Rakuten (RKUNY) Stock Analysis

March 1st, 2022

Table of Contents

Quick Stock Overview

Rakuten by the numbers.

1. Executive Summary

A brief discussion of Rakuten and it’s potential appeal to value investors.

2. Extended summary

A more detailed explanation of Rakuten’s business and competitive position.

3. Investment Thesis

Why I see potential in Rakuten stock.

4. E-commerce Segment

The core business that built Rakuten justifies the Company’s on its own: the rest is thrown in for free.

5. The Mobile Conundrum

The controversial segment that has dropped Rakuten’s valuation, and why that probably won’t last.

6. An Exportable Tech Expertise

An offshoot of the mobile expansion that has already generated a $2 billion contract in Germany and offers further export potential.

7. The Rakuten Ecosystem Moat

How Rakuten leverages its omnipresent position in the Japanese market to achieve an unbreakable moat.

8. The FinTech Segment

Japan lags behind the rest of the world in fintech growth. Rakuten is poised to dominate as fintech catches up.

9. Conclusion

Why Rakuten is worth a closer look.

Annex: VC, Foreign Acquisitions and Content

Rakuten businesses that are difficult to value reliably but which any potential investor should consider.

Quick Stock Overview

Ticker: RKUNY / 4755.T

Key Data

Industry: Internet retail

Market Capitalization ($M): $12,892

Price to sales: 0.9

Price to Free Cash Flow: 7.3

Dividend yield: 0%

Sales ($M): 14,002

Net Cash per share: $6.20

Equity per share: $6.46

P/E: –

Free cash flow/share: $1.15

1. Executive Summary

Rakuten is the largest e-commerce company in Japan, the 3rd biggest economy in the world. In most countries, this position would allow the company to trade at very expensive multiples, riding a global boom in valuation of established tech companies.

With only a $12B market cap, the company is tiny compared to Alibaba ($339B) or Amazon ($1579B). Amazon’s revenues are 33.6x Rakuten’s, but its market cap is 122x larger.

At a price to free cash flow ratio of 7.3 and price to sales ratio of 0.9, Rakuten is far from bubble territory.

Market negativity toward Rakuten is mostly linked to its expansion in the unprofitable mobile services segment. Investors have widely judged it a strategic mistake that caused the company to lose large amounts of money in a capital-intensive sector.

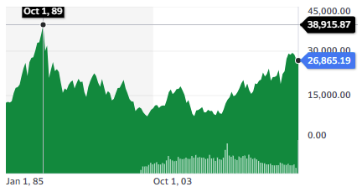

On top of the mobile expansion problem, Japanese equities have still not recovered from their highest point in 1989, 33 years ago (see below the Nikkei 225). There is little attention and enthusiasm for Japanese stocks in general.

This is something to keep in mind, as its influences how most analysts will judge any Japanese company, Rakuten included. Misallocation of capital and stagnation is not only common but expected. Any sign of trouble makes investors run away without a look back.

Until very recently, Rakuten was essentially operating only in Japan, with a focus on B2C sales. With an entirely new business line of international B2B service launching a month ago, inaugurated by a $2B contract, this is about to change. It should change investor perception of the company as well.

In this report, I will show the following:

The quality and growth of e-commerce segment alone coils support a much higher market cap. We will also discuss why some Japanese equities deserve a second look, especially growing and modern companies.

The capital-intensive phase of the mobile operations is largely done. Their losses should drop dramatically and they might even turn profitable.

The Rakuten ecosystem is a world-class moat, and the mobile activity reinforces it

The financial branch of the company is largely not discussed, despite large opportunities available in Online Banking, FinTech, Insurtech, and for monetizing the data collected.

The investment in mobile network technology has been used to develop a unique technology stack, similar to what Amazon did with AWS. It could be massively adopted abroad by low-cost mobile operators, as demonstrated by some recent high-margin sales of the solution. This will also transform Rakuten’s investing profile from “Japan e-commerce” to a diversified international tech conglomerate.

Let’s take a closer look at what Rakuten has to offer.