Free Report #24: ERO Copper (ERO)

“Better than boring alone is a stock that is boring and disgusting at the same time. Something that makes people shrug, retch, or turn away in disgust is ideal.” - Peter Lynch, One Up on Wall Street

Mining isn't a glamorous business. This is Peter Lynch's ideal scenario: boring and disgusting at the same time.

In spite of this, mining is still a vital part of the modern economy. In fact, the materials to build the computer which I am using to write this article had to be excavated from the ground.

Ditto for the device you are reading this article!

I previously covered Canadian gold miner Kirkland Lake Gold (KL) for my premium subscribers. However, KL is strictly a gold miner.

I thought I would investigate an even more highly sought after resource: copper.

Without further ado, let’s dive into ERO Copper.

Principle #1

A Business That We Can Understand

As the name implies, ERO is a copper mining company with a market capitalization of $1.7B.

Copper is ERO's primary business focus, with a minor gold and silver operation.

Despite the company's headquarters being in Canada, all of its operations are in Brazil.

A major asset of ERO is its ownership of the MCSA Mining Complex, which consists of operations located in the Curacá Valley, Bahia State, Brazil. Copper ore is mined at this location in the Pilar and Vermelhos underground mines.

The second most valuable asset is the 97.6% ownership of the NX Gold Mine, an operating gold and silver mine located in Mato Grosso, Brazil.

Finally, ERO also owns the Boa Esperança development project, an IOCG-type (Iron, Oxide, Copper, Gold, Ore Deposits-type) copper project located in Pará, Brazil.

Understanding Mining

Mines have some different terms and operating patters than most companies, so I thought I would go over them really quickly.

C1 Costs

C1 costs are a standard measurement in copper mining for the purpose of comparing basic cash costs across mine operations.

For 2020, ERO averaged an annual C1 cost of USD $0.67/lb. For context, the

global average last year was $1.17/lb.

AISC

This acronym stands for All-In-Sustaining-Costs, which was introduced and standardized in 2013 by the World Gold Council and may be used for any mining operation. It is not a perfect measure of production costs, but since it is a standardized measure, it allows comparisons between different miners.

ERO’s AISC for 2020 was USD $628/oz. For context, the global average last year was USD $975/oz.

To maintain profitability, it's crucial that mining companies keep their C1 and AISC costs as low as possible.

My research indicates that ERO's C1 costs and AISC are well below the global averages, which is great for investors. Compared to other businesses, this gives ERO a cost advantage.

ERO Operations

Back to ERO's operations.

ERO's largest operating mine, the MCSA complex, generates the majority of their cash flow. Last year, ERO processed over 2 million tons of ore from the complex, resulting in 42 thousand tons of copper production.

The NX gold mine produces a respectable, but smaller amount of ore for the company. ERO produced 36,830 ounces of gold in 2020.

In order to maximize its profits, ERO sells these metals on the market after they are successfully dug up and processed.

Last year's efforts generated $324M in revenues, $162M in cash flow from operations, and $52M in net income.

Boa Esperança

How about the other asset, Boa Esperança?

A critical part of the company's growth is the Boa project, which is still in development.

In the following section, I'll elaborate on the Boa project.

Verdict

It's nice to see a small Canadian miner like this. Ironically, KL is also a Canadian miner.

There's a mining boom going on in Canada!

But seriously, I appreciate the company's focus and small operation. It is less stressful to run two active mines rather than 15.

In addition to gold and copper supplies, they have some new exciting prospects with the Boa project. ASIC and C1 costs are well below average, which increases profitability.

Score: 1 Point

Principle #2

A Business That Has Favorable Long-Term Prospects

Growth Drivers

Copper Demand

A shortage of everything seems to be prevalent at the moment. The pandemic took a serious toll on certain industries.

Whatever the industry - semiconductors for cars, natural gas in Germany, petrol in the UK, or electricity in China - the demand for natural resources does not seem to be met.

