a constant challenge for PM.

Verdict

PM certainly has its work cut out for it, but I was surprised to see this many growth plans for the company.

IQOS seems to be a popular new product and is already witnessing global adoption, especially in Japan. I really like the company’s ambitious goal to reach 50% total revenues from non-smoking sources.

However, the hard fact is that combustibles still remains a huge part of the business. I applaud the efforts here, but I just am not optimistic with so many huge headwinds.

This is the largest of which is simply the collapse in the smoking market. The fact of the matter is that the world is getting healthier and way more conscious of what they put into their bodies. I don’t foresee this changing suddenly either.

This, in combination with increased government intervention just represents too much risk for me.

Score: 0 Points

Principle #3

A Business That is Operated by Honest and Competent People

Chief Operating Officer

Philip Morris is led by CEO Jacek Olczak. Mr. Olczak is a very new to the role, having been appointed in May 2021. However, don’t worry, because Mr. Olczak does have significant experience with PM.

Mr. Olczak has been with the company for nearly 30 years! He started with the company in 1993 in the finance department in the Europe division (he’s Polish if you couldn’t tell). From there, he climbed his way up to CFO in 2012, and was appointed as the COO in 2018.

Mr. Olczak seems to be very committed to the smoke-free future of the company, as it is his main priority.

Additionally, I was surprised to see that PM scored so high on Glassdoor reviews. Mr. Olczak seems to have some very good backing at the company, with an over 90% approval rating.

Alignment

PM is primarily owned by institutions. However, I was not expecting to see general public ownership of almost 25%. There are no significant amount of insider ownership, with the Executive Chairman of the Board owning $69M worth of shares.

Meanwhile, the CEO only owns $23M. I would expect him to own a bit more, given his long tenure with the company, but it’s still not terrible.

ROIC and Profitability

Because of PM’s stange accounting, their ROIC and ROE numbers are basically worthless to look at. I think margins are a better way to look at this company’s profitability.

These are actually pretty impressive numbers if they are accurate. The company has been able to keep their margins remarkably stable throughout the years, no doubt to their pricing power.

Rewarding Shareholders and Capital Allocation

Here is PM’s capital allocation message straight from the horse’s mouth:

I think this plan makes sense for the company. Capex is quite minimal, and management plans to plow cash into new smoke-free products, which is great. Share buybacks are great to see as well, and I have no problem with this.

The only problem I have is the dividend payout ratio of 75%. This seems way too high to me considering all the growth that needs to happen. Realistically, as a shareholder, I would want this dividend to be cut by at least 50%.

I get that PM is a mature company returning most of its cash to shareholders, but I think they should mostly be focused on new products in order to survive over the long term.

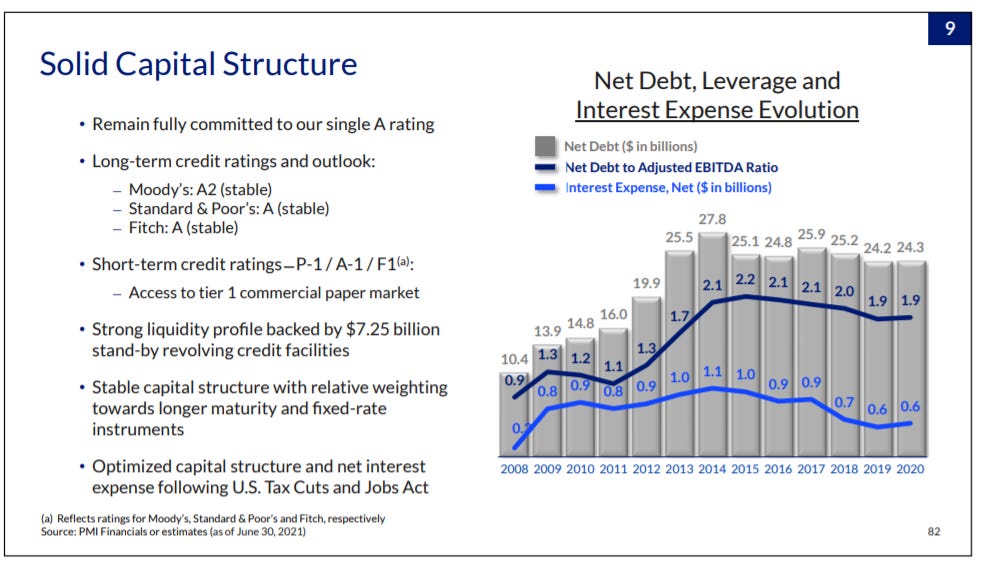

Really quickly, I just wanted to mention that PM has a pretty stable debt picture. The company does not have any concerns of defaulting that I can tell.

