Value Strikes Back

Is Value Investing Making a Comeback?

Is Value Investing Making a Comeback?

Investors trying to choose a strategy will quickly stumble upon the debate between growth and value investing. Growth investors focus on quickly growing companies, usually operating in a fast-changing environment and relying heavily on innovation. Value investors focus on buying stocks currently selling at a price below their intrinsic value (large margin of safety).

Value has underperformed growth for a decade. That often happens during a bull market, but the bull market appears to be over. The recent decline in growth stocks suggests that it might be time to revisit the growth vs value discussion.

The Growth vs Value Debate

Typical descriptions of investing style can degrade into caricatures. Growth investors are not all mindlessly ignoring valuations. Many value investors include growth in the calculations.

Still, there are significant differences between the 2 strategies, and the psychological profiles of each investor type differ. Growth investors tend to be more focused on the future and opportunities. Value investors tend to focus on risk management and not losing money (Buffett rule number 1).

These differences led to the creation of dedicated funds focused on “growth” or “value”. Historically, value was believed to outperform growth over a long enough period of time. But since 2008, it hasn’t been the case. And the discrepancy became even more spectacular after 2018 and the explosion in the stock price of growth stocks like Tesla.

14 years is a long time for underperforming, and this left a lot of people skeptical of value investing. I would even say that consensus was that value is out of touch, outdated, and outright dead.

Growth in Trouble

The period from 2019 to 2020 saw a performance shift. No fund has been more emblematic of the focus on not-yet-profitable growth and tech enthusiasm (mania?) than the ARKK ETF, headed by Cathie Wood.

In 2021 ARKK’s value more than doubled in just 2 years after an already impressive performance in the previous years. Still, ARKK’s fate has dramatically reversed. Its year-to-date performance (and we are just in April still) is -46%.

What makes it worrying, is that the ARKK pattern almost perfectly mimics the last massive surge in Nasdaq during the dot com bubble, before an equally massive crash. The similarity between both charts is eerie.

What’s bringing down ARKK is a broad decline in tech stocks. The most vulnerable are stocks with very high valuations compared to current profit/revenues. Markets have high growth expectations for these stocks. Any sign of trouble is brutally punished.

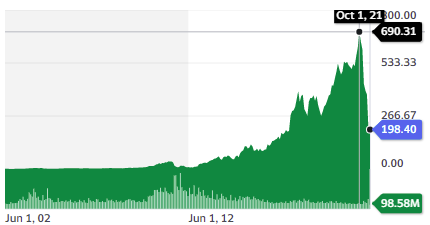

Most notably, Netflix crashed by -34% of its valuation in one day when announcing a slow down in user growth. Compared to its October 2021 peak at $690, Netflix stock has lost 72% of its value. That decline wasn’t driven by catastrophic news, but just a fear of growth slowing down.

The same panic gripped most tech stocks that day, with an average loss of 10%.

Multiples Contract

The Netflix crash illustrates the trouble with some growth strategies. Expected growth is used to justify higher and higher multiples in ratios like price-to-sales, price-to-earnings, or enterprise value to EBITDA. No ratio is too high if the company has network effects and keeps growing

Netflix stock valuation – with a P/E ratio of 253 and a price-to-sales ratio of 13.3 – was reflecting expectations of perfect growth and results for eternity. What recently happened is not that Netflix the company is necessarily in deep trouble. But NFLX the stock is being repriced at more reasonable and much lower ratios.

This kind of multiple contractions can hurt tremendously high-flying stocks, even if they are still growing. Just the hint of a slowdown in growth can be enough to send stock prices nosediving.

The Tortoise and the Hare

It is definitely too soon for value investors to claim victory after a 14-year period of underperformance. But I personally think that at the very least, both methods seem valid, contrary to claims that value has been left for dead.

To support this opinion, I will use a price chart comparing 2 emblematic companies, Berkshire Hathaway (BRK) as the archetypal value investing “fund” vs ARK Invest (ARKK) as the archetypal “new era” growth fund.

Since 2017, Berkshire was underperforming ARK. This became even more dramatic in the everything-remote era due to the pandemic. Still, Berkshire, the tortoise might beat the ARK hare in that race, with ARK losing all its advance in the last few months.

Conclusion

Value investing has a reputation for being a little boring, slow, and number-focused. These comments are quite fair. I also think we need as a society to fund innovation and take risks to move forward. I have no desire to denigrate growth investors or to be dogmatic about value investing superiority.

Growth investors have a reputation for being over-enthusiastic and taking large risks. I think they need to look at the past few months, and question their assumptions. P/E ratios of 100 or more are always at risk of repricing, no matter how high quality or quickly growing the company is.

Valuation doesn’t matter until it does. Maybe it is not just that “value guys don’t get it”. While growth investing is likely to outperform in expansionary periods, gains driven by excessive enthusiasm are likely to vanish when the market’s momentum turns and investors become more conservative.

Humility is an investor’s greatest asset. It allows us to look honestly at our mistakes and bias. To correct course and keep learning.

In that spirit, growth investors’ recent troubles should push them to adopt a more prudent approach. And value investors’ recent comeback should not be a reason for bragging or claiming mindlessly that their method is the best. Market victories are fickled and arrogance is punished swiftly!

Market Discussions

This is a series focused on recent developments in financial markets. The goal is not to discuss breaking news. Instead, we will focus on emerging long-term trends and lasting lessons we can draw from recent events. It will also take recent developments as examples that can teach us more about markets and investments.

Could You Share This Post?

Not only will you help your friends become better investors but recommendations are the lifeblood of Stock Spotlight’s growth. A few people sharing it on Twitter can really be a huge deal in terms of driving audience growth.

Thanks!

This article originally appeared on FinMasters.com - Is Value Investing Making a Comeback?