Free Report #10: McCormick & Company (MKC)

If you were to take a peek inside you pantry or fridge right now, I would be willing to bet my entire salary that you have a McCormick (MKC) product in there. In fact, there are probably multiple McCormick products in your house right now and you don’t even realize it (we will discuss this more in the overview).

Imagine eating just plain chicken breast. Sounds horrible right? Nobody likes bland food. Spices are just something that I think most of us take for granted. That’s what McCormick is all about; providing spice and flavor in large varieties to millions of consumers.

Personally, one of my favorites of their products is the Montreal Steak Seasoning. This stuff makes a steak taste incredible. Literally just thinking about it makes my mouth water. They even have a spicy and smoky variety!

I want to address something really quickly before we move on. Many investors have this belief that stable, dividend producing, consumer staple companies are the best decisions for a buy and hold type of investment. Simply buying a company that has a strong brand of products that everyone has in their home is thought to be an almost insurmountable moat that can never be eroded.

There is some merit to this argument. Some well known consumer brands (Coca-Cola, Hershey, Clorox, etc.) have been around for decades, or even centuries, and have been interwoven into the fabric of our society and culture. I think nostalgia and brand loyalty comes in to play here as well for many investors.

However, this mass market adoption of a brand/product does not necessarily equate to a great business with growing cash flows. Think about it. These companies have to spend billions because they operate at such a large scale. Sometimes this can actually be incredibly damaging to a company, especially when poorly managed.

As an example, just take a look at the mess that is Kraft Heinz.

Ok sorry, rant over now. Let’s dive into McCormick and see if they are in fact a great consumer staple company.

Principle #1

A Business That We Can Understand

This should be the easiest part of this write up. If you don’t understand food and flavor, then I don’t think I can help you.

McCormick is a 130 year old leading global manufacturer, marketer, and distributor of spices, herbs, extracts, seasonings, and other flavorings.

McCormick's customer base includes top quick-service restaurants, retail grocery chains, and other packaged food manufacturers, with about 40% of sales generated beyond the United States to include 150 other countries and territories.

Beyond its namesake brand of spices, the firm's portfolio includes some classic and renown brands like Old Bay, Zatarain's, Thai Kitchen, Frank's RedHot, French's, and the recently acquired Cholula brand.

As you can see from the image above, the company operates with two business segments: Consumer Brands and Flavor Solutions. Let’s break these segments down in detail.

Consumer Brands

These are the brands you know and love. You likely consume them every day. Products range from simple spices, like salt and pepper, to the most complex sauces, dips, and marinades. McCormick’s product line is diverse in both taste and geography, with a healthy income arriving from international locations. This segment provides roughly 75% of the company’s income.

In addition to the Montreal Steak Seasoning, I do also really enjoy Frank’s RedHot.

Flavor Solutions

The Flavor Solutions segment of the business accounts for the remaining 25% of the company’s income. In this segment, McCormick serves flavoring products to international food manufacturers and foodservice customers. These vendors purchase supplies either directly or indirectly from McCormick at large scale.

Verdict

This may seem like a short overview, but there honestly is not much more to go over here. McCormick is a large scale provider of spices and flavors to millions of people.

Easy point here!

Score: 1 Point

Principle #2

A Business That Has Favorable Long-Term Prospects

Tailwinds

Cooking at Home Popularity

Many people were forced back into their kitchens because of COVID. McCormick was one company that benefited greatly from this trend. As I stated in the beginning of this article, nobody enjoys eating plain chicken breast.

As more consumers got back in the kitchen, more McCormick products were purchased. This trend will likely retain some customers to the McCormick brand, but as we begin to emerge from COVID, this spike will eventually level off.

Broad and Expanding Portfolio of Products

As you can see from the image below, McCormick has a dense array of both products in the consumer segment and the flavor segment. Just like a stock portfolio, this diverse range of products helps offset each other when one underperforms.

McCormick is a very mature business, so it is hard to grow organically. Their main growth strategy is currently in Mergers and Acquisitions (M&A), as seen with their most recent additions with Cholula hot sauce brand and FONA International.

The more products and brands added, the more diverse the portfolio gets.

Headwinds

COVID-19 Related Costs

Ironically, COVID also hurt McCormick as well. Last year during the pandemic, McCormick had to shell out over $50M in pandemic related costs in FY20. This is mainly due to third party manufacturing expenses that have to be accounted for.

