Free Report #25: International Money Express (IMXI)

Are you familiar with the concept of remittances? Even if you've never heard of the term, you're probably familiar with the principle idea.

Remittances are money that immigrants and migrant workers send home to their families. For the family receiving the money, remittances are a crucial form of income.

This money is essentially a lifeline in many cases.

They're so important that during the worst of the Covid pandemic, the President of Mexico publicly thanked Mexican-American migrant workers, calling them "living heroes" for sending money home to their families.

Since it has the world's most robust economy and wealth, the U.S. consistently leads the world in remittance outflows.

Most remittances go to underdeveloped countries, which have the following problems:

Disparaged economy

Widespread corruption and poverty

Natural disaster prone

Wars and/or active conflicts

From the chart above, you can see that Latin America and the Caribbean (LAC) and certain African countries are on this list.

International Money Express (IMXI), this week's company, gives migrant workers access to these crucial remittance services.

Let's look at this essential service and see if there are any opportunities for investors.

Principle #1

A Business That We Can Understand

Check out this chart from Shinsei Bank if you're not familiar with the remittance process. Usually, remittance funds are sent via bank wire transfer.

Since the money has to go to three different banks (remitting bank, intermediary bank, and beneficiary bank), there are a lot of fees along the way. These fees hurt both remitters (since they have to pay fees to send money) and recipients (since they get less money).

Operations and Segments

IMXI's mission is to provide funds to families at the lowest possible cost. As both the remitter and beneficiary use IMXI's network, the customer only needs to pay one fee to the company instead of three to three separate institutions.

IMXI's process is as simple as three steps, and money can be delivered within minutes.

IMXI also offers other fund transfer services, such as:

In Person Wire Transfers

Bill Payment

Prepaid Debit Card

Check Processing Service

Due to the simplicity of its operation, IMXI has just one reporting segment: transaction fees. Although they do make a small profit on foreign exchanges, wire transfers are their major source of revenue.

Competitive Strengths

While researching IMXI, I noticed some particularly appealing business strengths:

Highly Scalable, Proprietary Software Platform

Network Effect

Strong Relationships with Major Banks and Financial Institutions

Powerful Brand with Strong Consumer Awareness and Loyalty In The LAC Corridor

As a shareholder, I value all of these things. Network effects are inherently sticky, and financial networks are no exception. Switching banks is a pain in the ass.

I also love the emphasis on the LAC corridor. IMXI's network seems to be the favorite of consumers, with over 18% market share in Mexico and 27% in Guatemala.

To round things out, IMXI has long-term relationships with some of the country's biggest banks, like Wells Fargo, Bank of America and US Bank.

Verdict

I like all of IMXI’s offerings here. A small scalable network that has growth potential is very appealing to me.

I really love the simplicity of the business. With one major reporting segment, there’s not much complexity here. The equation for success is simple: increased transactions = increased revenue.

I think there is a lot of potential here.

Score: 1 Point

Principle #2

A Business That Has Favorable Long-Term Prospects

Growth Drivers

Growing Remittance Transfers to the LAC Corridor

As I mentioned, the LAC corridor has one of the largest remittance flows on earth, and is likely to continue growing in the 2020s.

Here's a graph based on research from 2002 by the Pew Research Center. The LAC was predicted to have $30 billion in remittances by 2030.

The estimate was totally blown out of the water.

According to the World Bank, the LAC corridor received a whopping $103B in 2020 alone! And this is 10 years ahead of the 2002 estimates of $30 billion by 2020!

As long as these areas remain (again, unfortunately) underdeveloped, it's safe to say demand has grown and will continue to grow.

IMXI has benefited from this growth, as their annual results show.

The number of transactions continues to rise every year, with a 33% YoY increase in transactions.

