Free Report #8: Check Point Software Technologies (CHKP)

Check Point Software Technologies (CHKP)

Cybersecurity is no joke. With the interconnected-to-everything digital world we find ourselves in 2021, it’s no wonder cyber attacks keep occuring on a regular basis. Here’s a small list of major cyber crimes just this year:

Poisoning of a Florida based water utility

Microsoft Exchange Server Cyber Attack

There are actually many more attacks just this year, but these are the major ones. Cyber actors are seemingly attempting to target necessary infrastructure hotspots throughout the world, causing major economic damage.

This may all sound super futuristic, but it is the world we live in now. The battleground of the present is in cyberspace. Additionally, now that many of us are working from home, it is more important than ever to safeguard our digital lives.

So, how can we as investors take advantage of a bad trend? Let’s take a look at one of the largest cyber security firms in the world, Check Point Software Technologies (CHKP), and see if we can find a good business.

Principle #1

A Business That We Can Understand

If you are unfamiliar with cybersecurity/computer terms, then this may be a hard company to understand. It is still a bit hard for me to wrap my head around, but I get the gist.

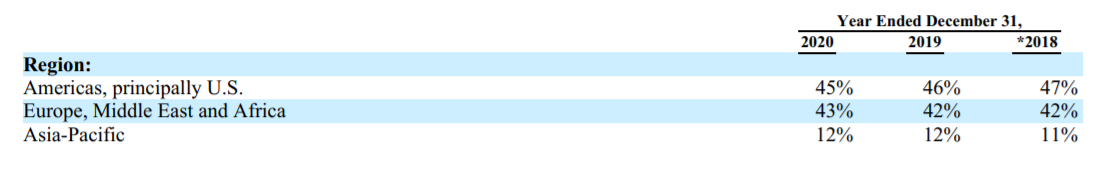

Essentially, Check Point is a $16B global leader in providing cybersecurity solutions to individuals, companies, and governments alike. They are headquartered in Tel Aviv, Israel, but have globally diversified revenue streams.

I was surprised to learn that Check Point has been around for a long time. It was originally founded back in 1993, just as the internet was being born. Check Point was credited with creating the very first commercially available firewall. They used the firewall product as a foundation for their business, and grew their product line from there.

Product Line

Speaking of product line, Check Point offers an entire suite of cybersecurity solutions to their customers. The have over 80 different product that they bundle into five distinct services.

Quantum: Securing private and enterprise level networks

CloudGuard: A defense designed specifically for cloud computing

Harmony: Unified security solution for users and their devices

Infinity-Vision: Unified management and Extended Detection and Response (XDR)

Check Point Infinity: A fully consolidated cyber security architecture of all above products

I could dive into the specifics and nitty gritty behind the product suite, but I feel it is pretty unnecessary. Most of the terms are jarnony and very technical, so I won’t bother you with those. However, to their credit, Check Point does do a decent job explaining the processes to you in their annual reports, it will just require you to do some homework.

Verdict

Check Point is an original cybersecurity firm, that has deep roots in the industry. They benefit from a diverse, yet consolidated product lines and revenue streams.

Check Point does present detailed explanations of operations in their reports, but as an average cyber-joe, I still feel a bit lost in the sauce with all the technical terms and jargon.

I think the average investor will need to do a decent amount of industry research to fully grasp the business as a whole. So for that, I can only give it a half a point.

Score: 1/2 Point

Principle #2

A Business That Has Favorable Long-Term Prospects

Tailwinds

Increasing Cyber Attacks

Unfortunately, as I stated previously, large cyber attacks are becoming more and more frequent. Everything is connected to the network/cloud these days, and if your business is not on the web, then you won’t be in business very long.

Literally every company, agency, and government now requires a robust cybersecurity solution. Cyber threats are becoming increasingly sophisticated, and can lead to devastating outcomes. Nobody is going to be willing to risk operating on an unsecured network.

Given this fact, this will benefit Check Point’s business. The cybersecurity industry is slated to grow over 14% annually over the next five years. This is an excellent tailwind to have.

Subscription Business Model

In addition to being an asset light business, Check Point also operates with a subscription business model. This is one of the best business models to have, as recurring revenue streams are incredibly valuable to any firm.

Those recurring revenues should continue to drive top and bottom line growth.

Headwinds

Competition

Since cybersecurity has such a big market, naturally there are plenty of other contenders in the space. This requires the companies in the industry to be constantly evolving and outselling the other for market dominance.

Check Point recognizes this, and invests heavily into R&D and marketing. This expenditure has impacted their margins over the past few years. However, this still isn’t a large problem, as margins are still in the 40% range.

Acquisitions

Organic growth of a business is always the preferred method of growth. However, once a company reaches a certain size, they end up running out of room for organic growth, and instead acquire smaller firms.

Now, this isn’t actually a bad thing. M&As are commonplace in any industry. However, it seems Check Point has become more reliant on M&As to grow over the past few years.

Many of these acquisitions are pretty recent, so it is hard to say if they have worked out well or not. Plus, that is beyond the scope of this newsletter.

Verdict

Check Point is in a growing, but competitive industry with a subscription business model. Organic growth seems to be stalling a bit, but recent (hopefully good) M&As should help the firm continue to grow.