The same is true for copper.

I did not realize how much copper is used in modern manufacturing until I started doing research for this article. Copper is found in everything from your smartphone to bullet casings.

Did you know that a commercial airplane contains 118 miles of copper wiring?

In addition, copper demand is projected to grow over 13% per year for the next decade.

A major growth catalyst for the copper industry will be a switch to renewable energy. If we want to electrify everything, something will have to conduct the electricity.

Enter copper.

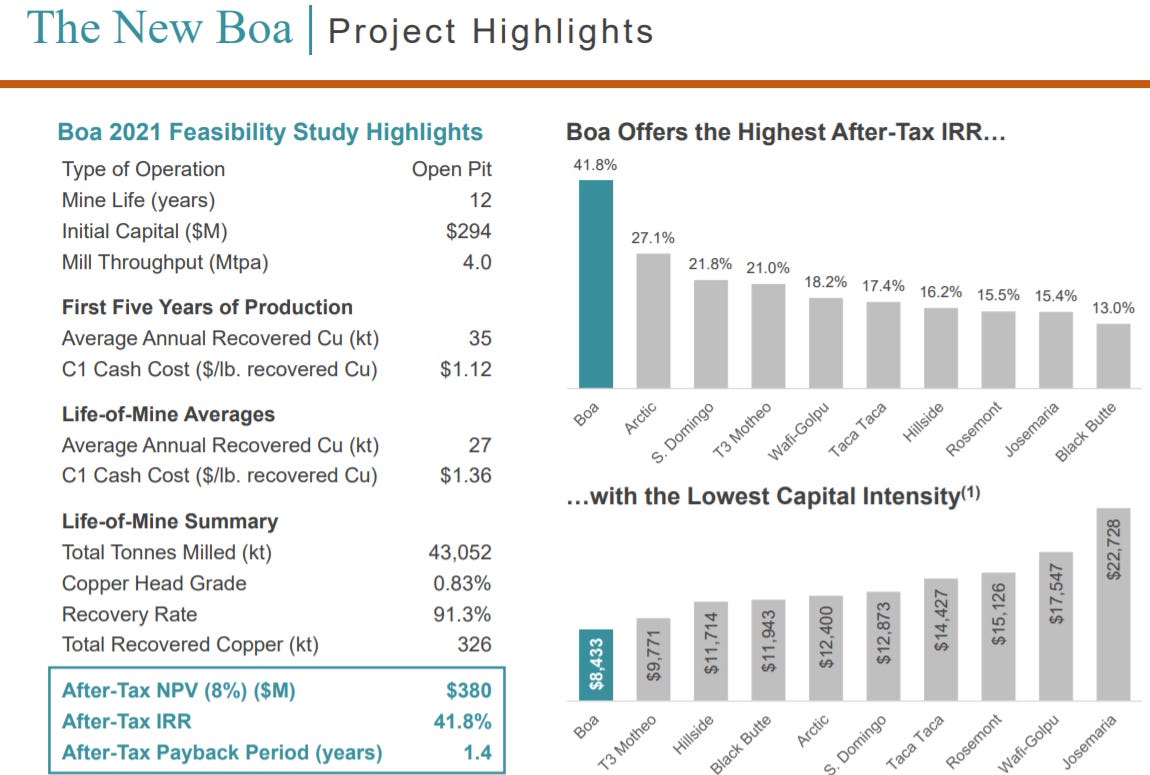

Boa Esperança Project

Once the Boa project is completed, the company will benefit from increased revenues and cash flows. ERO's growth strategy is based on these initiatives.

Once the Boa project is operational, the company expects its production capacity to double. Having only an after-tax payback period of 1.4 years, ERO is looking at a return on investment of over 40%!

As far as I can tell, the Boa project has tremendous potential, especially for the price ERO paid for the mine. More information will be provided in the third quarter earnings report.

Details about the project findings can be found here.

Mine Reserves

Allow me to go over one more quick mining lesson.

