Free Report #12: PayPal Inc. (PYPL)

I’m about to make an statement that will shock nobody: our lives are becoming more digital with each passing day. Yes, I know, this is a fiery hot take.

When I was 16 years old (in 2009), I got my first job as a lifeguard at the local YMCA. I still remember receiving a physical check for my first few pay periods. Not long after, the organization switched to direct deposit, and I saw the check delivered directly to my bank account.

If you were to give a 16 year old a physical check today, they probably wouldn’t know what to do with it.

Now, I’m not bemoaning the younger generation here. The simple fact is that in 12 short years, we have digitized financial transactions to the point that they are not just commonplace, but the standard. Go back 20 years, and digital transactions would be an exception rather than the rule.

This leads us to the giant digital payment provider, PayPal Inc. (PYPL). I am sure most of you have heard of them, or are customers yourself. They offer a service that is not rivaled by many, and have cornered the digital transactions marketplace.

So, does PayPal offer a good value to investors in 2021? Let’s find out.

Principle #1

A Business That We Can Understand

A Happy Marriage

First, a little history.

As you may or may not know, PayPal was originally founded in 1998 as Confinity. The company worked up to an IPO in 2002, but then was quickly snapped up by eBay, which at the time, was the largest and most popular online marketplace.

This was a great acquisition for eBay at the time, as PayPal was a perfect match to complete digital transactions on the site. PayPal then expanded out to many other storefronts and partnered with popular payment processors like Mastercard and Visa.

The Divorce

By 2015, PayPal was a certified digital transaction behemoth. eBay recognized the dominance of PayPal, and realized it was time to spin off the company into its own independent venture.

I actually recently covered how this split became wildly successful for shareholders, so be sure to check it out.

Present Day

Let’s fast forward to 2021 and discuss their current operations since 2015.

PayPal offers a two sided operation, broken down between merchants and consumers. The merchant side allows storefronts to use PayPal’s software to offer secure payment processing to buy products and services. The consumer side allows people to purchase those goods or services and transfer money to different accounts, both domestically and internationally.

The company currently has 392 million active accounts, including 29 million merchant accounts. From colossal online storefronts like Amazon, to the boutique pottery craftsman, PayPal is offered everywhere online.

The company supports withdrawal of funds from bank accounts in 56 currencies and holding balances in PayPal accounts in 25 currencies. Additionally, transfer of funds supports more than 100 currencies globally.

How does PayPal make money? Pretty simple: they make small commissions on these transfer of funds (2-3%). That may sound small, but as large as PayPal’s network is, it adds up to a huge number at the end of the day.

Ownership Stakes

As if the PayPal business itself wasn’t good enough, the company also wholly owns the companies below:

Venmo: peer-to-peer payment platform

Xoom: international money transfers

Braintree: payment processing

iZettle: point of sale service

Hyperwallet: payout services

Honey: online coupon finder

Simility: fraud and risk management

Verdict

PayPal is running a fantastic business. They are working with one of the strongest network effects I think you will find on the market today. The service offered is beneficial to both sides, and the convenience is unparalleled.

Easy point here!

Score: 1 Point

Principle #2

A Business That Has Favorable Long-Term Prospects

Tailwinds

Strong Network Effect

As mentioned previously, PayPal’s biggest strength is the density of its network. They are closing in on 400 million members, which is staggering. That’s larger than the entire US population!

The security and ease of use on the platform is unparalleled. I have personally processed hundreds of PayPal transactions, both as a merchant and a consumer. I cannot think of one time that I had an issue with payment at all.

It just works; and that’s perfect.

E-commerce and Strategic Partnerships

Again, no surprise here. We all know that e-commerce is huge, and will get even larger as more people come online throughout the world.

PayPal already has been partnered and integrated with some of the largest institutions, such as Amazon, Mastercard, Visa, Google, Alibaba, Pinterest, Facebook…you name it.

With this company, you don’t have to worry about regulation risk, like you do with Alibaba or Amazon, and can still benefit from one of the global economy’s largest tailwinds.

