Free Report #9: Take-Two Interactive (TTWO)

I have always loved video games ever since I was young. My first video game console was a Super Nintendo, and I made many friends (and enemies) playing games like Mario Kart, Super Smash Brothers, and The Legend of Zelda. I actually wrote a piece on Nintendo in a previous issue, so be sure to check that one out.

As I grew older, naturally I started to gravitate towards more mature games. When I was around 11 years old, GTA San Andreas released, and I remember all of my friends playing it. However, I did not own a PS2, and my parents forbid me from playing an “M” rated game. Better to stick to family friendly Nintendo products.

To my parents chagrin, this did not stop me from playing the game. I had many friends who had the equation for gaming success: A PS2 + parents that didn’t know (or care) what their kids were playing. All I had to do was go over to my friend’s house to play.

And play we did. My friends and I sunk many hours and nights into doing all kinds of crazy things in the game. Whether it was getting into a shootout with the cops or drag racing in the streets of San Andreas, we always had a blast.

Today, I am going to look at the creator of the GTA franchise, Take-Two Interactive (TTWO). GTA is a very successful franchise, but there is plenty more to the company than just GTA.

Let’s dive in.

Principle #1

A Business That We Can Understand

Founded in 1993, Take-Two Interactive consists of five wholly owned video game developers: Rockstar Games, 2K, Private Division, Playdots, and Social Point. Each of these developers focus on either a specific market or certain type of game.

Here’s a rough breakdown of each division’s main focus:

Rockstar: Creates large AAA video game titles with original IP. Products include: GTA, Red Dead Redemption, Max Payne, etc.

2K: Creates sports, shooter, action and RPG titles for mass market adoption. Products include: NBA/WWE 2K series, Borderlands, Civilization, etc.

Private Division: Publishing label focused on bringing titles from the industry’s leading creative talent to market. Products include: The Outer Worlds and Kerbal Space Program.

Take-Two recently acquired mobile game developers Playdots and Social Point. With the acquisition came a some quite popular IP, like Dragon City and Two Dots.