Let's look at a mining company's reserves.

Business models in mining are very different from those of other types of companies, as they rely on being able to extract ore from the ground in order to refine it into pure metal.

In other words, every mine has a total amount of resources as well as an expiration date, which is dependent on how quickly the resources are depleted.

So knowing how much gold is left in ERO's mines is crucial to its valuation. Reserves are divided into three categories.

Proven and Provable: This means that drilling and digging have found this resource already, and the company is sure of its quality and quantity.

Measured and Indicated: This is the very probable resource, known to be there from ongoing production, but not accessible for production yet.

Inferred: This is the resource the company thinks is likely to be in the ground. These reserves are judged by an expert guess depending on local geology, previous returns and limited sampling in the area.

ERO Reserves

If interested, I highly recommend you research the company's reserves yourself. This information is included in the investor presentation.

The bottom line is that ERO still has plenty of mining to do. Below is a quick breakdown of the expected amounts of elements (not ore) in the ground:

MCSA Copper Mine

Proven and Probable: ~536 tons

Measured and Indicated: ~115 tons

Inferred: ~400 tons

NX Gold Mine

Proven and Probable: ~245 Koz

Measured and Indicated: ~270 Koz

Inferred: ~195 Koz

Boa Esperança Project

Proven and Probable: ~357 tons

Measured and Indicated: ~412 tons

Inferred: ~92 tons

Risks

Share Dilution

Management tends to rely on share dilution to raise cash, which has risen exponentially over the past few years. It is not a new IPO per se, but they did re-list from the OTC market to the NYSE back in June.

For both this listing and Boa's project, they may have had to dilute shareholders. I would be concerned if dilution was continued.

Errors in Assumptions (Reserves & CAPEX)

There's always the possibility that ERO is inflating their reserve figures in order to impress shareholders or save face.

Although I don't get this vibe from the management team, it is always possible.

In addition, if capex gets too high, this will seriously affect margins and the bottom line.

Copper/Gold Price Fluctuations

The main risk of mining is the volatility of the price of the element they are mining. Fortunately, gold and copper prices are near their all-time highs.

However, if prices crashed, ERO's profits would suffer. Copper is such a valuable resource, so I don't see this happening anytime soon.

Still, you never know.

Verdict

It seems like dilution is leveling off to a manageable degree, which is good. I believe the capex and assumptions are as accurate as possible, so the risk here is relatively low.

ERO's growth drivers appeal to me a lot. Over the next decade (and probably longer), copper is going to be one of the most important natural resources, and its demand will grow steadily.

ERO's reserves and Boa project look like they will be extremely profitable for many years to come.

I like this!

Score: 1 Point

Principle #3

A Business That is Operated by Honest and Competent People

Executive Chairman and Director

Chief Operating Officer

Christopher Dunn and David Strang founded the company together in 2016, so I included them both in the leadership section.

Both gentlemen have extensive experience in the mining industry, specifically with copper. They each bring their own strengths to the table.

Strang operates as the CEO and is more of a hands-on executive. It makes sense considering Mr. Strang led many other mining companies that were either sold or successfully operated for over 20+ years.

Mr. Dunn, on the other hand, has worked as an investment banker for over 25 years, primarily serving the mining industry. Mr. Dunn has also held executive positions with a few mining companies.

I think both of these gentlemen are excellent leaders with great industry expertise. Here’s a quote from the annual report from the CEO:

“We will continue to focus on delivering low-capital and high-margin growth through innovation and operational excellence, while remaining fully committed to the health and well-being of our employees, contractors and their families in the years to come.” - CEO David Strang

I know this is corporate speak, but as a shareholder, this is exactly what I want to hear.

Alignment

ERO has a high percentage of insider ownership, which is terrific. Over 6% (or $108M) of the company is owned directly by Strang. He is followed up by Mr. Dunn and the company’s Chief Geological Officer, Mike Richard.