Industry Consolidation

Since their spin off in 2015, PayPal has been on an acquisition spree. They have been quick to act by consolidating the industry and insuring their position as top dog.

Previous competitors like Venmo, Xoom, and Braintree were encroaching on PayPal’s territory. Rather than compete, PayPal just bought them up. It also added some diversity plays with acquisitions like Hyperwallet, iZettle, and Honey.

These key purchases have only strengthened PayPal’s network even further.

Digital Currency/Mobile Adoption

PayPal’s most rapidly adopted feature is One Touch. One Touch allows users to simply make a purchase in an app or online store without logging into PayPal, or enter any additional information. This also applies to POS stations with physical storefronts by just using your phone.

The more phones, the more usage.

No matter what your stance on digital currencies, they will undoubtedly be more prevalent in the coming decade. PayPal’s business already primed for this adoption. They already have crypto wallets for currencies like Bitcoin, Ethereum, Litecoin, and Bitcoin Cash, and users can buy, sell, and purchase merchandise with them.

Headwinds

Strong Competition in Big Tech

Even though PayPal deals a lot with financial transactions, it’s purely a tech company. They only mainly operate a network, and not a bank. Therefore, they face stiff competition from the like of other big tech giants like Google, Amazon, Apple, and Square.

PayPal has done a good job of swallowing up the smaller competition, but it can’t buy Google tomorrow.

However, I think that this is more of a minor risk. I think these large tech companies recognize PayPal’s dominance, and are willing to submit and cooperate rather than compete with PayPal.

But you never know.

Foreign Exchange Risk

Due to the nature of PayPal’s business as an international payment processor, it faces foreign exchange risk. Due to constant fluctuations of the different international currencies that it processes, PayPal’s conversions are subject to market forces, which are beyond its control.

This is not a risk specific to PayPal though, and I think the company is smart enough to recognize it, and diversify accordingly.

Verdict

In my opinion, PayPal’s tailwinds far outweigh the headwinds. With the certain increases in e-commerce, mobile phones, and cryptocurrency, PayPal’s business is almost future proof already.

Additionally, the moonshots in some of the acquisitions could really turn into something great for the company.

Score: 1 Point

Principle #3

A Business That is Operated by Honest and Competent People

President & CEO

Mr. Dan Schulman is the President and CEO of PayPal. Mr. Schulman was appointed as President of PayPal in 2014 while it was still under eBay, and was there to lead the company to its independence in 2015.

Before heading PayPal, Mr. Schulman had a very successful career with many different companies. He started off working for telecom giant AT&T, and then went on to become the founding CEO of Virgin Mobile USA, before it was acquired by Sprint. He also has held leadership positions with Priceline and American Express.

Additionally, Mr. Schulman is on the board of many organizations and councils, like the Council on Foreign Relations, the World Economic Forum’s Steering Committee, and Verizon Communications. He has also been lauded with many awards and decorations.

Mr. Schulman seems like a great CEO with a lot of leadership positions in a variety of roles. It’s nice to see that he has been there through the transition with eBay, and continues to manage effectively.

Alignment

PayPal is largely institutionally owned, with little insider ownership. That being said, the CEO, Mr. Schulman, does have the largest insider ownership, at around $73M, which is probably quite a significant amount of his net worth.

ROIC and Profitability

PayPal is an extremely profitable company. They have managed to have great (over 10%) ROIC and ROE over the past five years, which is phenomenal to see.