Industry Leader

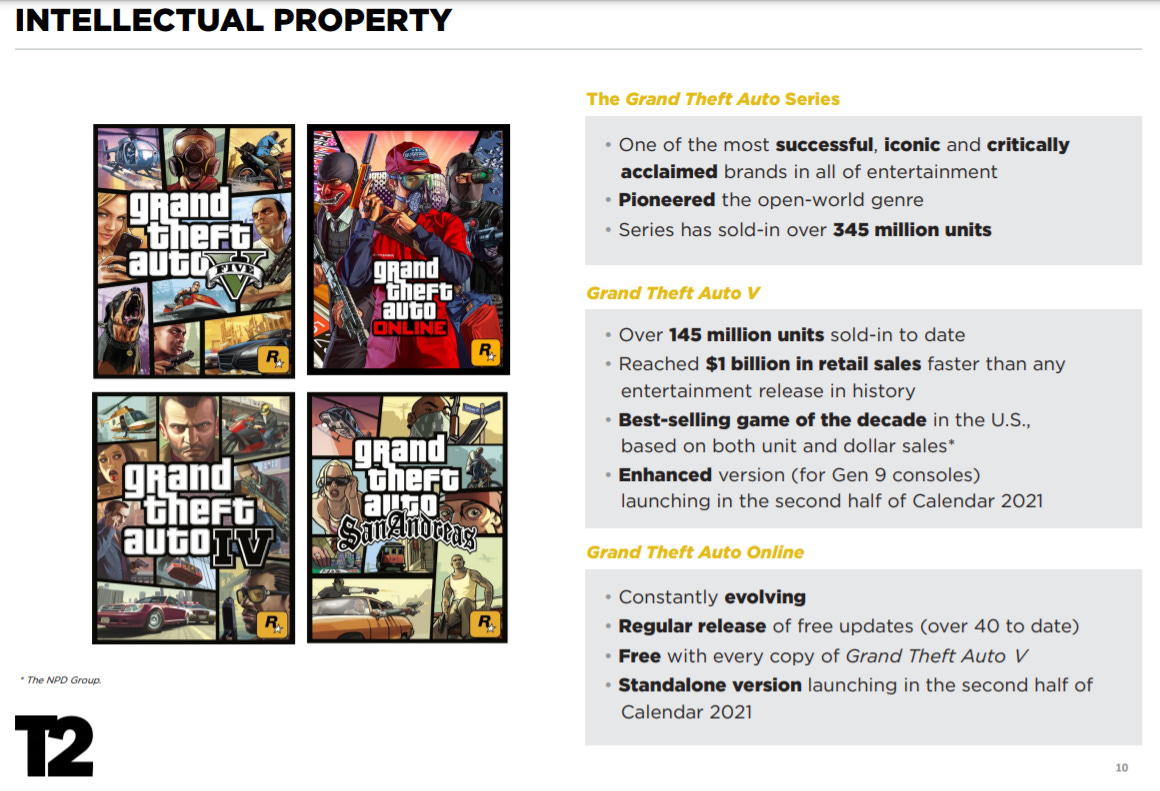

Take-Two is without a doubt a leader in the video game publisher/developer industry. It’s original IP GTA and Red Dead Redemption are some of the most critically and commercially successful video games of all time.

In fact, GTA V alone is one of the best selling video games of all time, having sold over 145 million units!

GTA Online is also still has an incredibly active user base, especially for being an almost eight year old game. GTA Online is full of ways for gamers to spend real currency in the digital world, essentially making it a money printing machine.

Verdict

Take-Two is a big player in the video game industry. The company has excellent IP with an ever expanding portfolio of games and publishers. GTA Online is an amazing cash cow, which will likely continue to fund the company on its own.

Easy point here!

Score: 1 Point

Principle #2

A Business That Has Favorable Long-Term Prospects

Tailwinds

Take-Two was kind enough to provide their own growth prospects for the company. Nevertheless, I will go over my own observations.

Growing Industry

The video game industry is a good industry to be operating in right now. Gaming is becoming more popular with each passing year, and will likely continue to grow as more of the world comes online.

The increasing trend of digital sales through online marketplaces is one of the best tailwinds for Take-Two, as it will continue to naturally cut costs for them in the long run. This is an enormous benefit to the company; this is why software companies end up being so profitable. In fiscal 2021, digital online revenues increased by $540.7 million year over year and accounted for 86.6% of total net revenue!

Strong Original IP

Take-Two’s IP are titans in the industry. Take-Two has a nice balance of both infrequent and frequent game development. Let me explain.

The 2K team puts out annual sports games like NBA 2K and WWE 2K. These annual games provide a nice and steady stream of income every year.

Conversely, blockbuster titles like GTA and Red Dead Redemption are developed by Rockstar, and only release a title once per console generation (or sometimes longer!).

This development strategy complements one another nicely, as Take-Two can benefit from the best of both worlds. Additionally, the company seems to be more positioned to make mobile gaming a larger portion of the business, as seen with their recent acquisition strategies with Playdot and Social Point.

Headwinds

Competition

It’s no surprise that an industry with this much growth and profitability is massively competitive. Take-Two is competing for a large market, and with that comes a many others vying for market share. Competitors include:

Microsoft

Sony

Electronic Arts

Activision Blizzard

Zynga

All of these competitors also have some good IP to their names. With plenty of attention to capture, Take-Two will be likely forced to increase their advertising budgets in order to stay in the limelight.

Hit-Driven Industry/IP Dependency

Similar to the movies/TV, the video game industry is largely hit driven. Luckily, Take-Two has had a stellar track record of successful (although sometimes buggy) releases. IP management has been quite solid, as the franchises seem to grow with each iteration.

However, the company is reliant on specific titles to drive sales. The five best selling franchises make up for a major chunk of its revenues (84.1% in fiscal 2021). Underperformance of any of these franchises is bound to have a negative impact on the top line and profitability.

Lucky for Take-Two is that this is a general risk for the entire industry and is not specific to themselves.

Verdict

Take-Two is benefitting from the double whammy of two secular tailwinds: from the growing popularity in video games and a growing digital marketplace. When combined with amazing IP and a growing mobile portfolio, this should be a recipe for success.