This is a management team that is firmly aligned!

T. Rowe and Fidelity are the largest institutional owners, representing nearly 30% of the entire firm.

ROIC and Profitability

ERO is posting impressive profitability numbers for a young company. The management is obsessed with ROIC (almost hyper-focused), and they claim ROIC to be more than 65%.

I am not sure how the 65% is calculated, but regardless, it's impressive. To provide context, I have included Tikr's calculations as well. Although they are not the same numbers as ERO claims, they are certainly impressive!

Rewarding Shareholders and Capital Allocation

Currently, management plans to reward shareholders by allocating capital to no-brainer projects, such as the Boa project. The objective is to keep growing production capacity while maintaining low capital intensity.

ERO seems to be doing quite well despite its short track record.

The company pays no dividends.

As much as I would prefer the company to buy back shares whenever it makes sense, I believe that company is more growth-oriented right now, and that's fine with me.

I'd rather have that than dividends any day.

Verdict

ERO has a great management team. The company is making great business decisions. The Boa project has a payback period estimated at just 1.4 years!

As a shareholder, this is the kind of management I like (at least on the surface).

Definite point here!

Score: 1 Point

Principle #4

A Business That is Available at an Attractive Price

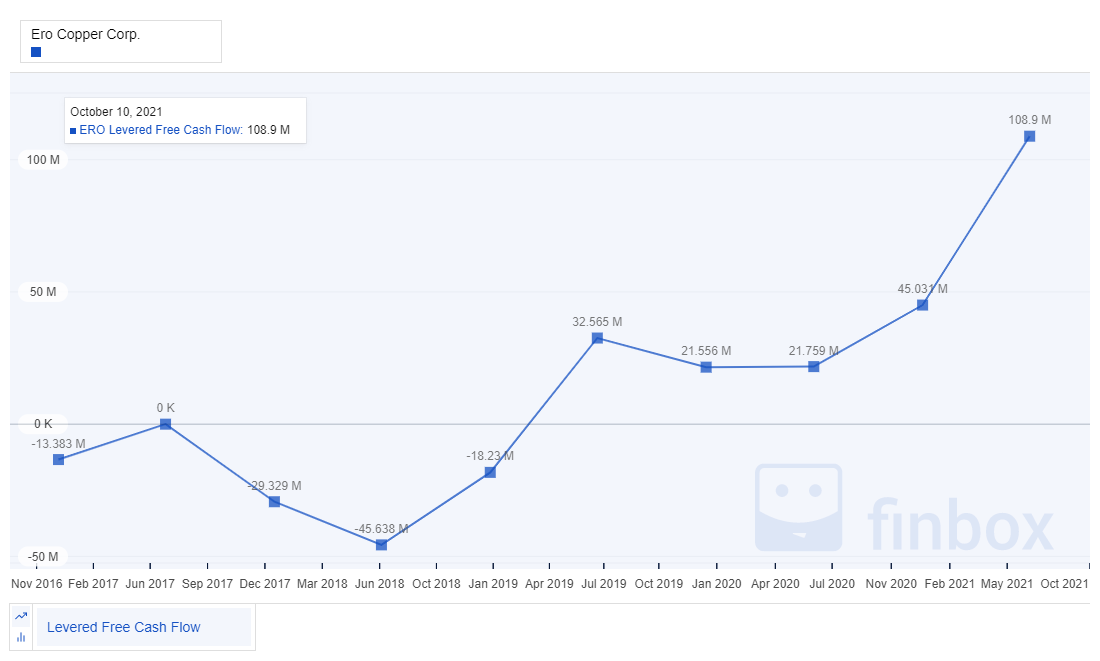

Free Cash Flow

Let's talk about valuation. ERO has grown its cash flow very quickly over the past five years.

The ERO saw its FCF decline to $-45M in 2018, but has since grown by more than 100% CAGR to hit $109M!