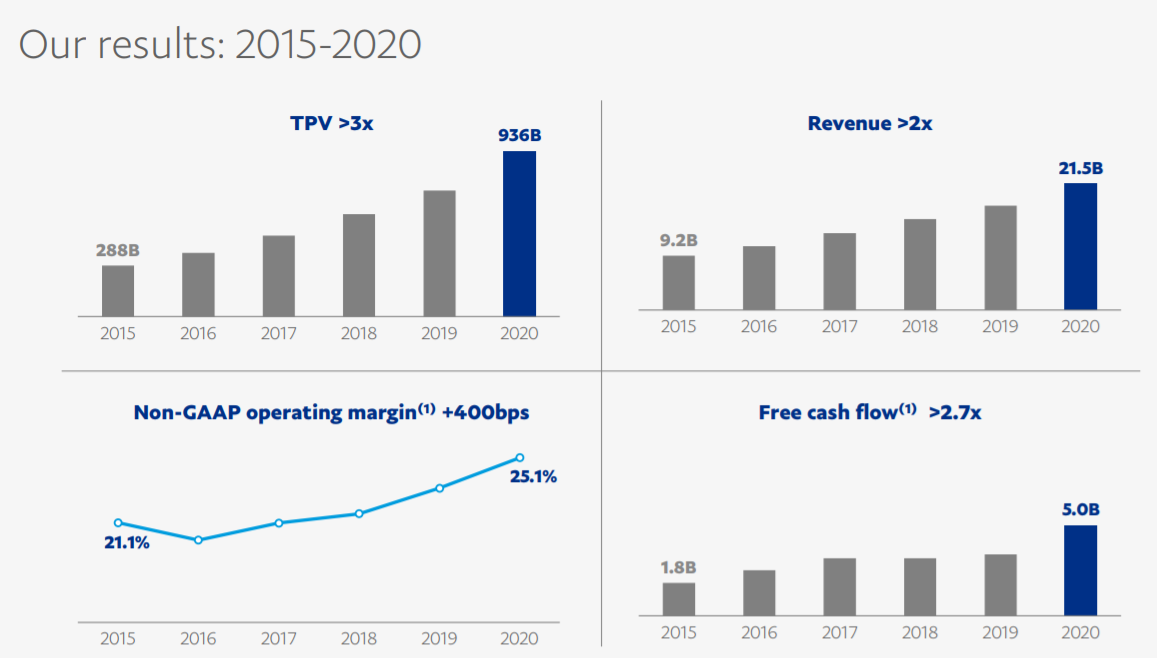

Here’s a great snapshot of the growth that the company has been able to pull off ever since the spin off:

Capital Allocation

I love it when management is honest and upfront about its future goals. PayPal plans to produce over $40B in free cash flow over the next five years (around $8B a year) and reach over 750M active users.

This forecast is really nice to see. It helps us see into management’s goals and helps us hold them accountable.

Verdict

I think PayPal has some great leadership. The past five years have seen extremely positive growth in all areas. Profitability is high and users keep joining. The executive team is open and honest with their goals for the future.

I love it.

Score: 1 Point

Principle #4

A Business That is Available at an Attractive Price

Free Cash Flow

PYPL has been pretty bouncy FCF over the past few years, however, things are moving in the right direction. FCF has compounded near 100% over the past five years. This is pretty good considering all the acquisitions as well.

Unfortunately, this stellar growth comes at a cost. PYPL was actually trading at decent P/FCF levels (~30) pre-COVID. Post-Covid, has seen a sharp spike in share price, and therefore P/FCF levels. PYPL currently sits at a very lofty 65.8 P/FCF.

