Upstart Holdings (UPST) Stock Analysis

Upstart has seen its stock soar and crash, while the company moves forward with its unique and disruptive technology.

Table of Contents

Quick Stock Overview

Upstart by the numbers.

1. Executive Summary

A brief discussion of Upstart and its potential appeal to value investors.

2. Extended summary

A more detailed explanation of Upstart’s business and competitive position.

3. AI Revolution in the Loan Industry

How AI is changing an ossified 5 trillion dollar industry.

4. Upstart’s Business

An overview of Upstart: unique technology, competitive positions and exposure to recession.

5. Financials

Upstart by the numbers: balance sheet, cash reserves, expenditures, and valuation.

6. Conclusion

Why Upstart is worth a closer look.

Quick Stock Overview

Ticker: UPST

Key Data

Industry: Finance / Loans

Market Capitalization ($M): 1,412

Price to sales: 1.5

Price to Free Cash Flow: -

Dividend yield: -

Sales ($M): 998

Free cash flow/share: -

Equity per share: $8.78

P/E: -

1. Executive Summary

Upstart is both a tech company and a financial company. They provide AI-driven risk assessment and borrower rating services to lenders, offering greater accuracy than traditional credit scores.

Upstart’s stock price over the last two years would put a roller coaster to shame. UPST went public on Dec 18, 2020, selling shares at $20 each. Less than a year later, in October 2021, the stock peaked at $390, an 1850% gain. A year later, it was trading at less than its IPO price.

This extreme trajectory appears to be driven almost entirely by the market’s view of growth tech stocks, which went from being the belle of the ball in 2021 to being absolute pariahs in 2022. There’s no visible connection between the price movements and the performance of the company itself.

Still, the company is still holding a strong market position. Its technology is also performing remarkably well against traditional credit scoring systems. They have signed more partnerships with banks and credit unions and entered new markets with explosive growth potential.

So while it is true the sector as a whole could suffer from a recession, it would still be a huge business – lending isn’t going away – and Upstart could come out of it on top.

Upstart is losing money because of its very high R&D spending but has a relatively long period before needing fresh cash. With the recent massive stock price decline, we might just have enough margin of safety in the stock price to be worth a second look.

If the company returns to the 2021 net income level, its stock price would mean a P/E of just 8, despite the fact that the company has grown revenues 117% yearly in the last 3 years.

Upstart stock was unquestionably overvalued at $390/share, but is it now undervalued and oversold at under $20?

Let’s take a closer look.

2. Extended Summary: Why UPST?

The AI Revolution in the Loan Industry

The 5 trillion dollar lending industry still relies on decades-old methods to assess the risk of a potential borrower defaulting. More abundant data and new AI able to process the information can replace outdated methods with more precise and usable results.

This technology can dramatically expand the pool of potential borrowers with no significant increase in risk.

Upstart’s Business

Upstart is a leader in the personal loan FinTech market. It has just entered two major new markets: auto refinance loans and small business loans.

Upstart is not a lender. It evaluates the creditworthiness of loan applicants and refers them to partner lenders. This business model allows it to leverage the money and network of its banking partners and to be a partner, rather than a competitor, to traditional lenders.

Financials

Upstart has been affected by high interest rates and recession fears. Revenue growth has stopped and the company is losing money after three straight profitable years from 2019 to 2021. It is currently burning cash due to its large R&D spending. Still, the company has up to 2 years of cash runway and the capacity to reduce spending if needed. If it survives the downturn, it should be well positioned to resume aggressive growth.

3. AI Revolution in the Loan Industry

The Limits of Traditional Credit Scores

For decades, the financial industry has issued loans following a standardized procedure. They look at the applicant’s financial profile, mostly through credit scores, and decide on their risk profile. They then decide whether they are willing to approve the loan and what interest rate they need to charge to cover the risk of default.

This is pretty standard and a well-oiled machine. It is also woefully outdated.

This procedure emerged during an era when the data available on loan applicants was very limited. Essentially, banks and other lenders could only look at past credit performance and salaries. The real risk profile of an individual might be significantly different from what the model calculated from this limited information.

One standard credit score that uses these methods is the FICO score. It is used by 90% of top lending financial institutions in the US. FICO scores are primarily based on past credit history and current credit standing.

This is not a bad method, but it has limitations. For example, people who don’t use credit and live within their means will not have credit scores, though they may be financially stable and reliable.

This is why you can see personal finance advice like “get a credit card and always pay back the balance, so you have a build a great credit profile“. To get a good loan, you need to first have debt for as long as possible. This is not the most logical way to look at it.

And there are a lot of things a FICO score doesn’t include. Many of these have an impact on the real risk of defaults:

Age

Education

Salary and employment history

Family situation

Place of residence

Of course, banks and lender each have their way of trying to integrate these data on top of the FICO score and into their decision about giving loans. But this is far from a perfect process or a standardized procedure, especially for national lenders relying on automated procedures.