Unfortunately, 2021 looks even worse. Management has earmarked a whopping $60M for pandemic related costs in FY21. This is a solid 12% of their 2020 earnings that has to be shelled out.

Luckily, this is likely a short term problem that should hopefully work itself out within a year.

Debt

Mature companies tend to me more debt ridden than that of younger companies. McCormick is no exception to this. Historically, they have had relatively high debt levels for my taste, but this is not uncommon in their industry.

Debt has really spiked in the last few years. I suspect this was probably due to a plethora of M&A activity. It’s beyond the scope of this article do analyze the effectiveness of managements M&A strategy, as these can take years to really determine the winners and losers.

Verdict

McCormick operates with a large and diverse portfolio of edible products that are very consumable. However, the debt of the company is pretty high, even though they are relativity at par level for their industry. COVID related costs are temporary, but high relative to earnings.

The business is mainly growing through M&A activity, which can be risky to bet on. Additionally, they are using a lot of debt to do it. Personally, it’s not something I want to bet on, since M&As are notoriously hard to do successfully.

This is going to have to be a pass for me.

Score: 0 Points

Principle #3

A Business That is Operated by Honest and Competent People

Chairman, President, & CEO

Mr. Lawrence Kurzius is the current CEO of McCormick. Mr. Kurzius is a tenured executive and has been with the company for quite some time. He was first brought on board in 2003 through the acquisition of Zatarain’s, where he served as the President and CEO for 12 years. Before that, he worked for other well known brands like Quaker Oats and Mars Inc.

Since joining the McCormick team, Mr. Kurzius has held a variety of executive positions. In 2016, he was elected to become the new CEO, Chairman, and President of the company.

Alignment

McCormick has very little insider ownership, with over 75% of the company being institutionally owned. Additionally, the executives seems to be paid pretty highly. The currently salary of the CEO is quite high ($19M), and the rest of the management team’s salaries are high as a percentage of the company’s earnings.

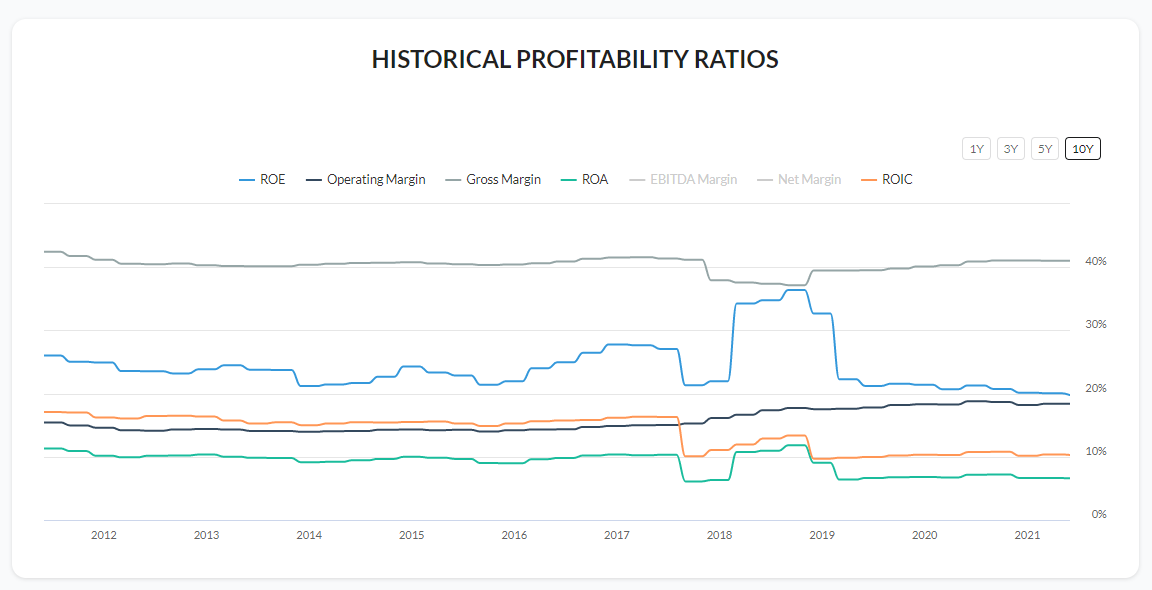

ROIC and Profitability

McCormick’s ROIC and profitability metrics are kind of mediocre. Historically, ROIC has been just above 10%, and margins have been stable. There are no red flags here, but nothing great is jumping out at me.