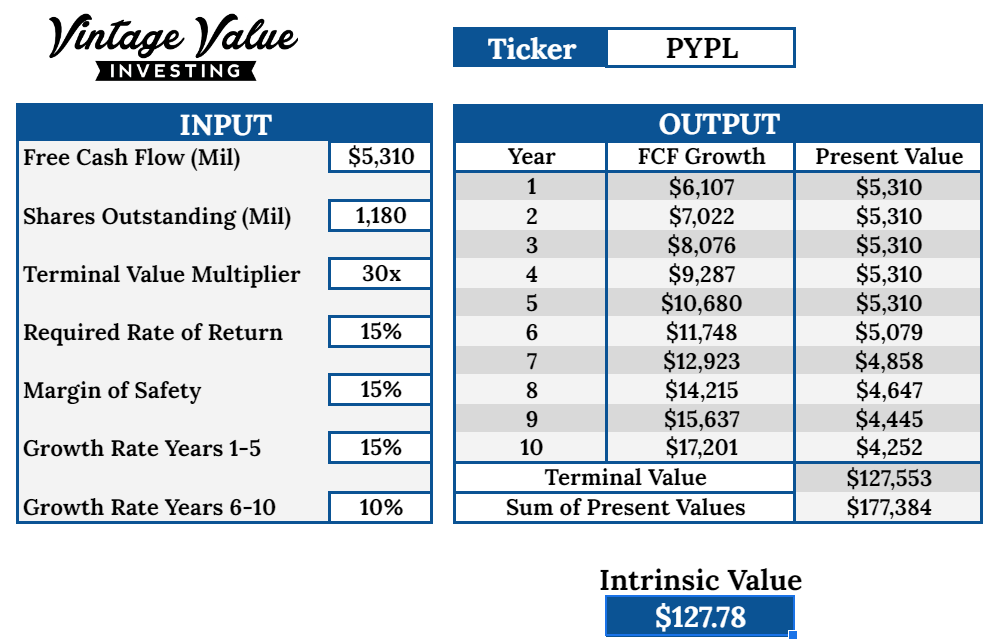

Since we know management’s goal is to hit $40B in FCF by 2025, we can calculate the expected growth they have to meet to hit that target. In order to hit $40B, PYPL needs to compound FCF at a rate of 15% per year.

This rate seems quite reasonable, considering they have historically compounded at about a 25% rate. I will then taper off the growth from years 6-10 at 10%. P/FCF will be back near historic levels, at around 30.

Discounted Cash Flow

Here’s my DCF work on PYPL with zero margin of safety:

And here’s a 15% margin of safety:

Verdict

Current PYPL share price: $294.63

My buy price: $127.78

So yeah, it seems like PYPL is quite overvalued, at least by my DCF calculation. PYPL is currently offering about a 6% rate of return at its current valuation.

It’s hard to say if this 6% return is even safe, given that the share price has spiked so much Post-COVID. But as you can see, prior to COVID, you could have bought the company at a pretty reasonable valuation.

Props to anyone that did so!

Score: 0 Points

Final Thoughts and Score

PayPal Inc. (PYPL) Score: 3/4

PayPal is a very attractive business, but unfortunately, not at a great price. My one and only qualm is the high valuation. That being said, I don’t think that a DCF is the best way to value this company, as a better method would be better to account for growth.

With a company like PayPal, I am less worried about getting a good deal as I am not overpaying. If I were to buy now, I would surely be overpaying. PayPal will be one to go on the watchlist in case of another depression in share price.

Recommended Articles

How Companies Create Value for Shareholders (Part 2): Vintage Value Investing

In my second article on value creation, I discussed how companies add shareholder value by innovating on products, advertising properly, and funding growth appropriately. I hope you enjoy it!

Music

When I first came across Berried Alive, I thought it was just a goofy parody group with a terrible name. I was kinda right.

Berried Alive is a husband/wife internet duo who create some really interesting music. It’s a strange mashup of heavy hip hop and metal, with harsh and also mellow vocals. Oh, and almost all the songs are puns of different fruits.

If you can get past the goofy names, there is actually a lot of talent going on here, especially in the guitars and vocals. “Blood Orange” is a crazy mash up of many different genres, but is ripe with many interesting riffs and melodies.

Holdings Disclosure

Neither I nor anyone else associated with this website and newsletter has a position in PYPL and no plans to initiate any positions within the 72 hours of this publication.

I wrote this article myself, and it expresses my own personal views and opinions. I am not receiving compensation, nor do I have a business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer

None of the writers or contributors of Stock Spotlight are registered investment advisors, brokers/dealers, securities brokers, or financial planners. This report is being provided for informational and educational purposes only and on the condition that it will not form a primary basis for any investment decision.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA (publishers of Stock Spotlight) on whether to buy, sell or hold shares of any particular stock.

None of the information in our articles is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The information is general in nature, and is not specific to you.

Vertigo Studio SA is not responsible and cannot be held liable for any investment decision made by you. Before using any article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

The views about companies and their securities expressed in this report reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA on whether to buy, sell or hold shares of any particular stock.

We did not receive compensation from any companies whose stock is mentioned in this report.

No part of the analyst's compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed in this report.