Grow Market Share in LAC Corridor

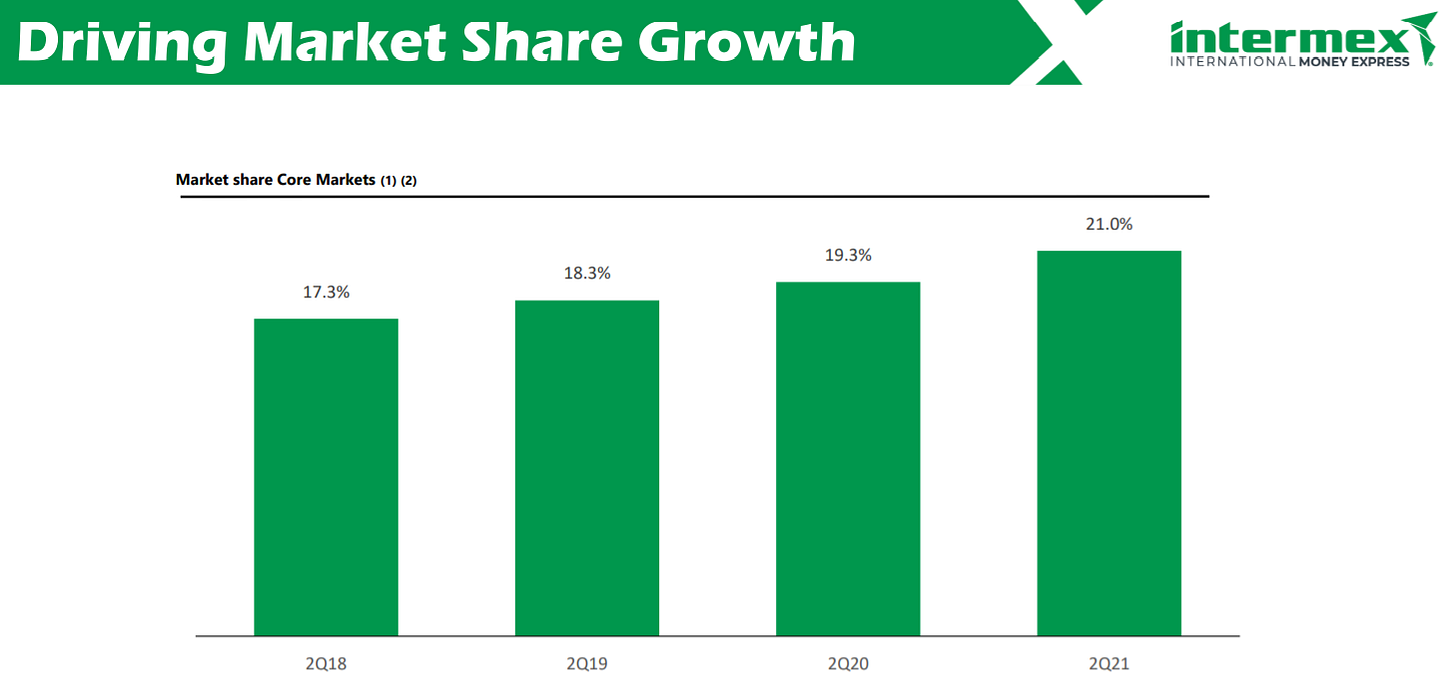

Depending on the location, IMXI enjoys a market share of 18% - 27%. This is a pretty good share of the market, but there is definitely room for improvement.

Mexico and Guatemala are two of the biggest markets for the company, and they plan to expand their market share in those markets.

IMXI can generate repeat business through the use of customer data, and track and effectively recapture one-time users, while also improving sending agent productivity.

Furthermore, IMXI is staging a targeted marketing campaign to increase its market share in large states where it is underrepresented.

It seems that these efforts are working. Within just three years, the company has increased its market share from 17 to 21 percent.

Expanding to New Corridors

Over the past few years, IMXI has aggressively expanded its business operations.

The company opened its remittance receiving services to Africa in 2019 along with its sending services from Canada.

El Salvador and Honduras both experienced strong growth in remittance volumes, with 5.3% and 13.2%, respectively.

If IMXI can keep the integrity of the network, this should work smoothly.

With a network business, more is better!

Risks

Loss of Banking Relationships

IMXI conducts a substantial amount of business with a few banks, including Wells Fargo, Bank of America and US Bank.

Losing such a banking relationship could very well lead to the company losing a great deal of business. A major goal of IMXI should be to open up as many bank relationships as possible to reduce concentration risk.

Currency Exchange Controls

Currency conversions do not represent a major portion of the company's revenues per se, but a dramatic change in policy can adversely affect the company.

Volatile currency conversions may prevent customers from sending money at all, and instead force them to wait for a more convenient time.

Verdict

This is an excellent list of growth factors. I am pleased to see that IMXI has proven that it can grow market share and that remittances are growing steadily every year.

Moreover, the number of transactions and countries available continue to grow, enabling them to expand their network even faster.

Despite the risks, I feel there are considerably more tailwinds here than headwinds.

Score: 1 Point

Principle #3

A Business That is Operated by Honest and Competent People

Chief Executive Officer, President, and Chairman

Intermex is currently led by Robert Lisy, who has served as CEO, President, and Chairman since 2009.

Lisy seems like an ideal leader for IMXI. He's a retail financial services and electronic payment processing industry veteran with over 25 years of experience, he has also held many other executive positions.