I like the subscription business model, plus the industry expansion. I think there is far more good than bad here.

Score: 1 Point

Principle #3

A Business That is Operated by Honest and Competent People

Founder & CEO

Mr. Gil Shwed is the founder of Check Point, and also has led as the CEO of the company for over 27 years. He is kind of a rockstar in the cybersecurity world. He is the one credited for inventing the modern firewall, and is the author of many other security patents.

Mr. Shwed has been the recipient of many accolades and awards over his career, and also serves as a board member for many science and technology universities. He also is quite an active philanthropist.

Mr. Shwed is a cybersecurity pioneer, and is absolutely someone I want running this company. His stellar track record is nothing short of impressive.

Alignment

Check Point has a large portion of the equity owned by insiders. Most of this portion is owned by the CEO Gil Shwed, with a whopping 18% (over $3B!) of the company.

This is great to see the CEO have such a large stake in the company. What’s more, is he receives very little annual compensation as a salary.

Mr. Shwed’s net worth is tied to the success of the company. This is exactly what we want to see.

ROIC and Profitability

Check Point’s management has been able to churn out some stellar returns for the company while maintaining high margins. ROE and ROIC have managed stay above an amazing 20% over the past decade.

Verdict

Management is clearly the strong point for this company. The CEO is an cybersecurity rockstar, has been with the company for nearly three decades, and has over $3B of his personal assets in the company.

The team has been able to churn out amazing profitability metrics over the past decade. This has the hallmarks of top-tier management.

An easy point here.

Score: 1 Point

Principle #4

A Business That is Available at an Attractive Price

Free Cash Flow

CHKP has been a steady cash flow machine over the past 10 years. Growth has been slow, but steady, with about a 5% CAGR.

It looks like management has been using that cash to purchase back stock, as well as buy smaller firms. They have been able to purchase shares at around a 4.5% clip over the decade. This is great to see.

Historically, CHKP has hovered around a P/FCF between 12 - 16.

I think that CHKP will continue the status quo. Slowly and steadily grow FCF, buy back shares, and acquire smaller firms. I will combine the FCF growth rate (5%) with the share buyback rate (4%) to reach an estimated long term 9% growth rate. I will lock in that 9% growth for the decade, since the business is remarkably stable. I eventually plan to model in share dilution or repurchases into my DCF model, but this will do for now.

I’ll split the difference for the terminal multiple at 14.

Discounted Cash Flow

Here’s my DCF work on CHKP with zero margin of safety:

And here’s a 15% margin of safety:

Verdict

Current CHKP share price: $118.74

My buy price: $110.96

CHKP does not technically check the box here for a 15% return, with a margin of safety. However, it is not far at all from that 15% threshold. In fact, if I was willing to accept a 12% return, with a larger margin of safety, it would be a buy.

Depending on my rate of return, it is either slightly overvalued, or fairly valued. However, I think that CHKP is one of those rare companies that you want to pay up for. It’s business model is attractive and safe, and that is worth paying fair value.

Score: 1/2 Point

Final Thoughts and Score

Check Point Software Technologies (CHKP) Score: 3/4

I really like this business, I just wish it was trading at a slightly lower price. A lot like last week’s issue with Logitech, Check Point seems to be a wonderful business trading at a fair price.

The SaaS business model is super lucrative, and the CEO seems to be a great leader, oriented for long term success. It’s likely to benefit from the secular growth tailwinds of the cybersecurity industry.

In this case, I think CHKP is a great stock that can pad a portfolio with safe and stable 12% returns over a decade. The risks seems very minimal.

Recommended Articles

How Companies Create Value for Shareholders (Part 1): Vintage Value Investing

Sorry for the shameless plug, but I really think this is a good subject to educate yourself on. Understanding what a business needs to do in order to create value for you, the shareholder, is key to an investment decision.

Stay tuned for Part 2!

Music

I really enjoy Misery Signals’ sound. Their heavy, yet melodic sound is exactly what I am looking for in music. It’s just a shame we have to wait so long in between albums.

“Sunlifter” is one of my favorite tracks off the new album, Ultraviolet, that came out last year. It seems especially appropriate for early morning summer jogs when the sun comes up at 5:30 AM.

Thanks for reading, see you next week!

Invest Wisely,

Dillon Jacobs

Holdings Disclosure

Neither I nor anyone else associated with this website and newsletter has a position in CHKP and no plans to initiate any positions within the 72 hours of this publication.

I wrote this article myself, and it expresses my own personal views and opinions. I am not receiving compensation, nor do I have a business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer

None of the writers or contributors of Stock Spotlight are registered investment advisors, brokers/dealers, securities brokers, or financial planners. This report is being provided for informational and educational purposes only and on the condition that it will not form a primary basis for any investment decision.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA (publishers of Stock Spotlight) on whether to buy, sell or hold shares of any particular stock.

None of the information in our articles is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The information is general in nature, and is not specific to you.

Vertigo Studio SA is not responsible and cannot be held liable for any investment decision made by you. Before using any article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA on whether to buy, sell or hold shares of any particular stock.

We did not receive compensation from any companies whose stock is mentioned in this report.

No part of the analyst's compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed in this report.