The swings in growth have caused ERO's P/FCF to fluctuate frequently. The current P/FCF is around 16x, which is actually low for a company growing FCF so quickly.

I am rather optimistic about ERO's growth prospects. I assume a 10% annual growth rate in years 1-5, and 15% in years 6-10 once the company is able to realize the full potential of the Boa project.

I believe a fair P/FCF for this company would be around 20x.

Discounted Cash Flow

On a side note, DCF probably isn't the best method of valuing a mining company. Adding up all the assets and calculating cash flows based on metal prices is the best approach. However, for consistency's sake, I will perform a DCF as usual.

Here’s my DCF work on ERO with zero margin of safety:

Here’s my DCF work on ERO with 20% margin of safety:

Verdict

Current ERO share price: $18.42

My buy price: $23.13

I like this a lot. The undervaluation of ERO surprised me.

Even so, I would still seek to value the firm according to all its assets before I purchase shares. But from the DCF standpoint, this is amazing.

I also think it is quite possible for the stock to compound at a higher rate than this.

Score: 1 Point

Final Thoughts and Score

ERO Copper Inc (ERO): Score: 4/4

Another perfect score, folks. This is really great to see, especially after my disappointing Philip Morris analysis last week.

The risks for ERO here are minimal, in my opinion. AISC and C1 costs are low, resulting in great profitability and reducing risk for the company. Managers have plenty of experience and seem to have a knack for capital allocation.

There aren't many things to dislike about this. Markets are currently undervaluing these so-called "ugly and dirty" industries since they aren't as ESG friendly as software companies.

I completely understand this mentality. However, the unfortunate truth is that we still need these "ugly and dirty" companies in order to live a modern lifestyle and to become a more environmentally friendly society.

In this decade, I think it is possible that we might see a commodity super-cycle. In order to provide the materials needed for the green energy transition, we will need a large and growing amount of natural resources such as gold, cobalt, zinc, copper, and gas.

In my case, I intend to capitalize on this demand.

Recommended Reading

Gazprom Has Gone Vertical – Which Other Bombed-Out Energy Stock To Look At Next?: Undervalued Shares

My commodity super-cycle thesis is also shared by Sven Lorenz from Undervalued Shares. He proved this with his analysis back in 2018 of Russian gas giant, Gazprom.

In June, I wrote a report on Pampa Energy (PAM) to my premium subscribers. Sven mentions PAM in this article. He also wrote a report about PAM for his subscriber base.

Ironically, both of us covered the stock at roughly the same time!

Around May, I picked up some shares at about $15.10 per share. I’ve been fortunate enough to enjoy a 20% gain since then.

I am curious (and hopeful!) if it will return to the $60 range like it was back in 2017...but time will tell!

Music

Wage War may not be my cup of tea, but their latest album, Manic, has some damn good songs. Their song "Death Roll" is one of the highlights.

During its entire run time, this song just does not stop swinging for your jugular. This is true headbanger material, so I'm all for it.

Check it out if you're looking for inspiration in the gym!

As always, thanks for reading!

Invest Wisely,

Dillon Jacobs

Holdings Disclosure

Neither I nor anyone else associated with this website and newsletter has a position in ERO and no plans to initiate any positions within the 72 hours of this publication.

I wrote this article myself, and it expresses my own personal views and opinions. I am not receiving compensation, nor do I have a business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer

None of the writers or contributors of Stock Spotlight are registered investment advisors, brokers/dealers, securities brokers, or financial planners. This report is being provided for informational and educational purposes only and on the condition that it will not form a primary basis for any investment decision.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA (publishers of Stock Spotlight) on whether to buy, sell or hold shares of any particular stock.

None of the information in our articles is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The information is general in nature, and is not specific to you.

Vertigo Studio SA is not responsible and cannot be held liable for any investment decision made by you. Before using any article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA on whether to buy, sell or hold shares of any particular stock.

We did not receive compensation from any companies whose stock is mentioned in this report.

No part of the analyst's compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed in this report.