Previously, he worked with Western Union and Vigo Remittance Corp., two of the biggest names in the industry. Additionally, he was a co-founder/CEO of Direct Express, which was sold to American Payment Systems.

Alignment

Most of IMXI's ownership is held by large institutional funds. Over 3% of the stock is owned by Mr. Lisy, who has invested over $22 million. This is quite impressive, especially since it represents 20x his annual salary.

ROIC and Profitability

Normally, I would include a chart with ROIC and ROE, but the software I usually use is giving me very inconsistent numbers, so I am focusing on margins instead.

The company has only been public since 2018, so not a whole lot of data is available, but overall, gross margins are very stable around 22%, with a healthy FCF margin in the teens.

The company doesn't pay dividends.

Verdict

I don't see any problems with the IMXI management team. There is no doubt that Mr. Lisy is doing a great job with the company, and I am very happy with the ownership percentage and tenure with the company that he has.

It would be nice to see margins increase, but for now, things seem to still be stable.

Score: 1 Point

Principle #4

A Business That is Available at an Attractive Price

Free Cash Flow

IMXI was able to grow FCF steadily...until Covid came along. In spite of this, the company has bounced back very quickly, and is almost at the point where they are about to surpass their previous market high of $46M.

Before then, FCF was compounding over 200% each year, but we are only able to draw conclusions from a very limited amount of historical data.

Currently, the company has a P/FCF around 15, which seems to be the median. The P/FCF was depressed to single digits during Covid years because of the catastrophic dip in FCF.

I am quite optimistic about IMXI's growth prospects. For the next few years, I think the company will compound its FCF at a rate of 15%, then slow down to a more moderate rate of 10% in the years after that.

Additionally, I believe the P/FCF is low for this company, so I'm using a 20x multiple.

Discounted Cash Flow

Here’s my DCF work on IMXI with zero margin of safety:

Here’s my DCF work on IMXI with 15% margin of safety:

Verdict

Current IMXI share price: $17.01

My buy price: $23.25

This is great! Based on my modest growth rates, it seems that IMXI has a 36% upside potential. And that's WITH a 15% safety margin!

This is an excellent deal for a business of this caliber.

Moreover, the company has a market capitalization of $656M, putting it squarely into small cap territory. IMXI's market cap should have plenty of room to grow, theoretically speaking.

Score: 1 Point

Final Thoughts and Score

International Money Express (IMXI): Score: 4/4

It seems like I'm on a roll these days!

In all seriousness, there are several aspects of this business that I like, most notably the growth drivers. As long as the status quo holds, it is likely that remittances will continue to grow rapidly.

When combined with natural growth tailwinds and expansions, the network effect can achieve astounding growth. Providing management does not become too greedy and forgets about the customers, I think this can turn into a great investment.

The valuation is also very impressive!

Recommended Reading

Drilling at the bottom (Transocean / RIG): Cyclical Value Investing

Twitter introduced me to Jonathan Schramm's (aka @Cyclical_invest) Cyclical Value Investing blog the other day.

Although he seems to be just getting started, he has recently written an incredibly insightful piece about Transocean (RIG) that deserves your attention. Before my encounter with this article, I never believed this industry would be so interesting.

It is highly recommended that you take a look at this!

Music

August Burns Red is one of the best metalcore bands ever. They have made a lot of high-quality music over the years. In my opinion, they are a cornerstone of the genre; they change very little, but always produce powerful performances.

The band's new single, Vengeance, is a complete assault on the ears. Jake Luhrs, lead vocalist, demonstrates vocal ranges that I have never heard before...and I love it.

This is a short, but brutal piece. Check it out.

As always, thanks for reading!

Invest Wisely,

Dillon Jacobs

Holdings Disclosure

Neither I nor anyone else associated with this website and newsletter has a position in IMXI and no plans to initiate any positions within the 72 hours of this publication.

I wrote this article myself, and it expresses my own personal views and opinions. I am not receiving compensation, nor do I have a business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer

None of the writers or contributors of Stock Spotlight are registered investment advisors, brokers/dealers, securities brokers, or financial planners. This report is being provided for informational and educational purposes only and on the condition that it will not form a primary basis for any investment decision.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA (publishers of Stock Spotlight) on whether to buy, sell or hold shares of any particular stock.

None of the information in our articles is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The information is general in nature, and is not specific to you.

Vertigo Studio SA is not responsible and cannot be held liable for any investment decision made by you. Before using any article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA on whether to buy, sell or hold shares of any particular stock.

We did not receive compensation from any companies whose stock is mentioned in this report.

No part of the analyst's compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed in this report.