Enter the AI Credit Score

The idea behind Upstart’s technology relies on a simple fact. 80% of Americans have never defaulted on any credit or loan. Despite this, only 48% have access to the best credit conditions.

So there is a significant part of the population, tens of millions, that are judged unfairly by the standard credit scoring system. This is especially hurting minorities and other groups that have traditionally suffered from discrimination.

This has serious financial consequences. Many borrowers pay excessively high interest rates, potentially costing them thousands of dollars annually. Many more are effectively excluded from borrowing.

This is also costly for the lenders, as it artificially limits the customer pool and excludes viable customers.

Upstart has developed an AI system that looks at any data available about a potential borrower. It ranks borrowers along 5 grades, from A to E.

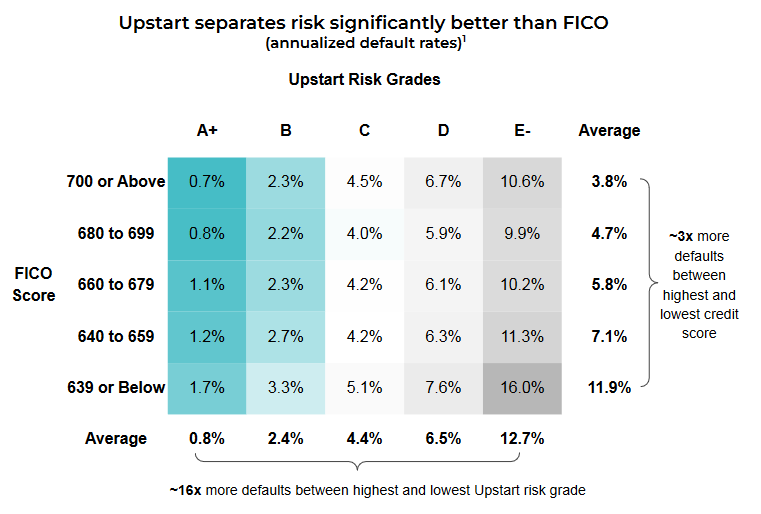

This gets interesting when you cross-reference the Upstart grades with the FICO scores.

FICO accurately predicts that the risk of default drops as the FICO score rises. But in reality, it agglomerates together a lot of different profiles. It just does not have enough data to distinguish between them.

Upstart grades create MUCH more homogenous cohorts (see the vertical columns below). This strongly indicates that the AI model is much more predictive than traditional scoring. The groups are homogenous enough that it makes sense to give them a similar interest rate.

Upstart’s system also gives a much more accurate picture of risk. Upstart can identify a cohort of borrowers (grade A) defaulting only 0.8% of the time. By comparison, even the best FICO score cohort still defaults at a 3.8% rate (horizontal lines).

This allows Upstart’s partners to give a much better deal to the best borrowers, as they are no longer grouped together with less reliable borrowers.

This produces outstanding deals for the Grade A borrowers that somehow happened to have a lousy FICO score.

This greater accuracy gives Upstart a strong advantage against traditional scoring methods. It’s also a strong selling point for partner banks: more accurate risk forecasting means higher profits for them.

The technology allows lenders to reduce the focus on past credit records and emphasize lending no more than the borrower can afford to pay.

This model is particularly useful for serving younger borrowers. Many younger borrowers don’t have an extensive enough credit record to be effectively rated by traditional models.

4. Upstart’s Business

Growing Conviction from Partners

Looking at the stock chart, you could believe Upstart was an established company that ran into operational problems in 2021.

In fact, it is only now getting out of the “start-up” phase and turning into an established company. For example, Upstart has doubled the number of bank and Credit union partners since its stock price peak at the end of 2021.

The dramatic rise and fall of the stock were less driven by the company’s performance than by a rapid climate transition from irrational exuberance to equally irrational terror. Of course, valuation matters and a triple-digit P/E ratio was way too high, but the subsequent selloff may have swung the pendulum too far in the opposite direction.

So while investors are running away from the company, actual business is still growing in new categories. Small personal loan volume is up fourfold from last quarter.

The company is also quickly growing new lines of products, notably, car refinance loans. The 291 car dealers using Upstart systems grew to 702 by the last quarter, and Honda just added more than 1,000 of its dealerships in October 2022.

Another very new business line for Upstart is small business loans. The volume of these loans originated through Upstart grew from $1M to $10M in the last quarter.

For reference, the entire small business loan market is $644B, and the auto loan market is $786B. While I am not a big fan of relying solely on TAM (Total Addressable Market), there is certainly space for Upstart to keep growing. Even originating only 1-5% of the loans of these sectors would be multiplying these business lines by x10 to x100.

The takeaway is that the company profile is changing quickly for the better, and markets don’t seem to realize it.