Verdict

While I don’t think McCormick’s management is necessarily bad, I don’t think they are great either. The CEO has a good career history, but he has made a lot of acquisitions during his tenure that have yet to been seen how they will play out.

The executive pay is high especially for the current debt levels, and the profitability is nothing stellar. I am not exactly thrilled with management here.

Score: 0 Points

Principle #4

A Business That is Available at an Attractive Price

Free Cash Flow

MKC has been able to compound FCF over the past decade at pace of about 14%. This is pretty nice growth for a company that just makes seasonings.

Given this steady growth, MKC does command a pretty high P/FCF, which is sitting near historic highs of about 32x. I think that this multiple will likely contract in the future, and will return to the 20x floor.

Given MKC’s rising debt levels over the past couple of years, I think that MKC should pay down some debt. However, I am not getting this signal from management, so I assume most of this FCF will result in more acquisitions and/or dividend payments. The currently pay a dividend of $1.36 per share, maintaining about a mid-40% payout ratio.

I don’t think that there will continue to be 14% FCF over the next decade, as the company will need to eventually pay down some debt. I will cut the growth to the current ROIC range (10%) and taper it off to 7% from there.

Discounted Cash Flow

Here’s my DCF work on MKC with zero margin of safety:

And here’s a 20% margin of safety:

Verdict

Current MKC share price: $88.34

My buy price: $38.20

Based on my initial projections and DCF, MKC seems significantly overvalued. MKC seems to only be offering mid-single-digit returns at its current valuation.

MKC is far too pricey for me right now, as my hurdle rate is usually 15%. This is going to have to be another pass for me.

Score: 0 Points

Final Thoughts and Score

McCormick & Company (MKC) Score: 1/4

I really wanted to like McCormick as an investment. It’s business model is safe, likeable, and easy to understand. But unfortunately, that’s about the only place where the good aspects lie.

At this point in the company’s life-cycle, the growth of the business lies almost entirely in M&A. In order to successfully pull off M&As, you need stellar management. I just don’t get the warm and fuzzy here from management. I need that warm and fuzzy feeling if I have to rely on them this much to grow the business.

Additionally, the debt is an issue that needs to be addressed. I would be even more concerned if McCormick decides to continue to lever up for more acquisitions.

Overall, McCormick has a great business model, but I am not so sure about the growth prospects. It’s not for me.

Recommended Articles

The Case for a Longer-Term Oil and Gas Bull Market: Lyn Alden

I love Lyn’s blog. This article is a doozy of a read. I am a big proponent of clean green energy and the investments we need to make in order to make a difference. However, Lyn hits readers with some cold hard facts of the “green” energy sector, and why gas and oil will likely be here for longer than we think. For better or for worse.

I highly encourage you to read this eye-opening article!

Music

Make Them Suffer is one of my favorite bands in the metalcore genre right now. Their sound seems to solidly progress with each album. I especially love the atmospheric tone and complementing vocalists. They go hard too.

“Contraband” is one hell of a ride. I find the vocals on this track (featuring Courtney LaPlante from Spiritbox!) to be nothing short of spectacular. From the high pitched screams, to the deep low growls, the vocalists give it their all. Of course, the rest of the musicians are stellar as well.

This track is fantastic. Give it a listen.

Holdings Disclosure

Neither I nor anyone else associated with this website and newsletter has a position in MKC and no plans to initiate any positions within the 72 hours of this publication.

I wrote this article myself, and it expresses my own personal views and opinions. I am not receiving compensation, nor do I have a business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer

None of the writers or contributors of Stock Spotlight are registered investment advisors, brokers/dealers, securities brokers, or financial planners. This report is being provided for informational and educational purposes only and on the condition that it will not form a primary basis for any investment decision.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA (publishers of Stock Spotlight) on whether to buy, sell or hold shares of any particular stock.

None of the information in our articles is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The information is general in nature, and is not specific to you.

Vertigo Studio SA is not responsible and cannot be held liable for any investment decision made by you. Before using any article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA on whether to buy, sell or hold shares of any particular stock.

We did not receive compensation from any companies whose stock is mentioned in this report.

No part of the analyst's compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed in this report.