The industry risks are definitely present, but Take-Two has been able to successfully navigate through them historically. I am pretty confident they will continue to execute their strategy.

Score: 1 Point

Principle #3

A Business That is Operated by Honest and Competent People

Chairman and CEO

Mr. Strauss Zelnick is the Chairman and CEO of Take-Two Interactive. He first joined as Chairman of company back in 2007, and then moved to the position of CEO in 2011. A decade of tenure is great to see.

Prior to Take-Two, Mr. Zelnick has been involved with a plethora of media/entertainment companies. He is the co-founder of ZelnickMedia, and was the former President of BMG Entertainment, and the former COO of 20th Century Fox. He also serves as Vice Chairman of the Entertainment Software Association.

Mr. Zelnick is quite an experienced executive in the media and entertainment industry, and seems to be a great man for the job.

Alignment

Take-Two is mostly institutionally owned, with the insiders owning less than .5% of the company. This isn’t necessarily a red flag, but I do prefer to see more insider ownership.

Of note, the CEO has $24.6M of personal wealth in the company, which is good to see.

ROIC and Profitability

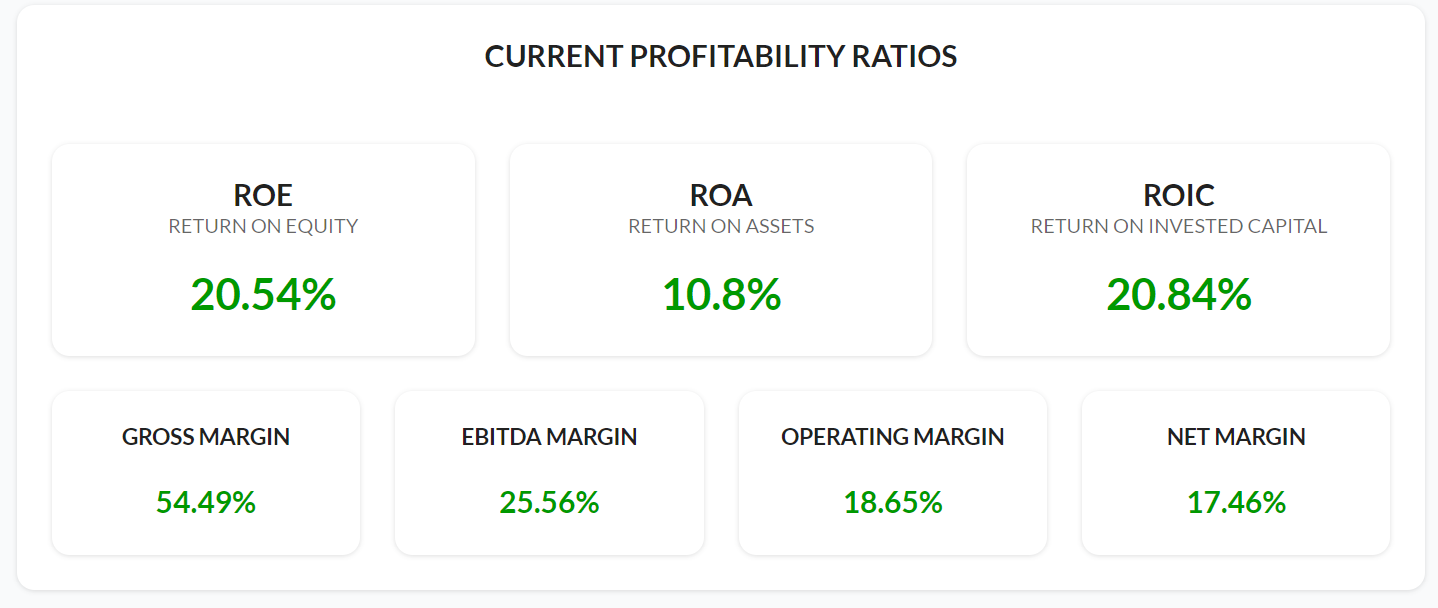

Take-Two has been operating with high efficiency over the past decade. The hit driven cyclicality shows in the numbers over time, but ROA, ROE, and ROIC have been remarkably stable over the past five years.