Verdict

I like the direction Mr. Olczak is moving the company towards. I will be very curious to see how he performs in his new position as CEO.

Everything else looks fine for me…except the dividend. A 75% payout ratio is just way too high. Either management sucks at capital allocation or they simply have no other ideas.

This is why I usually don’t like dividends as a shareholder. Once you start the dividend machine, it become nearly impossible to shut it off, even at the detriment of the company.

Still, PM squeaks out with a point here as I don’t see any major issues.

Score: 1 Point

Principle #4

A Business That is Available at an Attractive Price

Free Cash Flow

PM’s FCF has been anything but consistent. Starting in 2012, the company went on a cash losing streak until 2019, when they finally started to turn things around. They unfortunately have not been able to grow cash at all over a decade.

It’s also surprising to see investors were willing keep the price at 30x for this company back in 2017. Luckily, it is back down to 15x, which is about average.

I find it pretty hard to forecast this company’s FCF growth. PM is essentially a dividend and buyback machine that has been unable to significantly grow revenues or cash flow.

I think I will project a best case scenario here for the company. I will grow FCF at a very slow pace of 2% for five years, and then bump it up to over 5% after the 2025 goals are hit, which will hopefully drive more profits.

Discounted Cash Flow

Here’s my DCF work on PM with zero margin of safety:

Here’s my DCF work on PM with 25% margin of safety:

Verdict

Current FISV share price: $96.08

My buy price: $47.04

I honestly was not expecting PM to be this overvalued. If anything, I was expecting to see the company to be undervalued. It seems like the growth of the company’s future ambitions have been fully priced in.

At this point, even with my optimistic growth rates, the company is only presenting an 8% return with no margin of safety, which is not thrilling. In order for me to be even interested in this company, the price would have to dip around ~65%.

Not for me at all.

Score: 0 Points

Final Thoughts and Score

Philip Morris (PM) Score: 2/4

I personally have a hard time understanding why people want to invest in tobacco companies, objectively speaking. These are very old companies that must evolve in order to stay alive.

I don’t want a business that has to transform to stay alive. I want a business that is growing and thriving. As a shareholder, the last thing I want to worry about if legislation will pass tomorrow that will affect my primary business model.

I could understand more if this is a deep-value situation, but in this case, I certainly am not getting that.

To be fair, PM is a huge company and there is a lot going on. I can safely guarantee you that I missed something in this analysis.

But in the end, there are just too many risks here for me. Many other companies are on the market that have way less risk and higher reward.

Recommended Reading

I really enjoy Tiago’s writing. This article is quite the scathing one, especially since most people will disagree with it.

I, for one, appreciate a contrarian take on Amazon. Read it for yourself and see what you think.

Music

I was never a huge fan of Invent Animate in the past, but I can happily say that I am now. Invent Animate recently released their three track (more like 2.5) The Sun Sleeps, As If It Never Was EP a couple weeks ago.

The entire EP clocks in around 10 minutes, so this is an easy single listening session. In fact, I suggest you only listen to the entire thing as one song, since each song bleeds into the other.

The guitar-work and vocal are superb, but what really stands out here is the overall somber mood, tone, and ambience.

A true work of art.

Can You Recommend This Newsletter?

Recommendations are the lifeblood of Stock Spolight’s growth. A few people sharing it on Twitter can really be a huge deal in terms of driving audience growth.

Here, I’ll even provide you some language you can just copy and paste:

I’ve really enjoyed @St0ck_Spotlight newsletter. If you like stock analysis, you should really check it out!

Thanks

Holdings Disclosure

Neither I nor anyone else associated with this website and newsletter has a position in PM and no plans to initiate any positions within the 72 hours of this publication.

I wrote this article myself, and it expresses my own personal views and opinions. I am not receiving compensation, nor do I have a business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer

None of the writers or contributors of Stock Spotlight are registered investment advisors, brokers/dealers, securities brokers, or financial planners. This report is being provided for informational and educational purposes only and on the condition that it will not form a primary basis for any investment decision.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA (publishers of Stock Spotlight) on whether to buy, sell or hold shares of any particular stock.

None of the information in our articles is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The information is general in nature, and is not specific to you.

Vertigo Studio SA is not responsible and cannot be held liable for any investment decision made by you. Before using any article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA on whether to buy, sell or hold shares of any particular stock.

We did not receive compensation from any companies whose stock is mentioned in this report.

No part of the analyst's compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed in this report.