Verdict

Take-Two’s management is doing a great job. The CEO is very experienced, and has been with the company for over a decade, which is fantastic for this industry. Margins are stable and profitability is relatively high.

Score: 1 Point

Principle #4

A Business That is Available at an Attractive Price

Free Cash Flow

TTWO has had some voilaite, but growing FCF over the past 10 years. We can see huge spike in cash flows in 2013, when GTA V released. Ever since then, TTWO has been able to consistently monetize the game and compound FCF nicely.

TTWO has been able to grow FCF over 30% annually for the last six years. They will likely release a GTA VI /GTA Online in the next few years, which will be another huge blast of cash flow for the company.

I don’t think that it will be unreasonable for TTWO to grow FCF at around 20% for the next five years, and then crank it up to 25% post-GTA VI launch. If GTA VI is monetized even half as well as its predecessor (which it surely will), TTWO will have created another decade-long money printer.

TTWO has historically traded between 15x - 25x cash flows. I will split the difference with a multiple of 20.

Discounted Cash Flow

Here’s my DCF work on TTWO with zero margin of safety:

And here’s a 20% margin of safety:

Verdict

Current TTWO share price: $173.82

My buy price: $297.85

Based on my initial projections and DCF, TTWO seems to be significantly undervalued for a 15% return. If I lower the growth rates to a pessimistically low 10% - 15%, then I arrive at about fair value today.

On the surface, TTWO seems to be offering a good value if it can manage to grow as projected. It is difficult to grow 20% per year, but the stable cash cow that is GTA V has made the company far less risky. Unless they completely flop on the release of GTA VI, I can’t see FCF not compounding at a high rate.

Score: 1 Point

Final Thoughts and Score

Take-Two Interactive (TTWO) Score: 4/4

Take-Two Interactive is operating a great business at what seems to be a great price. Most of the risk for the company is the unannounced, yet all but confirmed launch of GTA VI.

I think the odds are high that Take-Two will have a successful launch of the next GTA title, and will monetize the platform accordingly. The biggest risk I see here is competition within the industry, with another business stealing market share.

I will assuredly be conducting further research to see if these growth rates are sustainable. But for now, things look great for Take-Two.

Recommended Articles

Nintendo, Disney, and Cultural Determinism: Matthew Ball

I am rather bullish on Nintendo as an investment (I do own shares). However, I find Matthew Ball’s take on the company to be quite different, as his thesis is quite more bearish than mine.

I love hearing different perspectives that challenge my viewpoint. I feel this is an essential element for personal growth.

Anyway, it’s a great article if you want to get smart on Nintendo’s business model.

Music

Sleep Token is a true enigma of a band. They are one of the only groups that are actually still completely anonymous, which is an enormously hard feat in these times we live in.

I am enthralled by their ambient, yet heavy sound. The vocalist has a unique and emotional (but very British) sound.

I was a big fan of their 2019 album, Sundowning. Their new single, “Alkaline”, is some great new material. I was curious as to what direction the band would go with their sound, but it overall sounds very similar to Sundowning, which is completely fine by me.

Looking forward to the new album in September.

Thanks for reading, see you next week!

Invest Wisely,

Dillon Jacobs

Holdings Disclosure

Neither I nor anyone else associated with this website and newsletter has a position in TTWO and no plans to initiate any positions within the 72 hours of this publication.

I wrote this article myself, and it expresses my own personal views and opinions. I am not receiving compensation, nor do I have a business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer

None of the writers or contributors of Stock Spotlight are registered investment advisors, brokers/dealers, securities brokers, or financial planners. This report is being provided for informational and educational purposes only and on the condition that it will not form a primary basis for any investment decision.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA (publishers of Stock Spotlight) on whether to buy, sell or hold shares of any particular stock.

None of the information in our articles is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The information is general in nature, and is not specific to you.

Vertigo Studio SA is not responsible and cannot be held liable for any investment decision made by you. Before using any article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA on whether to buy, sell or hold shares of any particular stock.

We did not receive compensation from any companies whose stock is mentioned in this report.

No part of the analyst's compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed in this report.